This article is based on the local banking scene in Singapore, so if you happen to be residing somewhere else in the world, it may be less relevant to you. Nonetheless, do read on as you may still find valuable gems in this article.

Also, this article will NOT be further updated to reflect the latest interest rates or banking schemes, which are in a perpetual state of flux. Instead, if and when it’s meaningful to do so, I’ll post new articles. So stay tuned. In the meantime, happy reading.

For decades, it didn’t pay to be a diligent saver.

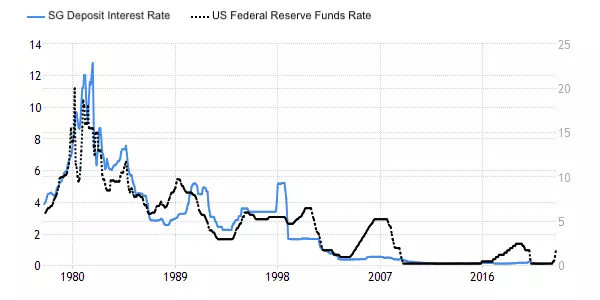

No thanks to the monetary easing policies that central banks around the world had so fervently adopted, deposit interest rates were close to zero for years. As seen in the above chart, comparing the Deposit Interest Rate in Singapore vs the US Federal Reserve Funds Rate from 1977 to 2021, Singapore’s deposit interest rate was clearly on a downtrend — from a high of 12.8% to a low of 0.12%.

Even amidst the aggressive interest rate hikes of recent, the base interest rate for savings accounts at any of Singapore’s local banks (DBS, OCBC and UOB) has stubbornly stayed at 0.05%.

The good news is, bonus interest rates (more on this below) have risen significantly from its lows in 2021 and savers can at least find some reprieve from the current high inflationary pressures.

In a nutshell, high-yield savings accounts offer interest rates (known as bonus interest rates) higher than the base rate on condition that the depositor fulfils certain categories. They incentivise account holders to essentially keep their accounts active and encourage consumption of the banks’ products and services.

In this article, I’ll be covering the following points to help you understand exactly how high-yield savings accounts work in Singapore:

- Know How to Determine the Effective Interest Rate (EIR)

- Keep Your Average Daily Balance Healthy

- High-Yield Savings Account Category Fulfilment

- High-Yield Savings Account EIR Comparison

- How to Optimise Your High-Yield Savings Accounts

Know How to Determine the Effective Interest Rate (EIR)

Perhaps the most important consideration before deciding on which high-yield savings account to open is the actual bonus interest you can expect to earn. Just go for the highest one, right? Well, I wish it was that simple.

Besides meeting the specific category requirements, the catch is that the maximum bonus interest rate is NOT applied to your whole balance, but rather on tiered or incremental amounts. As such, in order to make an apple-to-apple comparison, the Effective Interest Rate (EIR) should be calculated based on your projected savings amount. Let’s take a closer look at what I mean by EIR.

The catch is that the maximum bonus interest rate is NOT applied to your whole balance, but rather on tiered or incremental amounts.

For our case study, I’ve picked the UOB One Account. In order to hit the maximum bonus interest rate, an account holder has to fulfil the following two categories: minimum spend of S$500 monthly on any eligible UOB credit/debit card + minimum salary deposit of S$1,600 monthly.

Our calculations will be based on an account balance of S$100,000 and the rates published by UOB at the time of writing:

| Account Balance | Total Interest (Base + Bonus) |

|---|---|

| First S$15,000 | 1.40% |

| Next S$15,000 | 1.40% |

| Next S$15,000 | 1.50% |

| Next S$15,000 | 1.50% |

| Next S$15,000 | 2.50% |

| Next S$25,000 | 3.60% |

| Above S$100,000 | 0.05% |

For UOB One, the total interest increases as your account balance rises in equal increments of S$15,000 till you hit the top tier of S$25,000. The total interest starts at 1.4% and eventually maxes out at a cool 3.6% for the top tier. Thus, in order to max out your bonus interest, you are incentivised to maintain your balance ideally at around S$100,000. However, for amounts above S$100,000, the bonus interest is lost (i.e. the interest rate falls back to the base rate of 0.05%).

So what is the EIR? Here is the calculation:

Account Balance = S$100,000 Total Interest Earned p.a. = (1.4% x S$15,000) + (1.4% x S$15,000) + (1.5% x S$15,000) + (1.5% x S$15,000) + (2.5% x S$15,000) + (3.6% x S$25,000) = S$2,145 Effective Interest Rate p.a. = (S$2,145 / S$100,000) x 100 = 2.145%

I hope it’s evident that the EIR will always be lower than the advertised ‘up to’ interest rate. Here is a screenshot of the advertised rate from UOB’s website:

Most, if not all banks will naturally advertise their highest tiered bonus interest rate, rather than the lower and more complicated EIR. But if you were to scroll down to find out more about the savings account, you will certainly come across full details on how the bonus interest rates are tiered. In fact, some banks go the extra mile by providing online calculators that show you exactly how much interest you will earn per annum depending on your account balance and category fulfilment.

At the end of the day, you can become a savvier savings depositor by using the EIR to compare which account would suit you best. NEVER base your decision on the advertised ‘up to’ interest rate alone.

Keep Your Average Daily Balance Healthy

Some high-yield savings accounts (like OCBC 360) also offer a save bonus to incentivise depositors to increase their monthly balance. If you are gunning for it, do note that the increase in your monthly balance is based on your Average Daily Balance (ADB), NOT available month-end balance. Let’s take a closer look at how ADB might affect your save bonus interest.

Assuming your account balance at the beginning of the month stood at S$10,000. You intend to increase your balance by S$500 before the end of the month to qualify for the save bonus interest. Circumstances have it that you need to withdraw S$2,000 on the 7th day of the month. You think it should be fine as you intend to deposit S$2,500 one week later. This will increase your balance to S$10,500 before the end of the month and you can look forward to more interest next month. Yeah!

To your surprise, in the following month, you realised you’ve been ‘short-changed’ and did not earn your expected save bonus interest. What happened?

Here’s how your account’s ADB actually played over the entire month, day-by-day (assuming your ADB starts at $10,000):

| Day | Withdrawals | Deposits | Available Balance | Average Daily Balance |

|---|---|---|---|---|

| 1 | S$10,000.00 | S$10,000.00 | ||

| 2 | S$10,000.00 | S$10,000.00 | ||

| 3 | S$10,000.00 | S$10,000.00 | ||

| 4 | S$10,000.00 | S$10,000.00 | ||

| 5 | S$10,000.00 | S$10,000.00 | ||

| 6 | S$10,000.00 | S$10,000.00 | ||

| 7 | S$2,000.00 | S$8,000.00 | S$9,714.29 | |

| 8 | S$8,000.00 | S$9,500.00 | ||

| 9 | S$8,000.00 | S$9,333.33 | ||

| 10 | S$8,000.00 | S$9,200.00 | ||

| 11 | S$8,000.00 | S$9,090.91 | ||

| 12 | S$8,000.00 | S$9,000.00 | ||

| 13 | S$8,000.00 | S$8,923.08 | ||

| 14 | S$2,500.00 | S$10,500.00 | S$9,035.71 | |

| 15 | S$10,500.00 | S$9,133.33 | ||

| 16 | S$10,500.00 | S$9,218.75 | ||

| 17 | S$10,500.00 | S$9,294.12 | ||

| 18 | S$10,500.00 | S$9,361.11 | ||

| 19 | S$10,500.00 | S$9,421.05 | ||

| 20 | S$10,500.00 | S$9,475.00 | ||

| 21 | S$10,500.00 | S$9,523.81 | ||

| 22 | S$10,500.00 | S$9,568.18 | ||

| 23 | S$10,500.00 | S$9,608.70 | ||

| 24 | S$10,500.00 | S$9,645.83 | ||

| 25 | S$10,500.00 | S$9,680.00 | ||

| 26 | S$10,500.00 | S$9,711.54 | ||

| 27 | S$10,500.00 | S$9,740.74 | ||

| 28 | S$10,500.00 | S$9,767.86 | ||

| 29 | S$10,500.00 | S$9,793.10 | ||

| 30 | S$10,500.00 | S$9,816.67 |

If you look at the ADB column, you’ll notice that the minute S$2,000 is withdrawn, the ADB starts dropping gradually, day after day. After a week, it drops to S$8,932.08. As planned, a S$2,500 deposit is made on Day 14. Although the available balance hits S$10,500 that day, the ADB lags and needs time to gradually ‘catch up’ — it’s just the way moving averages behave. Sadly, by month end, the ADB only manages to climb back up to S$9,816.67, barely achieving the month-on-month increase of S$500 on the ADB (as required for the save bonus interest).

The moral of the story? Keep track of your ADB, but I don’t mean that you have to watch it like a hawk. I’m sure we all have better things to do. What I’m suggesting is to tweak your deposit and withdrawal pattern (if possible) to keep your monthly ADB healthy. Ideally make deposits at the start of the month and withdrawals towards the tail-end of the month. Not the other way around. This should keep your ADB on an uptrend more often than not and ensure you hit that S$500 save bonus target.

Ideally make deposits at the start of the month and withdrawals towards the tail-end of the month. Not the other way around.

High-Yield Savings Account Category Fulfilment

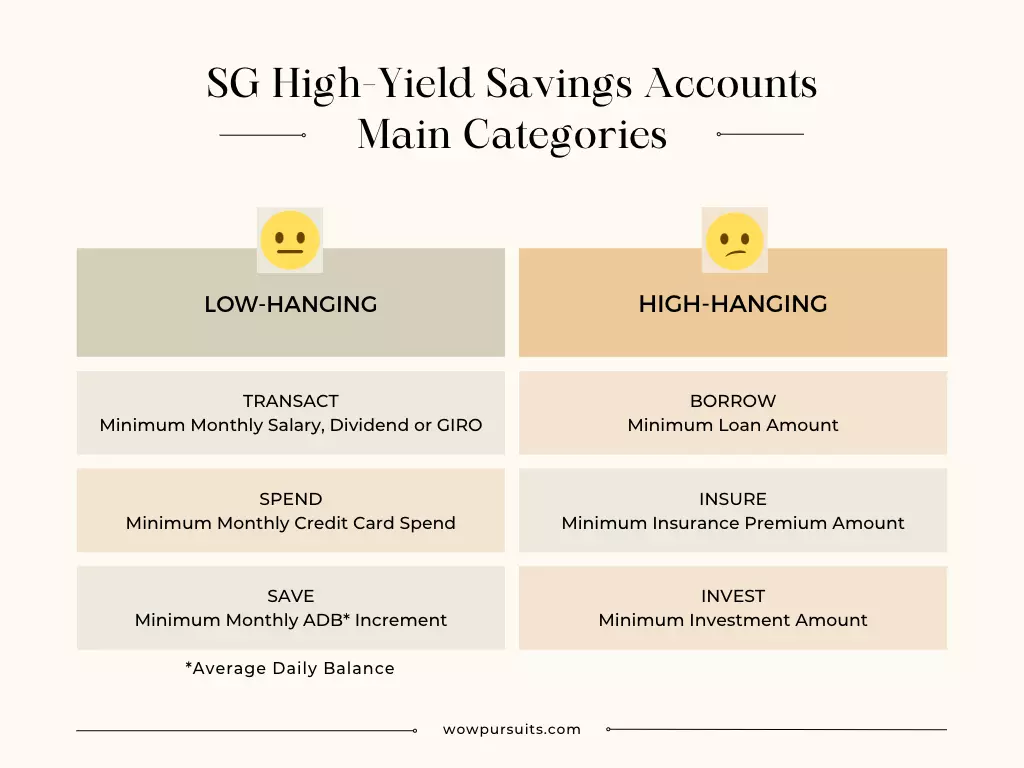

The bonus categories which incentivise the account holder vary from bank to bank. To keep things simple, I’ve split them into two groups: low-hanging (easy to fulfil) and high-hanging (difficult to fulfil).

Low-hanging requires the account holder to Transact, Spend and/or Save. High-hanging requires the account holder to Borrow, Insure or Invest. See the following diagram for more details.

Now, let’s take a look at the category fulfilment of five different banks: three local and two foreign banks. Needless to say, DBS, OCBC and UOB being the three local banks in Singapore have been selected by default. The other two foreign banks, Maybank and CIMB were thrown into the mix based on my own personal preference for a well-rounded comparison.

Full disclosure: This is not a product endorsement or sponsored post. All information presented in this article has been correlated from the data available by visiting each of the five bank’s website at the time of writing. Here’s what I gathered:

| Category | CIMB FastSaver | OCBC 360 | UOB One | DBS Multiplier | Maybank SaveUp |

|---|---|---|---|---|---|

| Transact | NA | Booster | Booster | Must-Have | Booster |

| Spend | Goody | Goody | Must-Have | Booster | Booster |

| Save | NA | Booster | NA | NA | NA |

| Borrow | NA | NA | NA | Booster | Booster |

| Insure | Goody | Goody | NA | Goody | Goody |

| Invest | Goody | Goody | NA | Goody | Goody |

Must-Haves

Out of the five accounts, two of them, namely, UOB One and DBS Multiplier have what I call a Must-Have. That means you must have it or you will not get any bonus interest at all. So please be aware of this.

For UOB One, it’s mandatory that you spend at least S$500 on your credit card every month. For DBS Multiplier, you have to credit either your salary or dividends from eligible sources like the Central Depository Pte Ltd (CDP), DBS Vickers Securities, DBS Unit Trusts, etc. (no minimum amount required).

Boosters

Next, you have what I call the Boosters. They may not be mandatory, but without them, you will not be able to earn a substantial bonus interest. Usually a combination of two to three Boosters are required to achieve a significant increase in your bonus interest rate.

For example, although OCBC 360 does not have a Must-Have, without a Booster in the Transact category (monthly salary credit of S$1,800), you will lose out on an EIR of 2.5%. That’s huge!

Goodies

Finally, you have the Goodies which are the icing on the cake that will increase your bonus interest rate even more. For instance, if you have taken a housing loan or perhaps bought an insurance policy from the bank, it will mean more interest for you. But do note that the Goodies may only last for a limited time (e.g. 12 months from the date of purchase of your insurance policy), so do read the terms and conditions carefully or check with your banker.

Making Sense of Category Fulfilment

Wrapping it up, you will want a high-yield savings account that does not require you to jump through too many hoops.

No Hoops: CIMB FastSaver is the only one out of the five that doesn’t require a depositor to jump through any hoops at all — no Must-Haves, no Boosters, just Goodies. This means that right off the bat, once you open a FastSaver account with CIMB, you start earning bonus interest. Nice!

Easy Hoops: For OCBC 360 and UOB One, the Must-Haves and Boosters are in the low-hanging categories (Transact, Spend or Save). This means that most can earn bonus interest with little effort.

Difficult Hoops: For DBS Multiplier and Maybank SaveUp, it’s unfortunate that these accounts require a Booster from the high-hanging categories (Borrow, Insure or Invest). Not everyone needs a loan, an insurance policy or an investment product from a bank. It may not be a deal-breaker, but it could mean significantly less bonus interest if you are unable to fulfil a high-hanging category.

High-Yield Savings Account EIR Comparison

Alrighty, now that you know how to calculate the EIR and have a better picture of how category fulfilment works, it’s time to determine which high-yield savings account will give you the most bang for your buck. Let’s look at the numbers.

| Account | No. of Categories | S$100k EIR |

|---|---|---|

| OCBC 360 – 3 Cat | 3 | 4.650% |

| OCBC 360 – 2 Cat | 2 | 4.050% |

| Maybank SaveUp – 3 Cat | 3 | 2.997% |

| DBS Multiplier – 3 Cat | 3 | 2.695% |

| CIMB FastSaver – Card | 1 | 2.145% |

| UOB One – Salary | 2 | 2.145% |

| CIMB FastSaver | 0 | 2.075% |

| DBS Multiplier – 2 Cat | 2 | 0.973% |

| Maybank SaveUp – 2 Cat | 2 | 0.947% |

| UOB One – GIRO | 2 | 0.883% |

OCBC 360

Out of the five banks, OCBC is the clear winner, offering the highest EIR by far (both for two and three categories). Even with just two categories (Transact + Save), it still offers an impressive EIR of 4.05%.

Do note that you need to credit your salary (Transact) of at least S$1,800 monthly, else your EIR drops by 2.5%.

In addition, OCBC 360 has its own unique category called Grow. It’s certainly not low-hanging. For depositors who maintain their ADB above S$200,000, they will get an additional EIR of 2.4% on their first S$100,000. It’s definitely a nice perk if you have no where else better to park your cash.

Maybank SaveUp

Maybank SaveUp offers the next highest EIR for three categories at 2.997%. The good thing about Maybank is that it doesn’t matter which category you fulfil. Any three is fine.

The downside is if you are only able to meet two categories, your EIR drops to 0.947%, and that’s really nothing to shout about.

DBS Multiplier

Next up we have DBS Multiplier. For three categories, DBS offers an EIR of 2.695%. But for two categories, the EIR drops to 0.973%, which is quite sad.

One thing worth noting is that DBS Multiplier doesn’t stipulate any minimum amounts for any of its categories. No minimum credit card spend, no minimum salary credit, no minimum anything.

Instead, the bonus interest rates are tiered based on the total cumulative amount from all categories. The higher the total amount, the higher your tier. Frankly, it’s not the simplest of schemes, but it does make category fulfilment easier without the minimum amount hurdle.

Also, DBS Multiplier has its own unique category called Paylah!, which encourages an account holder to spend via DBS’s e-payment app. Essentially, you just need to fulfil two categories, Transact + Paylah! and meet the minimum total amount of S$500 to earn bonus interest (though the EIR would be relatively low). This might work out nicely for those using Paylah! instead of credit cards and don’t intend to purchase anything else from DBS.

CIMB FastSaver

I must say that I’m pretty impressed by CIMB FastSaver. As previously mentioned, upon opening a FastSaver account, you start earning bonus interest at an EIR of 2.075% (no Must-Haves).

What’s more, if you can meet the minimum S$300 monthly credit card spend, your EIR gets bumped up to 2.145% (the same rate as UOB One). By the way, amongst the five banks, CIMB has the highest base interest rate of 0.8%. What’s there not to like?

UOB One

Finally, we have UOB One. I just love the simplicity of their category fulfilment. Just two categories — Transact (Salary) and Spend — to get an EIR of 2.145%.

However, my only gripe is that UOB splits the Transact category into two, Salary and GIRO. Not too long ago, it didn’t matter. Now, if you opt for GIRO, your EIR drops to 0.883%. That’s the lowest amongst all five banks. Not good news for retirees who are no longer salaried.

NEWS FLASH: Guess what… 2 days after posting this article, UOB increased their bonus interest rates — the highest ever. For UOB One-Salary, EIR is now at 5.003% and takes the number one spot. For UOB One-GIRO, EIR is now at a respectable 2.263%. Finally, the diligent saver is getting rewarded!

How to Optimise Your High-Yield Savings Accounts

So how do you go about choosing an account that suits you best? It boils down to a balance between category fulfilment and EIR. On the one hand, you might not want to go for the highest EIR if category fulfilment is not realistic for you. On the other hand, an account with easy category fulfilment may come with low EIR. Of course, the best combination would be both easy category fulfilment and high EIR. But as the saying goes: you can’t always have your cake and eat it too.

Single Account: Pick an Account that Suits You Best

If I had to pick just one high-yield savings account, which one would I pick? I think the answer would be obvious based on the above comparison: hands down, OCBC 360.

OCBC 360 came up tops in EIR and came in second for category fulfilment. Of course, things could change in the future, but for now we have a clear winner.

So if you were someone just starting out in your career and are able to save at least S$500 a month, OCBC 360 would be a good place to start. Coincidentally, Mrs Wow and I opened our very first high-yield savings account with OCBC 360 many years back. In this respect, I have to say that I’m very pleased that OCBC have kept up their good name.

Nevertheless, I wouldn’t advise the same for someone without full-time employment, like a university student. If you were a student saving up your allowance or perhaps earning irregular income from a side hustle, I would probably recommend you check out CIMB FastSaver. No categories to worry about and you get a pretty decent EIR.

Multiple Accounts: Mix and Match Based on Purpose

If you’re someone who saves regularly, it’s a matter of time before you hit the bonus interest balance cap of your high-yield savings account. That’s when you may want to open another account. What would be the best combination then?

When my joint OCBC 360 with Mrs Wow hit the cap, we decided to open two separate high-yield accounts in other banks, namely UOB and DBS. We had considered opening a second OCBC 360, but Mrs Wow being the more paranoid cautious one, didn’t like the idea that we had all our cash reserves in one bank.* I couldn’t have agreed more.

Over the years, our three high-yield savings accounts have served us well, each playing a different role in our financial management: UOB One for spending, OCBC 360 for saving and DBS Multiplier for investing (You can find out more about how I use DBS Vickers Cash Upfront to buy stocks).

This combination was decided based on the category fulfilment and EIR. Each account has it’s pros and cons but ultimately all three banks fit nicely into what we were looking for in terms of ease of management and reward.

Since retirement, we had to further tweak things to suit our financial situation. As we no longer earn income from our business (which we sold in 2020), our beloved OCBC 360 has not been generating as much interest as before. Therefore, we opened another savings account (OCBC Premier Dividend+) which still rewards for saving, but doesn’t require any sort of a salary credit.

*If you didn’t already know — In Singapore, all brick-and-mortar banks, online banks and brokerages have to be licensed and regulated by the Monetary Authority of Singapore (MAS). And for any MAS-regulated bank, it will automatically be insured by the Singapore Deposit Insurance Corporation (SDIC). There is no need for a depositor to purchase this insurance. This means that in an unlikely event of a bank failure, your deposit will be protected by the SDIC for an aggregated sum of S$75,000 per depositor, per insured bank/brokerage. If you would like to find out more, do visit SDIC’s website for further details on the deposit insurance coverage and how compensation is calculated.

Nothing is set in stone and we will most likely make changes over time depending on our financial needs, the interest rate environment and available banking schemes. Nonetheless, I hope this article has raised your level of awareness on high-yield savings accounts and provided you with some useful pointers.

Besides high-yield savings accounts, Singapore Savings Bonds are also a good place to park your cash reserves. To learn more, do read Mrs Wow’s article The Role Singapore Savings Bonds Play in Our Retirement Portfolio.