In 2019, Mr Wow and I decided it was time to write our wills. When we told a friend about it, his immediate response was, “What for? You guys don’t even have kids.” Interestingly, despite having two kids himself, he didn’t have a will then (I’m not sure if he has made one since). When I asked him about it, he simply said, “I don’t see the hurry.”

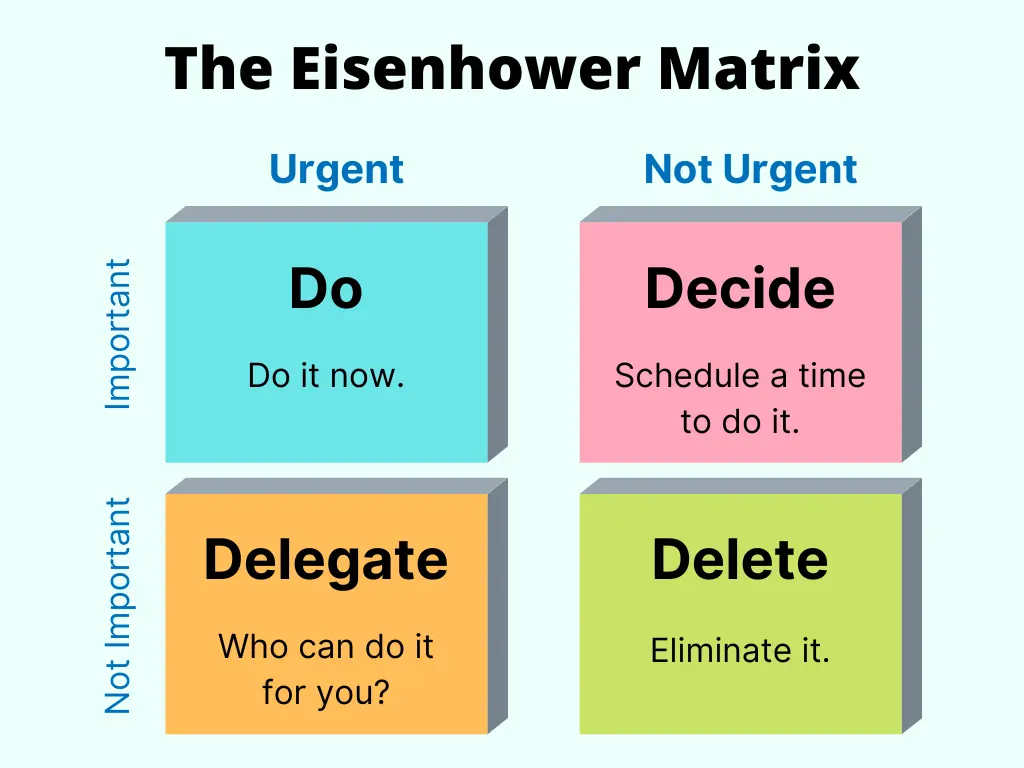

Ok… let’s tackle this “no hurry” mindset first. The Eisenhower Matrix, a simple but effective decision-making tool, splits tasks into four categories:

I think many folks classify making a will as important but not urgent, which often leads to procrastination. There’s a common belief that there’s plenty of time to handle such matters later. But without a committed plan and a scheduled time, it’s all too easy for “later” to become “never”.

Well, here’s a sobering thought — none of us are guaranteed a tomorrow. A while ago, I came across an article about local celebrity Mark Lee, who decided to make a will after experiencing the 7.4 magnitude earthquake in Taiwan on 3rd April. Waiting for a calamitous event to take action might be too late. It’s wiser to act now, rather than risk leaving your affairs unresolved, don’t you think?

Turning to the “no kids” question, you might, like our friend, wonder why you would need a will if you don’t have children. Well, LISTEN UP, all you child-free couples and proud singletons! Having a will is essential, no matter your family situation. Here are five reasons why:

- Point Your Money to the Right People

- Outsmart the Taxman

- Spare Your People the Posthumous Paperwork

- Skip the Family Feud

- Champion Your Charities

1. Point Your Money to the Right People

Making a will is actually a lot more straightforward when you’ve kids. Just divide your assets equally and you’re done. But things are a tad trickier when you don’t have direct heirs. Who gets a slice of your financial pie? A beloved niece? A close friend? Surely, there’s someone special you would want to benefit from your legacy.

When you write a will, you decide exactly who inherits your assets, right down to specific items of sentimental value. If you die without a will, your estate will be distributed according to the intestacy laws of your state or country, which typically prioritise blood relatives and may not include important people in your life who aren’t family by definition.

In Singapore, under the Intestate Succession Act 1967, the priority of distribution is spouses and children first, followed by parents, siblings, grandparents, and then aunts and uncles. I don’t know about your family situation, but my aunts and uncles, who have been freeloading off my dad for years, are the last people I would want to give my money to!

Without a will, it’s like I’m letting the government crash my party and hand out the goodie bags to a bunch of awful people. Good heavens! A will ensures that my assets go exactly where I want them to — into the hands of those who truly matter.

Did you know: If you have no living next-of-kin who can inherit your estate under the intestacy laws, your estate is considered bona vacantia (Latin for “vacant or ownerless goods”). In many jurisdictions such as Singapore, assets that become bona vacantia are transferred to the government.

2. Outsmart the Taxman

Mr Wow and I are lucky that we live in Singapore, where there’s no gift tax, estate tax or inheritance tax (though tax laws could change in the future). If you reside in a country that levies taxes on estates or inheritances, it would be wise to make a will, especially if you have substantial assets.

I mean, if you truly care about the people who will eventually inherit your assets, you would want to leave them as much as possible, rather than letting a large chunk go to Uncle Sam, right?

A will is a fundamental component of a comprehensive estate plan, and it can be effectively integrated with estate planning tools such as gifts and trusts. Strategic gifting can reduce the size of your taxable estate, potentially lowering estate taxes, while the establishment of trusts ensures that your assets are handled according to your wishes. Together, these tools not only assist in tax planning but also enhance asset protection.

3. Spare Your People the Posthumous Paperwork

I don’t like to trouble people. Not when I’m alive and definitely not when I’m dead. Dying without a will would mean leaving it to others to make critical decisions on my behalf during a time of grief — a situation I find both irresponsible and inconsiderate. Therefore, I consider it my duty to personally oversee these important matters and make sure that everything is in order beforehand.

Without a will, the legal processes can be time-consuming, stressful and costly. In contrast, a clear and legally sound will streamlines everything. The executor, whom you appoint to manage your estate upon your death, will distribute your assets to the beneficiaries after settling any debts and expenses. This prevents placing an undue burden on friends or family members, who might otherwise face a daunting wall of red tape and complex legal challenges.

Have a comprehensive plan: For complete coverage of your interests, both during your life and after, it’s recommended to have both a lasting power of attorney (LPA) and a will. An LPA ensures that someone trusted can legally act and make decisions on your behalf should you lose mental capacity one day.

4. Skip the Family Feud

Let’s face it. Families can get a bit kooky when inheritance is on the line, especially when substantial assets or sentimental items are involved. You don’t want your loved ones to fight over your money, nor do you want estranged family members laying claims to your assets.

A will is your way to lay down the rules, making sure that everyone knows who gets the vacation home in Sicily and who gets the collection of vinyl records. This is particularly important in blended families or in situations where there are significant relationships outside of immediate family ties.

Mr Wow and I have 10 nephews and nieces in total. Although they get along really well now, there’s no guarantee that harmony will continue. By clearly stipulating who inherits what in our will, we can reduce the likelihood of future misunderstandings or conflicts.

5. Champion Your Charities

What if you’ve been supporting a charity during your lifetime and wish to leave a part of your estate to that cause? Well, good for you! However, without explicit directions in a legal document like a will or trust, your wishes won’t be fulfilled because intestacy laws do not include provisions for charitable donations.

Besides ensuring your legacy continues to support the causes you value, leaving charitable bequests can also offer tax advantages. Depending on the size of your estate and the applicable tax laws, the portion donated to charity may be deductible, which could significantly reduce estate taxes.

Make revisions if need be: Wills are not set in stone. My dad updated his last year due to some changes in his assets. I’m sure Mr Wow and I will do the same as our circumstances evolve. Life changes constantly and it’s quite common — and advisable — for individuals to revise their wills accordingly. To make sure that your will reflects your current wishes, do review it every few years or after any major life event.

Wrapping up, many people assume that wills are only necessary for those with children or large estates. They couldn’t be more mistaken.

Writing a will is a prudent step for anyone who has assets, responsibilities, or specific wishes about how they would like their affairs handled after their death. It’s an important part of estate planning that can provide peace of mind to you and clarity to those you care about.

Put some thought to it.

You may also like: Dying to Learn: 5 Things Death Teaches Us About Life | Unlock Your Future: 5 Reasons to Plan for Early Retirement | 7 Wealth Accumulation Strategies to Grow Your Fortune