Some are born into it, while others work their entire lives for it. Some have it, then lose it. Some even kill for it. Mm-hmm, I’m talking about money.

What does money mean to you? Will wealth bring you happiness? Is it something you can live without? How much is enough?

Growing up, I remember thinking that if a person stays in a big house and drives a sleek continental car, he must be rich. And if someone stays in a small crummy apartment and travels in a BMW, i.e. BUS, MRT (= train in Singapore) and WALK, he must be poor.

If you think about it, we are all wired to judge someone’s wealth based on his expenditure. The bigger the house, the larger the yacht, the wealthier the person must be.

We never judge a person’s wealth based on how much money he saves simply because it’s not obvious. You can’t judge what you can’t see. It’s hard to imagine that the regular commuter sitting next to you on the bus is actually a multi-millionaire.

Then one might ask: why on earth would a multi-millionaire choose to take the bus every day? It just doesn’t make any sense. Curious? Read on then.

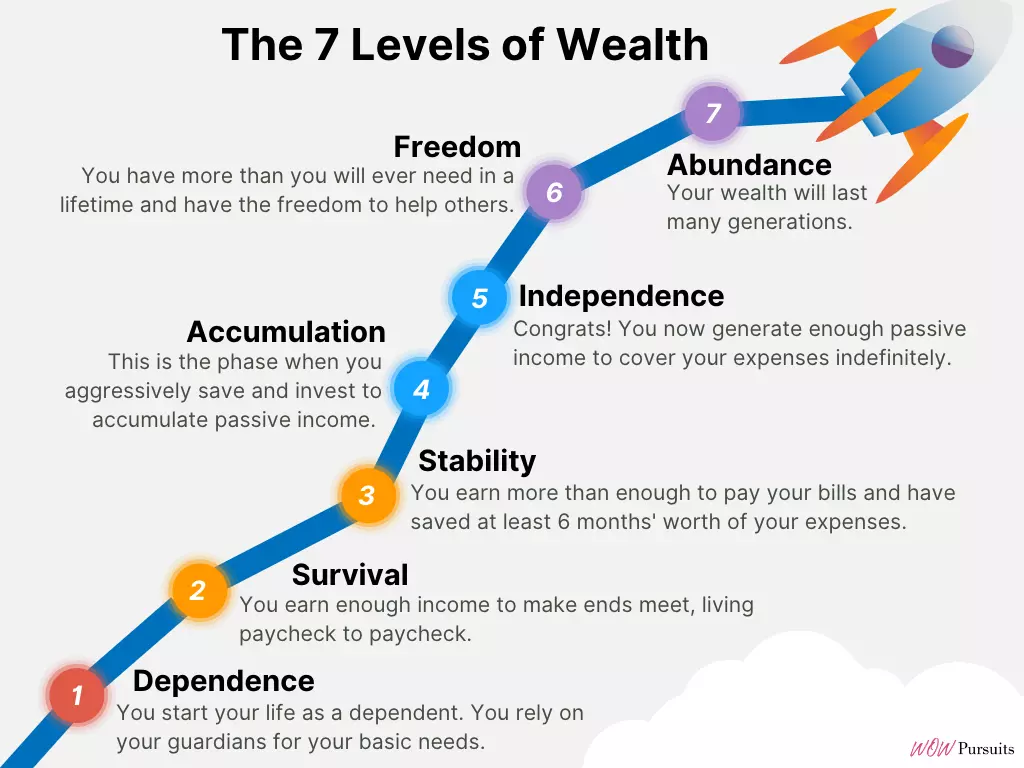

I hope you’ll not only find the answer, but also discover a different perspective of what wealth truly means. Without further ado, let’s explore the seven levels of wealth:

Level 1: Dependence

We all start at Level 1, Dependence. A toddler or anyone incapable of producing income is at Level 1. If you are in school and dependent on your guardian for your daily allowance that’s perfectly fine.

However, the opposite would probably be true if you were an adult who depends on handouts or government welfare to meet your basic needs. Whatever the case, I doubt anyone would choose to be at Level 1 for long.

A toddler or anyone incapable of producing income is at Level 1.

Food for thought: What about someone who has never worked a single day in his life and relies on income from a trust fund or inherited wealth since birth? Would that person be considered wealthy? Or is he no better than a child at Level 1? What do you think?

Level 2: Survival

Then comes the day when you graduate from school and start working full-time. You begin earning income on your own and no longer require sustenance from your parents. Welcome to Level 2, Survival.

At this level, it actually doesn’t matter whether you are a high school dropout or a college graduate. It doesn’t matter if you are earning $20,000 or $200,000 a year. When you are at Level 2, it simply means that you spend as much as you earn and are unable to save for a rainy day.

Case in point, when I graduated from university and landed my first full-time job, like many others, I was at Level 2, living paycheck to paycheck. Month after month, year after year, for whatever reasons, I just couldn’t save a single cent.

I was always in ‘need’ of a new shirt or tie. Not forgetting the countless social and networking sessions I ‘had’ to attend after work. If it was not this, it was that. The spending just never seem to stop. Sound familiar?

Of course, everyone’s situation is different. I’m sympathetic to those who may have to service a hefty student loan, or perhaps need to support their entire family, including their aging parents. Sometimes, circumstances are beyond our control. Hopefully, for those affected, it’s just temporary.

The same can’t be said about those who choose to inflate their lifestyles every time they get a pay raise and never seem to get out of the vicious ‘spend everything you earn’ cycle. Bigger salary, bigger car, bigger bills. Still no savings and you wonder why.

When you are at Level 2, it simply means that you spend as much as you earn and are unable to save for a rainy day.

Food for thought: Does it really mean that a person staying in a swanky penthouse apartment and drives a Porsche Cayenne is truly wealthy? Or perhaps he is up to his eyeballs in debt and would lose everything the minute he loses his job or business? There could be more than meets the eye, don’t you think?

Level 2 is no doubt better than Level 1, as you are no longer a burden to anyone. Nonetheless, your financial situation is still rather precarious and more needs to be done.

Level 3: Stability

Next up is Level 3, Stability, where you no longer live from hand to mouth. To be at Level 3, it’s not about how much you earn, but how much you spend and SAVE.

As a general rule of thumb, to achieve Stability, consensus has it that you should save enough to cover at least six months’ worth of your expenses.

If retrenched, six months of expenses would mean more than enough breathing room to find a new job. If you need to replace your refrigerator, piece of cake. It’s essentially your emergency fund (held in cash or equivalents) should something unexpected happen. This will offer you and your family stability in times of crisis.

To have any chance of achieving Level 3, the first step is to stop frivolous spending and eliminate all high-interest debt, especially credit card debt. If you have trouble keeping your spending under control, do read Mrs Wow’s article on 6 Types of Spending Triggers and How to Overcome Them. Believe me, I know it’s not easy, but we all have to start somewhere.

To be at Level 3, it’s not about how much you earn, but how much you spend and SAVE.

Check out: Yearly Financial Health Checklist

Level 4: Accumulation

Now that you have six months of expenses under your belt, it’s time for the next phase, Level 4, Accumulation. This level is also known as the Security Level, where you feel absolutely safe and secure financially.

Personally, I prefer to call this level ‘Accumulation’ as the focus is exactly that, to save, invest and accumulate wealth aggressively. The key to Level 4 is not just saving more money, but to INVEST and start generating passive income to cover your annual expenses.

While at Level 4, Mrs Wow and I switched to a higher gear to further increase our savings rate to about 80%. This provided the dry powder we needed for our investments. I know many might think how that is even possible. 80%? Though somewhat unconventional, we found a way to do it. You can read more about how we were able to reduce our expenses to retire early here.

The goal at Level 4 is to ultimately generate enough passive income to cover your annual expenses for the rest of your life. The truth is, to clear Level 4, it does take a fair bit of education, planning and discipline. It’s definitely no walk in a park.

The good news is, there is a way and you don’t need to make millions to get there. If you would like to know how Mrs Wow and I did it, do read the article How We Achieved Financial Independence Retire Early in 7 Years.

The key to Level 4 is not just saving more money, but to INVEST and start generating passive income to cover your annual expenses.

Check out: Why We Love Dividend Investing but It’s Not For Everyone and Beyond 9-5: Discover the 7 Income Streams for Lasting Wealth

Level 5: Independence

Congratulations! You are now generating enough passive income to cover your annual expenses indefinitely. You have made it to Level 5, Independence.

This is the level of wealth that every member of the FIRE community is at. But do note that Financial Independence is not necessarily a precursor of Retire Early (RE). Early retirement is a personal choice. Many who have reached Level 5, continue to work for fulfilment and enjoyment, no longer just for money.

When Mrs Wow and I achieved financial independence, it was, to say the least, the most liberating feeling ever. In a way, we did retire after selling our business. But lying on the beach and sipping cocktails every day wasn’t exactly what we had in mind for retirement.

To us, the whole point of achieving Level 5 is about HOT — Happiness, Options and Time. (You can read more about why we wanted to achieve FIRE here.) At Level 5, your life choices are no longer ruled by how much money you need to make. Rather it’s about pursuing your passion, your interests or whatever tickles you. For us, it gave birth to WowPursuits and we’re having the time of our lives.

At Level 5, your life choices are no longer ruled by how much money you need to make. Rather it’s about pursuing your passion, your interests or whatever tickles you.

Check out: The Big Reveal: Our Net Worth Exposed

Level 6: Freedom

I believe many would be truly happy and contented to stay at Level 5, as Mrs Wow and I are. However, the road doesn’t stop at Level 5. The next level of wealth is Level 6, Freedom.

It is the level of wealth where you have completely surpassed having enough to cover your own expenses indefinitely. At Level 6, your investment portfolio or otherwise generates substantial surplus income and it grows to more than you will ever need in your entire lifetime.

You now have complete freedom to go beyond self and start exploring philanthropic causes to give back to society. It’s also no longer financially unhealthy to splurge on a Lamborghini Veneno if you choose to do so. In fact, splurge all you want, you have complete financial freedom!

For Mrs Wow and I, we’re definitely not at Level 6 yet and it’s not a priority. Right now, we’re focus on actively managing our investment portfolio, preserving our wealth and spending time on things that bring meaning to our lives.

I don’t have a crystal ball, but if all goes as planned, our portfolio should grow over the years and maybe one day we will hit Level 6. If it happens, it happens.

At Level 6, your investment portfolio or otherwise generates substantial surplus income and it grows to more than you will ever need in your entire lifetime.

Check out: The Joy of Simple Living: My Story

Level 7: Abundance

Finally, we have Level 7, Abundance. This is perhaps the pinnacle of wealth where you have so much of it that even after giving away a significant portion of your wealth to causes you believe in, you still have an abundance of leftover that will last generations.

I don’t think much else needs to be said about Level 7, except that it’s not a level of wealth that Mrs Wow and I desire. For us, Level 5 is enough and if we get to Level 6, it’s a bonus. Nonetheless, everyone has different aspirations and I can only speak for ourselves. What is your dream? What would be enough for you?

I hope that you have come to the realisation that wealth is not about how much you earn or what you own. Rather, it’s about having a different mindset and perspective on how to achieve the different levels of wealth.

It’s now time for me to address the question I posed at the beginning of this article: Why would a multi-millionaire choose to take the bus every day? The short answer: financial freedom or even abundance doesn’t mean you have to lead the high life. Everyone is free to make their own lifestyle choices. If you want to drive a luxury sports car, that’s awesome as long as you have enough to fund your expenses.

Financial freedom or even abundance doesn’t mean you have to lead the high life. Everyone is free to make their own lifestyle choices.

Check out: The Compound Effect: Supercharge Your Wealth to Abundance and Tame Your Emotions: Let Your Wealth Compound Uninterrupted

To nail it in further, I would like to share with you this inspirational story that I came across some years back. It’s about Ronald Read from Vermont, US, born in 1921, died at the age of 92 in 2014.

After World War II, Read was honourably discharged from the army and returned to Vermont where he worked as a gas station attendant and mechanic for about 25 years. After that, Read continued to work for 17 years as a part-time janitor in a departmental store until he retired.

Read received a lot of media attention after it was discovered that he had bequeathed $1.2 million to his beloved Memorial Library and $4.8 million to the Memorial Hospital that took care of him in his old age till he died. He left the remaining $2 million to his two stepchildren. No one, not even his close friends or family had any idea that he had amassed an estate worth nearly $8 million, much of which were shares in dividend producing US blue chips.

You see, Ronald Read chose to lead a simple and frugal life. If he were to sit next to you on the bus, you or anyone else would have never guessed he was a true blue multi-millionaire.

Since Read’s death, much has been published about him. He’s even on Wikipedia, featured as a philanthropist and rightfully so. I hope his story has inspired you as much as it has inspired me.

I leave you now with a well produced video on Ronald Read’s life, created by Bright Side (it’s about 8 minutes long). It’s entitled ‘A Janitor Kept His $8,000,000 a Secret His Whole Life’. Enjoy!

So which level of wealth are you at right now? Let us know in the comment section below.

You may also like: Admit It: Money CAN Buy Happiness | What Are Your Money Values and Why You Need to Know Them | 5 Things to Know if You Want to be Financially Successful | Don’t be a Rich Jerk: 5 Ways Money Makes Us Arrogant | Exploring Money Mindsets: A Rich Man & His Four Sons

This is the perfect blog for anyone who wishes to understand this topic.

You understand so much its almost hard to argue with you (not that

I actually would want to… HaHa).

You definitely put a fresh spin on a topic which has been discussed for decades.

Great stuff, just excellent!

Thank you so much for your support and encouraging words. It means a lot to us!

We will do our best to continue writing insightful and refreshing articles for you guys. 🙌

Great post!

A must read for those interested in the path of gaining wealth and financial freedom!

Love the visual/infographic of the levels.

I’d be really curious to see what percent of the population is at which level. If I were to guess, Level 1 and 2 would be the highest.

Thanks so much for your kind words, Brett. Glad you like the infographic on the 7 levels of wealth. 😄

Oh yes! I would be super keen to see the stats on wealth levels too. Yeah… unfortunately, I believe many are still stuck at the lower levels.

On the bright side, I do personally believe that ever since the FIRE movement started, many more have achieved Level 4 or 5. 💪

It starts with a shift in mindset about money and wealth, and that’s exactly what I hope this post can spark. 🙌

A great and very well structured post!

It’s really well explained, so even people who have not that much financial knowledge (like me) can keep up with.

Really learned a lot. Thanks for sharing.

You’re most welcome, Noah! 😄 And thanks so much for your valuable feedback. It warms my heart to know you have found this article beneficial. 🫶

At the end of the day, it’s not just about having financial knowledge, but adopting the right money mindset. You are clearly on the path to financial freedom! 🙌🌈