This is the final instalment of a three-part series on downsizing as a strategy to clear your mortgage and achieve financial independence. In my previous articles, I discussed the financial benefits and lifestyle benefits of downsizing. Now let’s look at the critical success factors of moving to a smaller home. As usual, I’ll be using Mr Wow’s and my experience as an example.

In case you haven’t already figured it out, our housing needs change over time. As we get older, what used to be the ideal home might be too big or impractical for us. Maybe maintaining that rooftop garden has become too much of a hassle. Or maybe your arthritic knee hurts each time you climb the stairs of your two-storey house. As your lifestyle and health change, you might want to move to a more suitable place where you can live comfortably.

Once you have decided that downsizing is the way forward, you need to run the numbers rigorously and consider the hidden costs. You should also avoid the common mistakes that many people make.

Here are the key factors to ensure the success of your downsizing project:

1. Run the Numbers Meticulously

First, you need to do the math.

How Much is Your Home Worth?

Do you know the current market? If your property is in Singapore, you can go to SRX Valuations (srx.com.sg/xvalue-pricing), a one-stop real estate portal to find out the X-Value of your property. The X-Value is a computer-generated market estimate of your property based on the recent transactions in your area, which you can use as a reference. SRX is able to calculate the market estimate of nearly every property in Singapore, so you will also find the portal very useful when you’re buying your next home. All you need is the postal code and unit number of the property you’re interested in.

If you’re not residing in Singapore, it’s likely there’s something equivalent to SRX in your home country. For example, there’s Zillow (zillow.com/z/zestimate) in the United States.

How Much is Your Next Home?

Is smaller really cheaper? How much cheaper are we talking about? With inflation and soaring home prices, the cost of a smaller home in today’s market may be the same as the cost of your bigger home nine years ago. Sure, your bigger home has also increased in price. Nonetheless, if you’re thinking of buying a place that’s brand new or in a prime location, it’ll not be cheap even if it’s smaller. So before putting up your home for sale, you need to do your homework and decide on where you want to move to first.

If you’re thinking of buying a place that’s brand new or in a prime location, it’ll not be cheap even if it’s smaller.

How Much Money Do You Stand to Make?

Many inexperienced home buyers and sellers often focus on the price of the property and overlook the additional costs such as stamp duties, legal fees and realtor’s commission. If you’re a Singaporean and you used your CPF savings to pay for your property, do note that you also need to refund that sum of money, plus accrued interest (= the interest you would have earned if your CPF savings had not been withdrawn for housing) when you sell your property.

Do not underestimate these costs, which can have a make-or-break significance to your plan to downsize. You’re not going to be very pleased if you’re left with next to nothing after all the trouble. It is therefore imperative that you find out all the transactional costs and crunch the numbers thoroughly.

After selling your old home and buying a new one, you may still need to renovate your new place, purchase fixtures, fittings and furniture and eventually move in, so don’t forget to factor these expenses into your calculation too.

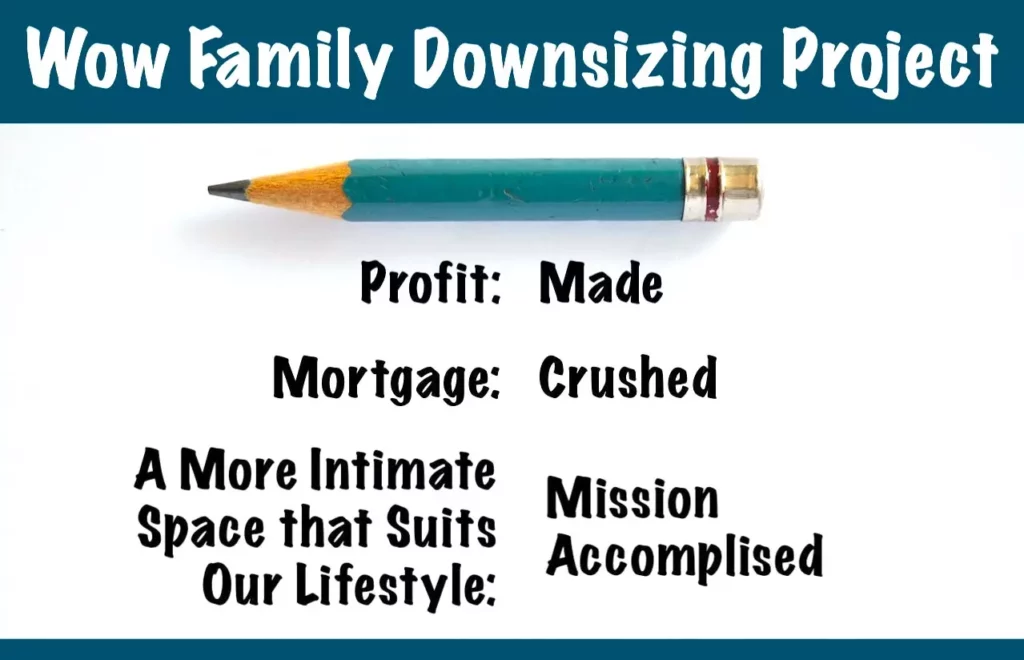

So how much did Mr Wow and I make from our downsizing project? Well, after using part of the proceeds from the sale of our old home to pay for our current one in full, we were left with S$156,969. Since the plan was to stay in our current home till we kick the bucket, we spared no expense in renovating it to our satisfaction. That cost us S$80,840. We also spent S$7,709 on fixtures and fittings, S$3,990 on furniture and S$650 on movers. We then invested the remaining money, a modest sum of S$63,780 in the stock market for passive income.

What if the Numbers Suck?

Unfortunately, some you might come to the conclusion that downsizing makes no financial sense after running the numbers. Hey, keep your chin up! At least you tried, right?

Staying put doesn’t mean you can’t make practical changes to your home to enhance your day-to-day living. Nor does it mean you can’t cut your expenses to improve your financial situation. If your mortgage is your main concern, you could look into refinancing to get a lower interest rate to reduce your monthly repayments.

2. Consider the Hidden Costs

There are some hidden costs that people often overlook, so do take note.

Repair and Touch-up

Does your home need to be repaired to be market-ready? Maybe the paint on a wall is peeling badly? Or maybe a floorboard is loose? If you’re not planning to stage your home to make it look move-in ready (which Mr Wow and I did), at least fix whatever unsightly damage that might put your potential buyer off.

Cost of Storage, Moving and Disposal of Bulky Items

People actually forget this, can you believe that! You should definitely take some time to find out the market rate of these services and include it in your list of expenses.

New Furniture and Appliances

Will the furniture and appliances in your current home fit into a smaller place or do you need to buy new ones? For instance, Mr Wow and I had to buy a new couch and TV console because the old ones were too big. Sometimes, it’s not that an item doesn’t fit into the space. It could be the fact that it doesn’t match the interior design of your new home. Thus, it would be wise to increase your shopping budget by at least 10%.

Additional Renovation Costs

Your renovation timeline might stretch longer than expected. I think those who were doing renovation at the height of the Covid-19 pandemic know exactly what I’m talking about. As if the delay was not frustrating enough, many homeowners also saw their renovation expenses shoot through the roof due to supply and labour shortage. Even under normal circumstances in a Covid-free world, your renovation cost can easily balloon when you change or add something, e.g. more built-in cabinets. Hence, you should definitely make allowance for additional spending in your renovation budget.

Your renovation cost can easily balloon when you change or add something.

3. Don’t Make These Mistakes

To ensure a smooth-sailing buying and selling process, avoid the following mistakes.

Buying a Place Before Selling Your Current Home

No matter how much you like a place, NEVER EVER commit to it before selling your current home. It can be a costly mistake because you will be pressured to sell your current home by a certain date to release capital for the new place.

Selling Without a Realtor (If You’re the Clueless Sort)

Selling a property yourself is now easier than before thanks to the many online tools and step-by-step guides at your disposal. So should you save on the commission and sell your home without engaging a realtor? The idea is very tempting, but do you have time to go through all the paper work yourself? Are you the clueless or scatterbrained sort? If you think you can’t handle the sale yourself, you should hire a realtor. It might be better to have a professional on your side to do all the work for you than to try to do it yourself and encounter complications during the process.

Hiring the ‘Wrong’ Realtor

There are many types of residential properties, so realtors often have different specialisations. If a realtor is busy selling multi-million-dollar homes, he or she might not have time for your $500,000 flat. Therefore, before signing an exclusive contract with a property agent, do have a good chat with him or her first.

Not Considering Your Lifestyle Needs

As mentioned in Part 2, your home is a lifestyle choice, so do consider your needs carefully before making a purchase. Where do you want to stay? Do you prefer a bustling area or a quiet one? How much space do you need? Do you need an extra room for your home business? Think long term and be pragmatic. For many people, the whole point of downsizing is to release capital to fund a more comfortable lifestyle. It would totally defeat the purpose if you ended up feeling miserable in a smaller home.

To sum up, downsizing offers both financial and lifestyle benefits, but it’s not for everyone. It worked for Mr Wow and me as several factors were in our favour. For one, we don’t have children, so we don’t need a lot of space. We also owned a pretty big flat that had appreciated in value (thanks to my dad’s advice) and this made downsizing economically viable. You need to consider factors that are unique to you.

Truthfully, I never liked the word ‘downsize’ because it has negative connotations of compromise, sacrifice and lower status. ‘Rightsize’ is a more positive and appropriate word. After all, it’s about finding the right home that offers the optimum size at the optimum price. I hope you find this series of articles helpful and insightful.

So would you consider downsizing to clear your mortgage? Do leave us a comment.