Today’s post is about our net worth and the size of our investment portfolio, which generates a six-figure annual passive income.

- Why Are We Sharing the Information?

- Our Net Worth Then

- Our Net Worth Now

- How Did We Accumulate Wealth?

- Why Retire With 35 Times Our Annual Expenses?

1. Why Are We Sharing the Information?

If you haven’t read We Achieved Financial Independence Retire Early in 7 Years, Mr Wow and I retired in 2020, aged 45 and 42 respectively. Prior to that, we ran a small business together for 10 years.

Over the years, different people have asked us, directly and indirectly, about our income and net worth. Their curiosity is understandable as we don’t quite fit into the standard “successful rich people” mould. We don’t live in a big house or even own a car. The business we had wasn’t a big or glamorous enterprise. It’s hard to believe that we have enough money to meet our retirement needs.

The thing is, Mr Wow and I have always been discreet about our finances, so nobody except, of course, the taxman knows how much money we used to make. We’ve also kept our net worth confidential. In fact, our family and friends don’t even know about this blog.

It’s not that we think discussing money is a social taboo. We just don’t see how sharing information about our finances will benefit anyone in our circle. First, those who have less money than us might feel bad about their financial situation. If they’re the jealous sort, they might accuse us of being boastful. Why take the unnecessary risk?

Second, we don’t want them to form opinions about us based on our net worth. It’s a fact that many people will perceive or treat you differently when they know how much money you have. They’ll also judge you in a narrowly defined way, i.e. what you choose to spend on. From the car you drive to the gifts you give, you’ll be judged. Even your outfit can’t escape some form of scrutiny. If you always wear the same clothes, you’re a miser. If you always buy new clothes, you’re a spendthrift. It’s like your money has become your whole identity even though you know you’re more than that.

We do however realise that we need to approach this blog in a different way. It’s a personal finance blog after all, so some transparency is needed if we want to be taken seriously. Also, we think you will find some of the information here useful for your retirement planning. So here it goes.

Please note that all figures are in Singapore dollars. At the time of writing, 1 USD = 1.34 SGD.

2. Our Net Worth Then

When we retired in 2020, we had $1,900,000 in investable assets* (rounded off), equivalent to almost 35 times our annual expenses of $54,500. This amount does NOT include the following:

- The monies in our CPF Special and MediSave accounts — If you’re not from Singapore, CPF is our Central Provident Fund for retirement and healthcare. We don’t have much in our CPF Special accounts (it’s quite pathetic for our age actually), but it’s still extra income down the road. We’ve decided not to make voluntary contributions for the time being as our investments are giving us higher returns and we value liquidity more.

- The cash value of our whole life insurance policies — We bought both our policies when we were young and single. If we had known what we know now, we would have opted for term plans. Anyway, we will eventually surrender them as we don’t have dependents. For now, they serve as a buffer should we mess up along the way. We’ve two options: (1) surrender one of the policies in our 50s and use the money to top up our CPF accounts, or (2) surrender both policies in our 70s and treat the money as our golden age bonus. The projected surrender value will be around $380,000 in total.

- Our paid-off home, a small flat — As our home does not generate passive income like an investment property, we categorise it as an unproductive asset.

*Our investable assets are diversified into stocks, ETFs, REITs, bonds and cash. Find out how we allocate them in The Retirement Bucket Strategy Demystified.

Check out: Should You Pay Off Your Mortgage Early?

3. Our Net Worth Now

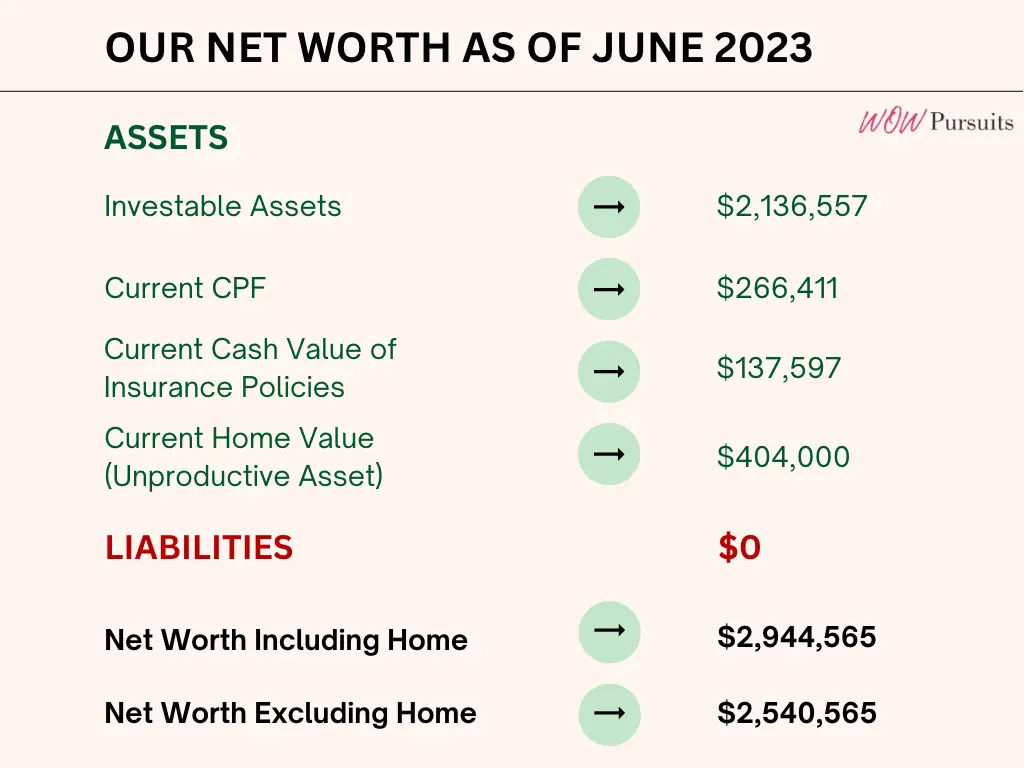

This is our net worth today:

We pay far more attention to our investment portfolio than our overall net worth as that’s our source of income. As of June 2023, we’ve $2,136,557 in investable assets, up $236,557 since we stopped work in 2020.

The increase is mainly because our passive income not only covers all our expenses, but also gives us a healthy surplus every year. On top of that, we haven’t travelled abroad for over three years, so that’s more savings and money to reinvest. Considering the dividend cuts in 2020 and 2021 due to the Covid-19 pandemic, we couldn’t be happier with the growth.

Last year, our investment portfolio generated a six-figure passive income, but we only spent $48,750 despite high inflation. In case you’re wondering, we don’t feel deprived of material comforts. We happen to love our lifestyle. This year, I estimate that we will spend around $58,000 as we’re planning to travel again.

Our long-term goal is to grow our passive income steadily so that we will continue to be in surplus.

Check out my two-part series: The Singapore Price Tag: Cost of Housing and Cost of Transport and Food

4. How Did We Accumulate Wealth?

So how did we manage to accumulate wealth and build a $1,900,000 investment portfolio to retire in the first place? It boils down to two factors: income and savings.

We were incredibly fortunate to make pretty good money, especially in the last five years of our business. The higher than average income made a huge difference. Instead of inflating our lifestyle, we tracked our expenses, kept to the same budget, saved and invested aggressively.

We also made the decision to pay off our mortgage by downsizing, which further reduced our expenses and increased our savings rate. We’ve been debt-free since 2018.

I want to keep it real by noting that being a child-free couple also made it a lot easier for us to build an investment war chest or even move to a smaller home. If you’re a parent working towards FIRE, please know that you’ve my greatest respect.

5. Why Retire With 35 Times Our Annual Expenses?

Why 35 times our annual expenses instead of the usual 25 times based on the 4% rule, you might ask. The short answer: we’re conservative investors.

From the very beginning, our aim was to create a sizeable passive income surplus every year to mitigate market risk. This way, we will not be too concerned even if some of our stock holdings are in the red or slash their dividends when times are bad.

To achieve the desired returns, a smaller portfolio of 25 times our annual expenses means we need to be more aggressive and have a larger allocation to equities. Frankly, despite what others may say, we find anything more than 60% highly uncomfortable.

At the end of the day, it’s about knowing our own risk tolerance and ensuring that we sleep well in retirement. After experiencing the Covid-19 recession and now high inflation, I can safely say that we made the right call to continue working until we hit our magic number. I’m not sure if we would be so unruffled if we had done otherwise.

But that’s just us. Everyone is different, so what’s your magic number? Do leave us a comment.

Related posts: Why We Wanted to Achieve Financial Independence Retire Early | 7 Levels of Wealth: A Different Way to Think About Money | Unlock Your Future: 5 Reasons to Plan for Early Retirement

I love a good net worth reveal! Awesome job and thanks for providing this personal finance voyeurism. I love that you went with 35x annual expenses to give yourself that added margin of safety–which, to be honest, you probably won’t need. Keep up the great work!

Thank you for taking the time to read and leaving such a positive note. 😊

I’m a bit of a worrier, so the 35X is a reflection of my “better safe than sorry” personality. 😅

I plan to write more about our passive income down the road, so do stick around!

Great Job Lynn, your story is the poster child for what everyone should be doing. I’ve been living below my means and investing as much as possible, but I started later in life.

I’m 53 now and could retire, but not ready to just yet. I wish all young people would follow in your footsteps so they can live a ‘work optional’ life in their 40’s and beyond!

Thanks, Jim. Your kind words mean the world to me. 😊

The best thing about financial independence — you have options, including whether to continue working or not. Your real estate portfolio is really impressive and I’ve no doubt you can retire any time.

Was reading your blog earlier today and especially enjoyed your article on living off dividends. Keep inspiring! ✨

Great post and thanks for sharing your approach to building your net worth! Kudos on being able to retire during the pandemic which is a success story in itself. Maximizing your income while keeping expenses flat is definitely not easy and I’m sure required significant sacrifice and discipline over long periods of time.

Hi Rob, thank you so much for your kind words! Much appreciated.

Yes, it took years of planning and execution to build our net worth. We’re just really happy that we were able to reach our FIRE goal. Definitely didn’t expect to retire to a pandemic. It was a huge relief that our portfolio survived the test! 😅