This article is part of our Newbie Investing series and is based on brokerages available in Singapore. Even if you happen to be residing somewhere else in the world, do read on as you may still find valuable gems in this article.

A lot has changed since I opened my first brokerage account over 20 years ago. I remember having to call my stock broker to help me buy and sell stocks on the Singapore Exchange (SGX).

These days, you don’t even need a stock broker (I can’t even remember the last time I called mine). Every buy and sell order is executed digitally without human intervention, either via a secured website or mobile app. This has made investing assessable and convenient for the masses.

However, before embarking on your investment journey, it is highly recommended that:

- You have reached Wealth Level 3, Stability, i.e. are free of any high-interest debt and have saved up a minimum of six months’ worth of emergency funds.

- You understand the basics of investing and know what the 4 main asset classes are.

Once you have the above under your belt, you are ready to open your first investment brokerage account.

The purpose of this article is to cover the basics and provide some useful tips to help you navigate through the plethora of brokerages available today. Here is what you should know before opening your first brokerage account:

- Open a Central Depository (CDP) Account

- Know Your Brokerage Account Types

- How to Optimise Your Brokerage Accounts

- Other Charges and Fees

1. Open a Central Depository (CDP) Account

If you don’t already have a Central Depository (CDP) account with the SGX, you will need one in order to own shares in a publicly listed company or fund on the SGX. Besides stocks, a CDP account is also required for bond purchases including Singapore Savings Bonds.

Think of a CDP account like your very own personal safe where all your stock and bond certificates are stored in digital form. Every time you buy shares of a SGX-listed stock or fund, it gets automatically deposited into your CDP account.

Think of a CDP account like your very own personal safe where all your stock and bond certificates are stored in digital form.

Many other countries have the equivalent of a CDP account, e.g. in Malaysia it is known as the Central Depository System (CDS), in Japan you have the Japanese Securities Depository Centre (JASDEC) and the list goes on.

There are two main ways to open a CDP account in Singapore, either (1) do-it-yourself or (2) get your broker to do it for you.

Do-It-Yourself

Go to SGX CDP Account Opening Form Selection. You have two options:

► Sign up using Myinfo — This is the easier and faster option. Read the instructions carefully and make sure you meet all the requirements (e.g. at least 18 years of age, have a Singapore bank account) and all the necessary documentation (e.g. scanned copy of signature) in digital form.

► Sign up using online form with supporting documents — If for any reason Myinfo doesn’t work or is not applicable, your second option is to complete an online form and submit/upload the supporting documents manually. Select ‘Others’, read the instructions and make sure you prepare and scan all the relevant supporting documents into the acceptable digital formats (e.g. JPG, PNG, PDF). This will take a little longer than the previous option, but it will surely get the job done.

If you are not comfortable signing up online, you can always sign up in-person at SGX’s office. Prior to making the trip down, do call SGX’s customer service hotline to make an appointment during office hours. And more importantly, don’t forget to bring along all the necessary support documents. You don’t want to make a wasted trip.

Get Your Broker To Do It

If you’re opening a CDP-linked brokerage account, you can also get your new broker to help you open your CDP account at the same time, killing two birds with one stone.

You will still need to fill in the CDP application form and prepare the necessary supporting documents (most of which you’ll need anyway for your brokerage account). Once done, your broker will handle the rest.

2. Know Your Brokerage Account Types

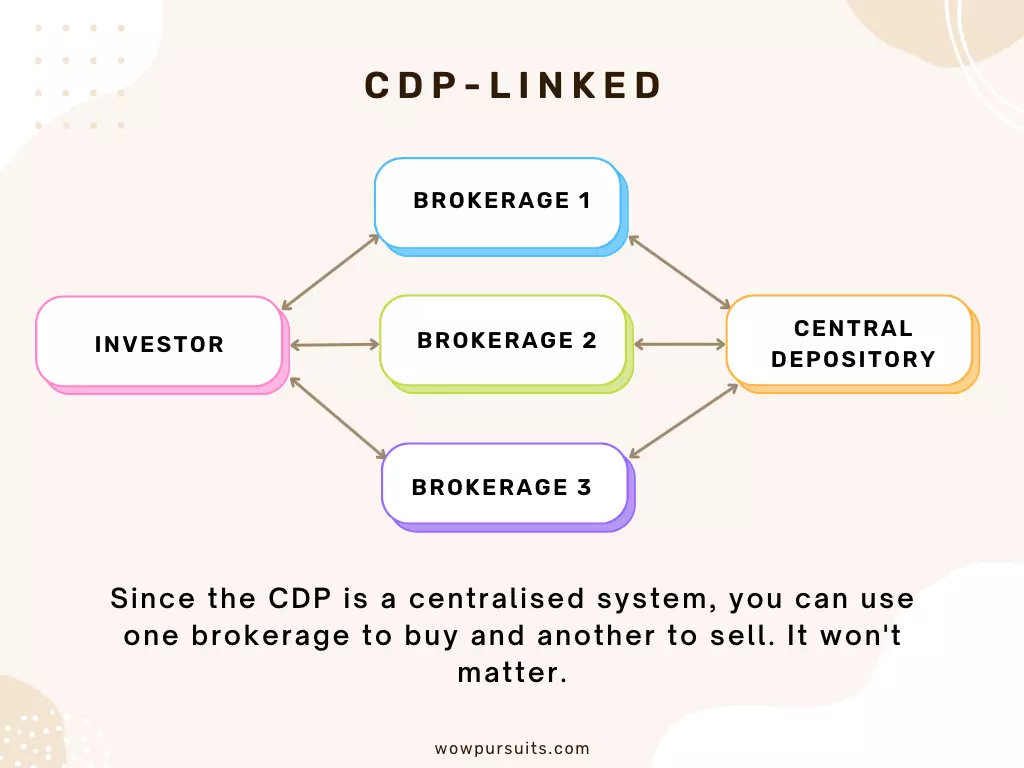

Before you begin comparing commission rates, etc., you need to be aware that there are essentially two types of brokerage accounts: (1) CDP-linked, and (2) Custodian.

CDP-Linked Brokerage Accounts

If you are a long-term investor who intends to buy SGX-listed stocks and securities, it is recommended that you open a CDP-linked brokerage account, typically available with any traditional or full-service broker.

Every time you buy a stock through a CDP-linked broker, it gets automatically deposited into the CDP. When you sell a stock, it gets automatically withdrawn from the CDP. As the CDP centralises all your SGX holdings, you are at liberty to use multiple brokerages if you choose to.

The main advantage of using a CDP-linked brokerage account is that all your assets are held in your name. In other words, you are the legal owner of the shares you purchased.

The main advantage of using a CDP-linked brokerage account is that all your assets are held in your name.

As a legal shareholder, you will

- be invited to attend the company’s annual general meetings (AGM),

- have voting rights,

- receive the company’s annual reports, and

- be notified of any announcements or actions of the company, e.g. extraordinary general meetings (EGM), rights issues, distribution reinvestment plans, etc.

Another advantage of having your holdings stored with the CDP is that your dividends and cash distributions will be directly deposited into your chosen bank account via the Direct Crediting Scheme (DCS). Here is the full list of the seven participating banks:

- Citibank Singapore Limited

- DBS/POSB

- HSBC

- Maybank

- OCBC

- Standard Chartered Bank

- UOB

So what’s the downside? Higher commissions. The commissions for CDP-linked brokerage accounts are much higher than custodian accounts (more on this later). This should come as no surprise as there will certainly be fees associated with the usage of the CDP services.

Here is my ‘Top 10’ list of brokerages that provide CDP-linked accounts. It will give you a good idea of how much the commissions are at the time of writing:

| Brokerages | Min. Commission | Trading Commission for < S$50,000 Contract Value | Trading Commission for S$50,000 to S$100,000 Contract Value | Trading Commission for > S$100,000 Contract Value |

|---|---|---|---|---|

| FSM One (Sell Orders Only) | S$8.80 | S$8.80 | S$8.80 | S$8.80 |

| DBS Vickers Cash Upfront (Buy Orders Only) | S$10 | 0.12% | 0.12% | 0.12% |

| DBS Vickers | S$25 | 0.275% | 0.22% | 0.18% |

| OCBC Securities | S$25 | 0.275% | 0.22% | 0.18% |

| RHB Securities | S$25 | 0.275% | 0.22% | 0.18% |

| CGS-CIMB Securities | S$25 | 0.275% | 0.22% | 0.18% |

| Maybank Kin Eng Securities | S$25 | 0.275% | 0.22% | 0.18% |

| UOB Kay Hian | S$25 | 0.275% | 0.22% | 0.20% |

| Lim and Tan Securities | S$25 | 0.28% | 0.22% | 0.18% |

| Phillip Securities (POEMS) | S$25 | 0.28% | 0.22% | 0.18% |

As seen from the table above, the minimum commission fee is typically S$25 for both buy and sell orders. The only exceptions are DBS Vickers Cash Upfront (S$10 for buy orders only) and FSMOne (S$8.80 for sell orders only).

For trading commissions, the fee is more or less the same, ranging from 0.18% to 0.28% depending on your contract value, i.e. the total amount per buy/sell order.

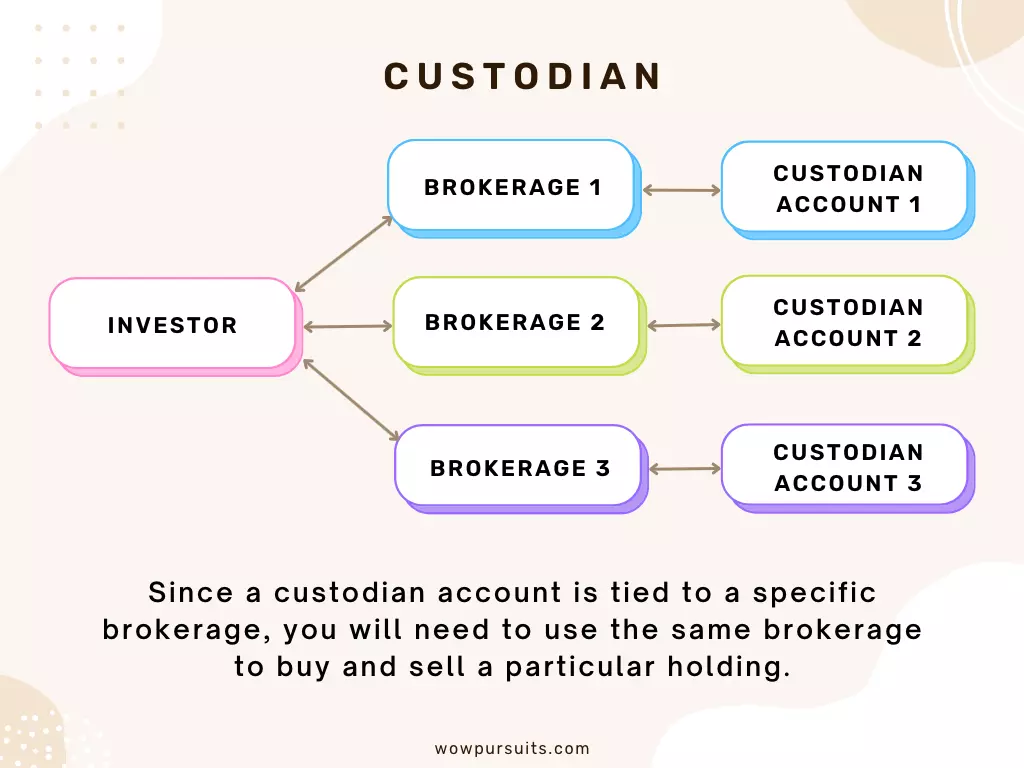

Custodian Accounts

The alternative to CDP-linked accounts are custodian accounts where your shares will be held in custody by your chosen brokerage in a nominee account. In this case, you are NOT the legal owner of the shares you bought.

Your shares will be held in custody by your chosen brokerage in a nominee account.

If you are a short-term trader and don’t intend to hold your SGX stocks for long, using a custodian account might work out better for you due to the lower commissions.

Also, if you intend to buy stocks from overseas markets, you have no other choice but to use a custodian account (the CDP is only for SGX stocks and securities).

If you intend to buy stocks from overseas markets, you have no other choice but to use a custodian account.

Besides the traditional brokerages listed in the above table (which also offer custodian accounts), you may want to explore these low-cost online brokerages that are licensed by the Monetary Authority of Singapore (MAS), have a local Singapore office for support and offer very competitive commission rates:

- Interactive Broker

- TD Ameritrade

- Moomoo

- Tiger Brokers

- Webull

There are of course other low-cost online brokerages out there. Those listed above are the ones I have personally explored and tested out myself. Some offer very attractive promotional rates, no minimum commissions and other goodies (the competition is stiff). Some have been around longer than others. Some are simple, while others are sophisticated.

After some evaluation, out of the five, I eventually narrowed down to one based on my own needs and preferences. In the following section, I’ll reveal exactly which brokerages I’m personally using, why I use them and how I use them. So read on.

3. How to Optimise Your Brokerage Accounts

If you are a long-term investor (not trader) like Mrs Wow and myself, I would strongly recommend the following:

- For SGX stocks and securities, use CDP-linked brokerages

- For overseas markets, use low-cost online brokerages

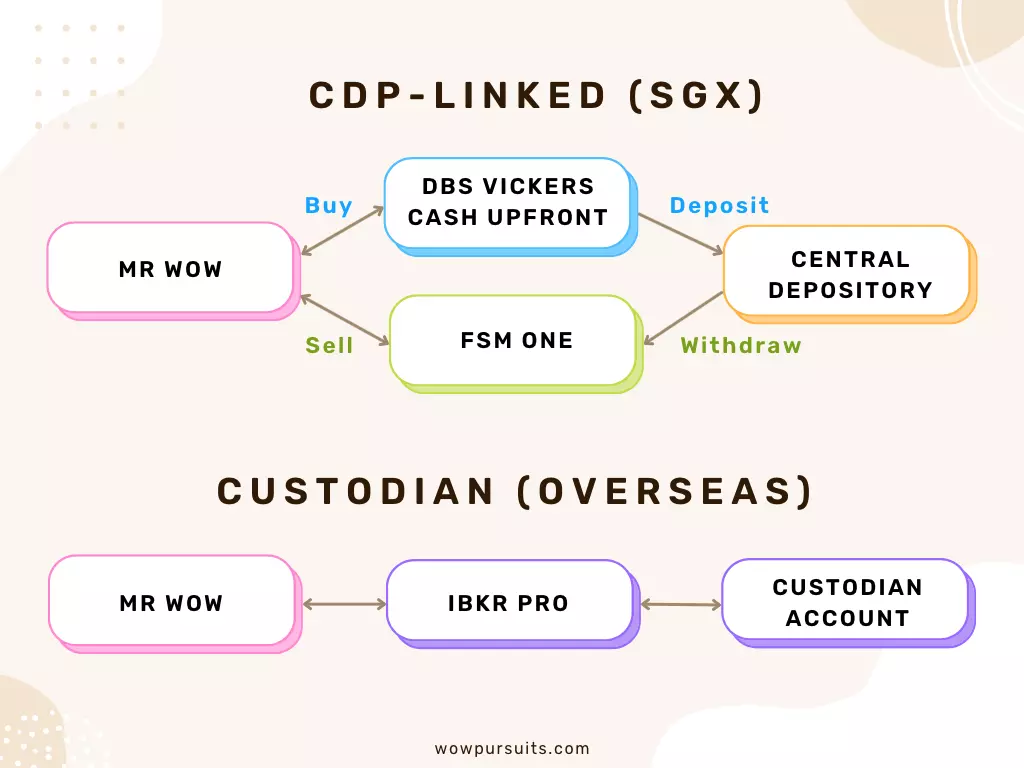

The combination will allow you to have legal ownership of the shares you buy from SGX, while letting you take advantage of the lower commissions offered by online brokerages for overseas markets. Here is my current set up:

Use DBS Vickers Cash Upfront to Buy SGX Stocks

Hands down, DBS Vickers Cash Upfront offers the lowest commission for buying SGX stocks amongst all the CDP-linked brokerages. It’s a no brainer.

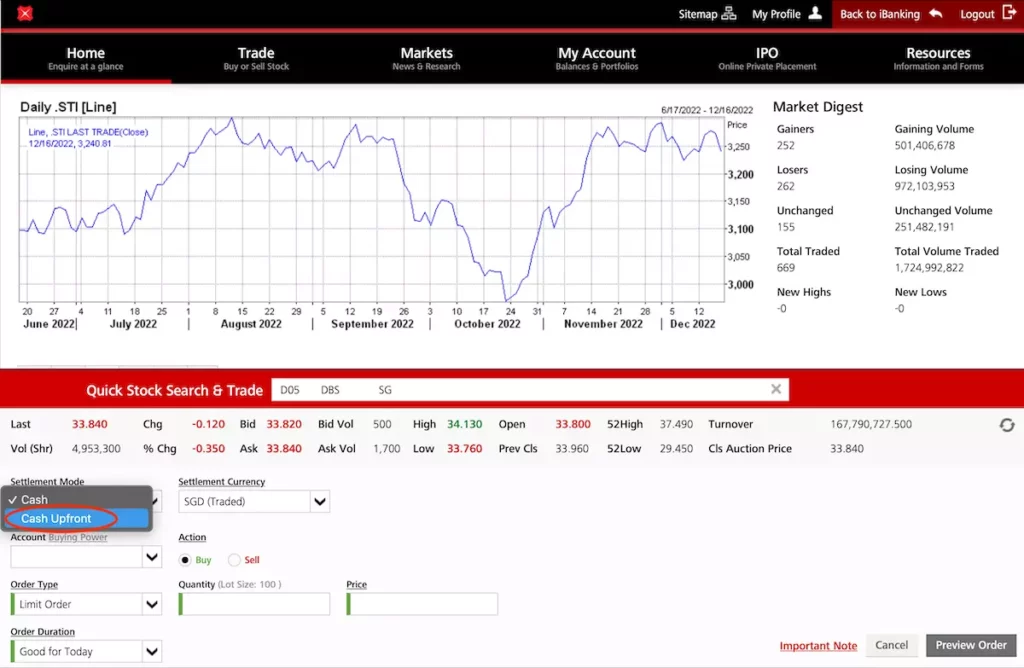

To use DBS Vickers Cash Upfront you will need a DBS/POSB banking account linked to your DBS Vickers account, and you have to ensure there are sufficient funds in your bank account prior to submitting your buy order.

As I already have a DBS Multiplier account which also rewards bonus interest for investing through DBS Vickers, it works out perfectly for me. (If you are not familiar with high-yield savings accounts, do check out my article on How High-Yield Savings Accounts Work.)

Usually, settlement of your buy order is two trading days after your trade date. If you have ready funds and don’t need those few days of credit with your broker, using DBS Vickers Cash Upfront will help you save quite a bit in commissions over the long run.

Just make sure you log in through your DBS/POSB digibank account (not directly into DBS Vickers), select the ‘Invest’ tab, then ‘DBS Vickers Online Trading’. While entering your buy order, make sure you select ‘Cash Upfront’ under the Settlement Mode option.

Use FSM One to Sell SGX Stocks

All CDP-linked brokerages (including DBS Vickers) charge a standard minimum commission of S$25 for sell orders, with similar commission rates all round.

FSM One is the only exception where they simply charge a flat rate of S$8.80 for every sell order, regardless of the contract value.

Just follow the instructions on the FSM One website or app to e-link your CDP to your FSM One account for sell orders only (note: buy orders go into a custodian account, not your CDP).

Use a Low-Cost Online Brokerage for Overseas Markets

Since you have no other choice but to use a custodian account for overseas markets, you might as well go with a low-cost online brokerage like Interactive Brokers (IBKR), Moomoo or Tiger Brokers, rather than a traditional or full-service broker. It would save you quite a bundle in terms of commissions and other fees over time.

For me, before low-cost online brokerages like Moomoo or Tiger Brokers arrived on the scene, I had always kept my eye on IBKR which is an established multi-asset online broker with a global reach.

What had initially deterred me from signing up with IBKR was the $10 monthly account inactivity fee. For an investor like myself, who buys and sells stocks irregularly, the inactivity fee was real a deal-breaker. However, on July 2021, IBKR announced that they would scrap the $10 inactivity fee for good. Hurray! Without hesitation, I jumped onto the IBKR bandwagon and have been with them ever since.

By the way, you may be wondering about the safety of your investments held in someone else’s name. What if the company goes bankrupt? Will you lose everything?

The answer is: legally no. For a brokerage that is MAS-regulated, the company has to hold clients’ funds in an account that is separate from their own. This means if the brokerage becomes insolvent, creditors have absolutely no claim on clients’ segregated cash and assets.

For a brokerage that is MAS-regulated, the company has to hold clients’ funds in an account that is separate from their own.

Nevertheless, should fraud be committed and the company commingled client’s funds with its own, then there is no guarantee that liquidators will be able to recover 100% of your custodial holdings.

Which is why, for absolute peace of mind, it’s best to have all your SGX holdings with the CDP. For your overseas holdings, you don’t have a choice. So make sure you sign up with a reputable and MAS-regulated brokerage.

4. Other Charges and Fees

Here is a list of other charges and fees associated with brokerages:

- CDP Clearing Fee

- Exchange/Trading Fee

- Custodian/Maintenance/Platform/Inactivity Fee

- Handling Fee

- Foreign Exchange Fee

- Transfer Fee (to another custodian account)

Depending on which broker you use and for what purpose, some of the listed charges and fees above will likely be applicable. For example, for CDP-linked accounts, you’ll need to fork out a tad more for the CDP clearing fee (0.0325%) and SGX trading fee (0.0075%).

For certain custodian accounts, you will be charged a monthly custodian fee. For example, OCBC Securities and DBS Vickers charge S$2 per counter per month. Some brokerages charge quarterly or yearly and may call it a maintenance, platform or inactivity fee. You may also be charged a handling fee for corporate actions such as cash dividends and distributions.

The good news is, in recent years, many low-cost online brokerages have done away with any sort of custodian fees, so do ensure that such fees are no longer applicable before signing up. You do not want to get a surprise at the end of the month.

The good news is, in recent years, many low-cost online brokerages have done away with any sort of custodian fees.

For most low-cost online brokerages, although there are usually no custodian or handling fees involved, you still have to contend with the exchange/trading fee, foreign exchange fee, etc. for trades on overseas markets. So please read the fine print.

Last but not least, if for any reason you intend to transfer your holdings from one custodian account to another with a different broker, be prepared to pay some sort of a transfer or administration fee which may turn out to be relatively hefty. Depending on the size of your holdings, it might make more sense to just liquidate and transfer the cash, provided market conditions are favourable.

I hope this article has provided you with some useful tips on how to go about choosing and setting up your brokerage accounts. As a new investor, you should know the difference between growth and value investing. Do read my article Why We Love Dividend Investing but It’s Not For Everyone if you are interested to learn more. Besides individual stocks, you can also consider low-cost diversified index funds.

More on investing: Investing Jargon in Layman’s Terms | Trading vs. Investing: What You Need to Know | The Importance of Liquidity in Personal Finance & Investing | Investing During a Recession: What You Need to Know | Portfolio Rebalancing for Beginners