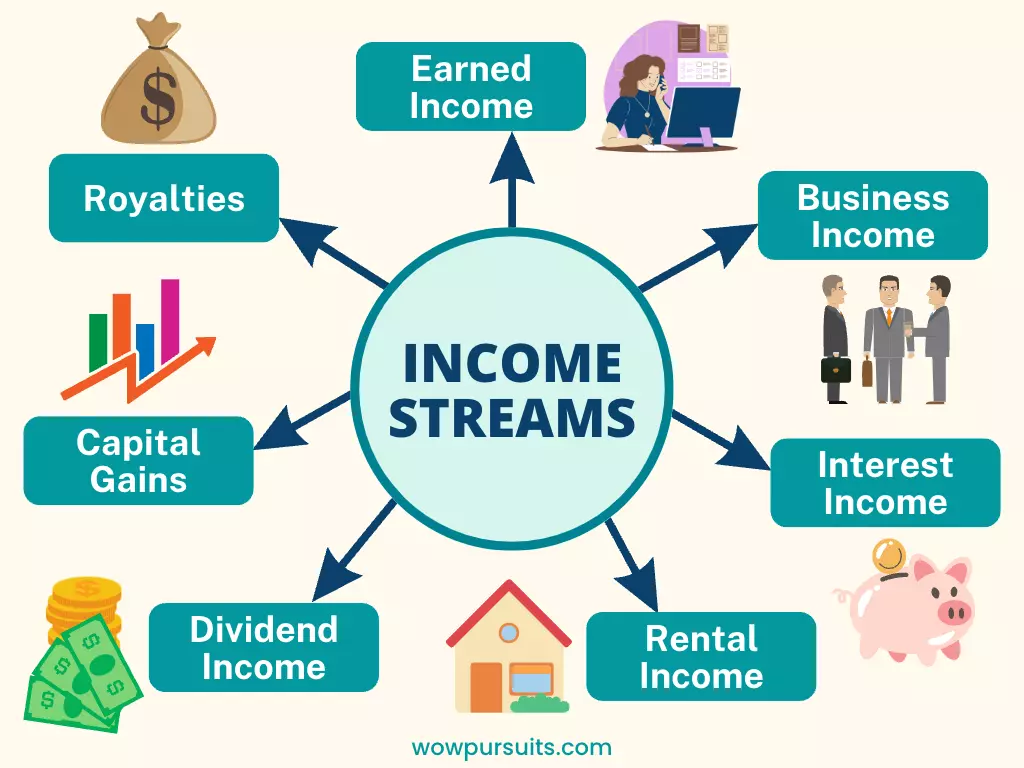

In today’s ever-evolving economy, diversifying your income streams has become a crucial strategy for achieving financial stability and abundance. As inflation continues to weaken your purchasing power and job security becomes a thing of the past, relying solely on a single source of income can be risky. Unexpected life circumstances such as a major health crisis can also disrupt your financial well-being.

By understanding and harnessing the power of multiple income streams, you can create a robust financial foundation and open doors to a world of possibilities.

In this article, we will explore the seven streams of income and learn how they can help you in your journey to financial success:

1. Earned Income

Earned income is the most common and traditional form of income. It refers to the money you earn by trading your time, skills and expertise. This income stream is typically derived from employment, where you work for someone and receive compensation in the form of salaries, wages, bonuses, commissions and/or tips.

To make the most of earned income, it’s essential that you focus on maximising your earning potential. This can be achieved through a few strategies:

- Develop Marketable Skills — Investing in your knowledge and skills such as acquiring professional certifications can enhance your value in the job market and open doors to higher-paying job opportunities.

- Negotiate Salaries and Benefits — When starting a new job or during performance reviews, negotiating for competitive salaries, bonuses and benefits can significantly impact your earning potential.

- Pursue Career Advancement — Proactively taking on additional responsibilities within your organisation can increase your chances of promotion, which translates to higher income.

- Start a Side Hustle — Engaging in side hustles can provide additional streams of earned income. This allows you to leverage your skills, pursue your passion, and potentially start a full-scale business.

My View: It’s important to keep in mind that earned income is not as stable as it seems as corporate downsizing and massive layoffs are becoming increasingly common. It’s also a fact that millions of jobs stand to be automated by generative AI. Even if you’ve an iron rice bowl, your earned income is still an active source that’s directly correlated to the number of hours you work. To have full control of your time, you will need to create passive income or someone else will always be calling the shots.

2. Business Income

Generated through entrepreneurial activities, business income involves starting and running a business that produce profits. It’s a versatile and potentially lucrative income stream. As a business owner, you’ve full control over your income potential, as well as the freedom to set your prices, manage your expenses and scale your operations according to your vision and goals.

The types of business income vary widely depending on the nature of your business. It may include revenue from the sale of products or services, consulting fees, client retainers, licensing agreements, franchise fees, or any other form of income directly generated by your business activities.

To succeed in generating business income, it’s vital to identify a viable market or niche, develop a solid business plan, and effectively execute your strategies. Establishing a strong brand, developing a loyal customer base, and delivering exceptional value are crucial factors for sustainable business income. Above all, you need manage your cashflow and expenses well.

Check out: 7 Things to Know Before Starting a Business and Why Even Bother Having a Marketing Plan?

It’s worth noting that building a successful business requires hard work, dedication and perseverance. You need to invest a lot of time, money and energy into it, especially at the initial stage. Even then, there’s always a risk of failure, and statistically speaking, many new businesses will fail.

My Business Adventure: Mr Wow and I know the challenges all too well as we ran a small business together before retiring early in 2020. That business gave us pretty good income, but it wasn’t the case with our maiden business, which failed in less than two years. All I can say is, don’t let fear of failure deter you. If you’ve done your research and believe in your business plan, the only way to find out is to give it a shot. Entrepreneurship can be highly fulfilling and the income derived from it has the potential to provide substantial financial rewards and contribute significantly to your overall wealth-building journey.

3. Interest Income

Interest income is earned by lending money to others or depositing funds in interest-bearing accounts. This income stream can provide a steady cash flow while allowing your money to grow passively. It can be generated through various financial instruments such as the following:

- Time Deposits — In a time deposit account, the bank or financial institution pays you a fixed interest rate on your deposit for the duration of the term, which ranges from a few months to several years. The interest rate is agreed upon at the time of opening the account and remains constant throughout the tenure. Generally, longer-term deposits or larger amounts tend to offer higher interest rates.

- High-Yield Savings Accounts — As the name suggests, high-yield savings accounts offer higher interest rates (known as bonus interest rates) than regular savings accounts provided that certain conditions are met. They incentivise you to essentially keep your account active and encourage consumption of the banks’ products and services.

- Money Market Accounts — Money market accounts typically require a higher minimum deposit and monthly balance compared to traditional savings accounts. They offer variable interest rates, meaning the rates can fluctuate based on market conditions. As they offer a high level of liquidity, they are often favoured by individuals seeking a combination of accessibility, stability and competitive interest rates for their cash reserves or short-term savings goals.

- Peer-to-Peer (P2P) Lending — P2P lending platforms connect borrowers directly with individual lenders. Lenders earn interest income by giving a loan to borrowers through these platforms. The interest rates vary based on the borrower’s creditworthiness and the terms of the loan. While P2P lending can be a good source of interest income, it’s important to note that it carries credit risk as borrowers may default on their loans. It also lacks liquidity as loans are typically tied up for the duration of the loan term.

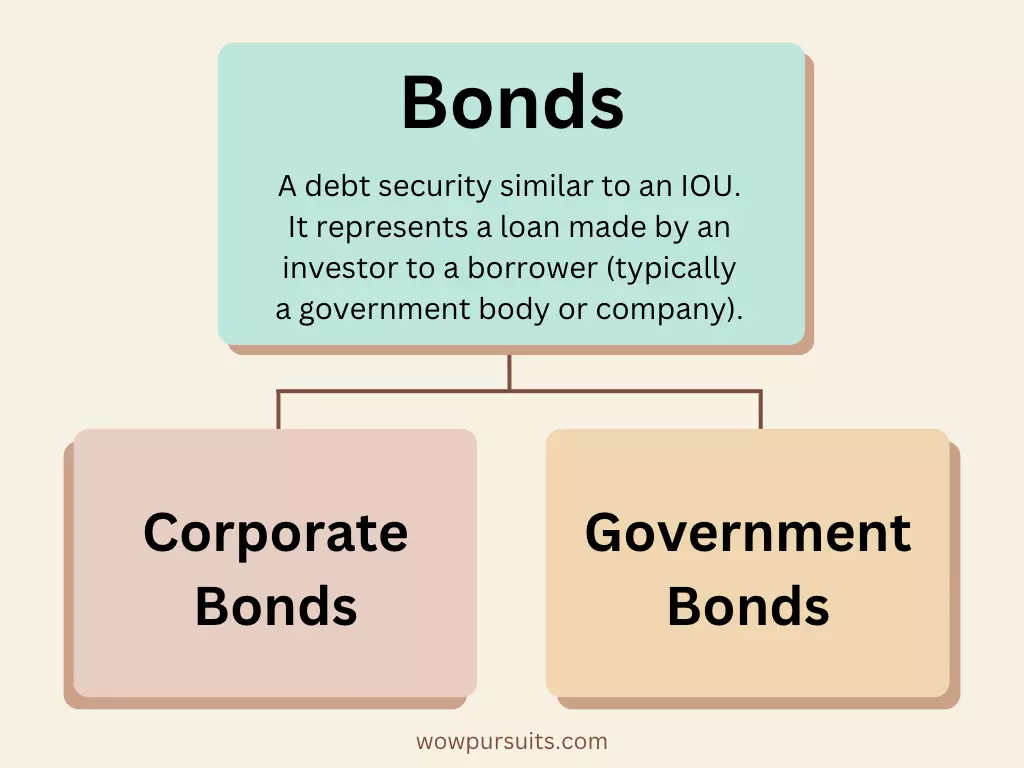

- Corporate Bonds — Corporate bonds are debt securities issued by corporations to raise capital. When you invest in a corporate bond, you’re essentially lending money to the issuing company. In return, the company agrees to make regular interest payments, known as coupon payments, typically on a semi-annual or annual basis. The principal amount is repaid to you when the bond matures. Corporate bonds can be included in an investment portfolio to diversify risk and provide passive income. However, it’s vital to carefully assess the creditworthiness of the company and consider the potential risks before making an investment decision.

- Government Bonds — Government bonds are debt securities issued by national governments (e.g. US Treasury bonds) or local governments (e.g. municipal bonds). They are available in various maturities, from a couple of years to a few decades. Government bonds, especially those with AAA credit rating, are considered safe investments because they are backed by the issuing government. That’s why investors often include government bonds in their portfolios to provide stability, income and diversification.

My Interest Income: Currently, intermediate AAA government bonds account for roughly 25% of my portfolio with Mr Wow. We place most of our cash in high-yield savings accounts and Singapore Savings Bonds.

4. Rental Income

Rental income is derived from owning and renting out properties such as houses, apartments, office spaces and commercial buildings. By becoming a landlord, you earn regular income in the form of rent paid by tenants. Rental income can provide a stable source of cash flow and is a good way to fight inflation as rents usually increase with the cost of living.

A key advantage of real estate investing is the ability to use debt financing, i.e. leverage, to increase the return on investment (ROI). Real estate also has the potential for appreciation over time, which is why it’s many long-term investors’ preferred asset class.

Nevertheless, it’s important to recognise that real estate is illiquid and cannot be readily converted into cash. Potential risks include unfavourable location, high vacancy rates, increased interest rates and negative cash flows. In addition, you need to be prepared for price fluctuations resulting from shifts in economic conditions.

Why I Don’t Own an Investment Property: Mr Wow and I do not own an investment property. Our only property is the home we live in, which is fully paid (yes, we’re debt-free). We consider our home a lifestyle expense, or rather an unproductive asset as it does not yield passive income like an investment property. Why don’t we diversify and buy an investment property, you might ask. Well, it’s because the Singapore real estate market is the most expensive in Asia Pacific, with the median price of private homes at US$1.2 million in 20221. Prices have since shot up even more. Instead of buying just one investment property, we prefer to diversify into REITs instead. See next point.

5. Dividend Income

Dividend income is earned by investing in dividend-paying stocks. When a company earns profits, it can choose to distribute a portion of those profits to its shareholders in the form of dividends. A dividend is paid per share of stock, so the more shares you own, the larger your dividend payout will be.

Besides stocks, index funds and Real Estate Investment Trusts (REITs) pay dividends too. REITs are required by law to distribute a significant portion of their taxable income to shareholders in the form of dividends, known as distribution per unit (DPU). This makes them an attractive investment for those looking for a steady stream of passive income.

Dividend income can provide both regular cash flow and potential long-term growth, especially if the dividends are reinvested to purchase additional shares. Nevertheless, do note that companies that currently offer appealing dividends may not continue to do so in the future.

The frequency at which dividends are paid also varies depending on the company and its dividend policy. Some companies give quarterly payouts, others semi-annually or annually. Factors such as the company’s financial performance, cash flow and management decisions can also influence the frequency.

Also, do note that not all companies pay dividends, in particular those in the growth phase or certain industries that prioritise reinvesting profits into expansion and research.

My Dividend Income: Mr Wow and I love dividend investing and maintain an equity-dominated portfolio that consists of about 60% stocks, ETFs and REITs. Despite the dividend cuts in 2020 and 2021 due to the Covid-19 pandemic, we still enjoyed a surplus. Find out more in The Big Reveal: Our Net Worth Exposed.

6. Capital Gains

Capital gains are earned when you sell an asset such as real estate, stocks, precious metals and other valuable possessions at a higher price than what you initially paid for it. They are a crucial aspect of investing and can contribute to the growth of your investment portfolio.

Capital gains can be realised over the short or long term, depending on your investment strategy and market conditions. Diversification across different asset classes and sectors can provide opportunities for growth and mitigate the impact of losses from individual assets.

In many countries, capital gains are subject to taxation. The tax rate on capital gains can vary based on factors like the holding period and type of asset. Some jurisdictions offer preferential tax rates for long-term capital gains.

It’s recommended that you consult a tax advisor or financial professional to understand the specific tax implications and regulations regarding capital gains in your jurisdiction. They can provide guidance on strategies to minimise tax liability while optimising investment returns.

I Make Capital Gains from Occasional Trading: Mr Wow and I are mainly long-term investors who buy and hold our investments for years, if not decades. But every now and then, we do a bit of swing/position trading (we enjoy it), which gives us extra moolah to buy ice cream, ha!

Check out: 4 Main Asset Classes: A Beginner’s Guide

7. Royalties

Royalty income is earned by leveraging your intellectual property such as copyrights, patents and trademarks. When others use your intellectual property under a licensing agreement, you receive royalties as a percentage of the revenue generated from its use.

Royalties are considered a form of passive income because they can continue to generate revenue without direct involvement once the intellectual property is created and licensed. The potential for royalty income depends on the demand for the intellectual property or product associated with it. Factors like market saturation and consumer preferences can influence the income-generating potential, not to mention marketing and distribution.

It should also be pointed out that royalty income often involves negotiation and contractual agreements with licensees, distributors or publishing companies. Understanding the terms and conditions of these agreements is key to ensuring fair compensation and protecting your rights.

My View: Let’s be honest. Very few people are able to generate royalty income as creating such intellectual property typically requires significant time, effort and investment, as well as a combination of talent and business acumen. If it’s one of your income streams now, good for you!

To sum up, by diversifying your income across these seven streams, you can create multiple sources of cash flow, reduce dependency on a single income stream, and increase your overall financial stability and potential for wealth accumulation.

That said, it’s important to strike a balance and make sure that you can manage and sustain each income stream effectively. More on this in my next article, so stay tuned.

Source:

- Singapore overtakes Hong Kong as the most expensive Asia-Pacific city for private homes: https://www.cnbc.com/2023/06/01/singapore-overtakes-hong-kong-as-most-costly-apac-city-for-private-homes.html

You may also like: Multiple Income Streams: Weighing the Pros and Cons | Why Having Multiple Streams of Income May Be Overrated

Nice overview and I’m a great admirer of your visuals!

I think depending on where you live, taxes also greatly influence how you allocate your income focus.

For me living in NY, I realized its less about what you earn, but more about what you keep. I was aggressively trying to shift more of my earned income to other sources of income with more favorable tax rates (e.g., dividends, municipal bonds and capital gains) as well as investments that would provide tax optimization (e.g., businesses writing off expenses and real estate with depreciation).

It’s hard to start the more favorable tax treatment income sources in the beginning because it usually requires either more capital or more work upfront, but amazing once you build them up!

Thanks for sharing your experience, Rob. Tax optimisation is so critical and the right strategy can really help to accelerate one’s wealth building plan. Sounds like you’re on top of things!