Retirement planning is challenging, to say the least. Since no one can predict his or her life expectancy, longevity risk is something that must be dealt with. To make sure that they do not outlive their money, retirees will have to stay invested, which of course exposes them to a different kind of risk, i.e. market risk. On top of that, they have to adequately address their spending needs and set aside an emergency fund.

The Retirement Bucket Strategy could be the answer to the above.

The Retirement Bucket Strategy is a time segmentation approach to retirement portfolio management. Assets are split into various time frames and invested differently to ensure that retirees meet their spending needs and have enough money for whatever the future may hold.

If you have heard of the Retirement Bucket Strategy and found it complicated or confusing, you are not alone. There are countless related articles and videos on the Internet and all of them seem somewhat different. Even though there are many variations of the strategy, the core principles remain the same.

Using my portfolio with Mr Wow as a case study, this article sets out to demystify the workings of the Retirement Bucket Strategy:

- What Exactly is the Retirement Bucket Strategy

- The Biggest Misconception about the Retirement Bucket Strategy

- Why Are There So Many Variations of the Retirement Bucket Strategy

- How Does the Retirement Bucket Strategy Work — A Case Study

- Benefits of the Retirement Bucket Strategy

- Drawbacks of the Retirement Bucket Strategy

1. What Exactly is the Retirement Bucket Strategy

The first time I came across a YouTube video on the Retirement Bucket Strategy, I was instantly intrigued. The idea of segmenting a portfolio into different pools or buckets — each with a different time frame, risk profile and asset allocation — made a lot of sense to me. I knew it was a strategy Mr Wow and I could adopt, so I began to research into it. Today, the strategy forms the basis of our portfolio.

The central premise of the strategy is that by holding some liquid assets (i.e. cash and equivalents) at all times, you can enjoy a stable standard of living while maintaining a diversified pool of assets for income and capital growth. The liquidity provides peace of mind to ride out periodic market fluctuations, lowering the risk of having to sell investments during downturns to fund living expenses.

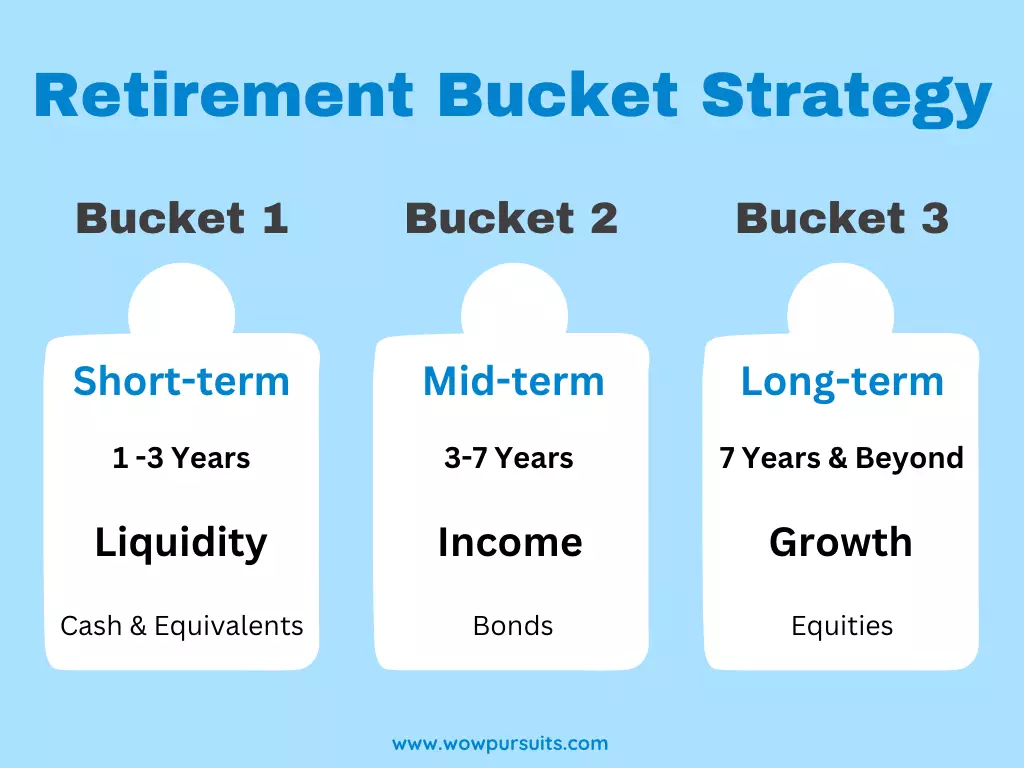

Here’s the strategy at a glance:

As shown in the above diagram, the strategy divides your retirement portfolio into three buckets. Each bucket has a specific time horizon (short-term, mid-term and long-term) and contains different asset allocations, put together with your risk profile* in mind.

*Risk profile refers to an assessment of an individual’s willingness and ability to take risks.

Here are the goals of each bucket:

Bucket 1: Short-term

Bucket 1 (aka the Cash Bucket) is the liquid component of your retirement portfolio. It comprises up to three years’ worth of living expenses, held in stable cash and equivalents like time/fixed deposits, Singapore Savings Bonds and T-bills. The money is used for day-to-day expenses and emergencies.

As cash and equivalents are low-yield, this bucket is not meant for growth. Instead, its purpose is to

- maintain healthy liquidity (funds can be accessed immediately or at a short notice), and

- give peace of mind that you will have money to meet your spending needs in the next few years even if the market takes a nosedive.

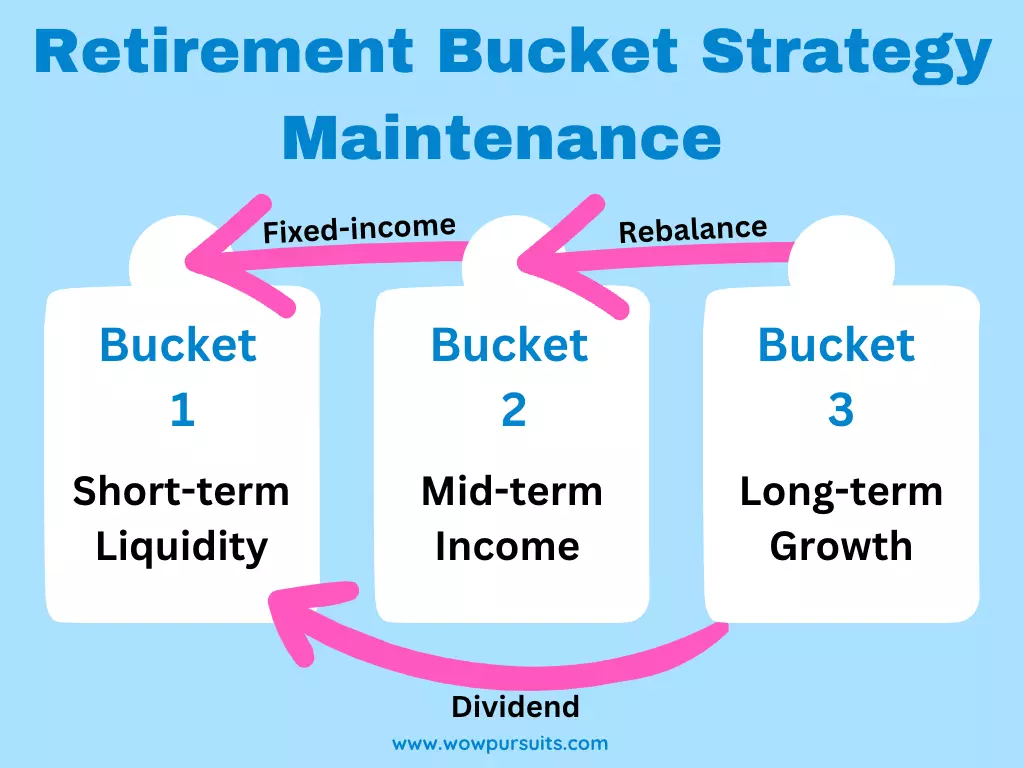

Maintenance: Bucket 1 needs to be replenished regularly so that it does not run out of money. The funds will come from Bucket 2 and 3.

Bucket 2: Mid-term

Bucket 2 (aka the Defensive Bucket) has a longer time horizon of three to seven years. Its primary investment objective is income. To achieve that, it invests in low-risk, fixed-income assets such as bonds. This balances the need for stability (returns that keeps pace with inflation) and potential capital appreciation in the mid-term.

Maintenance: Income from Bucket 2 is used to replenish Bucket 1.

Bucket 3: Long-term

Bucket 3 (aka the Equity Bucket) is positioned for long-term capital growth and dividends from value stocks and funds. Returns must outpace inflation so that you will not run out of money in retirement. This means taking a relatively higher degree of risk by investing in assets that expose you to price volatility. The lengthy time horizon will enable the bucket to ride out short-term fluctuations and generate high returns in the long run. It is therefore crucial that you do not sell assets from this bucket during a market downturn.

Maintenance: Returns from Bucket 3 are used to replenish Bucket 1. Over time, Bucket 3 is likely to increase in value and thus allocation proportion, so you will want to rebalance* your portfolio by selling some stocks to buy bonds (i.e. top up Bucket 2).

*Rebalancing refers to the process of returning the values of a portfolio’s asset allocations to the original, desired levels. These levels were determined based on an investor’s tolerance for risk and desire for reward. To deepen your understanding, read: Portfolio Rebalancing for Beginners.

The following diagram gives an overview of how you can maintain your buckets:

Check out: Portfolio Diversification: Understanding its Pros and Cons

2. The Biggest Misconception about the Retirement Bucket Strategy

Before we go any further, allow me to clear a common misconception about the strategy. I held this misconception myself when I first started exploring the subject, so by addressing it here, I hope it will help to shorten your learning curve.

The Retirement Bucket Strategy requires you to maintain the allocations in all three buckets on an ongoing basis. Nevertheless, many people have the wrong impression that they are supposed to ‘empty’ the buckets in chronological sequence, i.e. spend everything in Bucket 1, then Bucket 2, followed by Bucket 3. At first glance, that may seem like the logical thing to do since cash is low-yield and the investments in Bucket 3 take time to grow. On second thought, it doesn’t make sense to do so as that would totally defeat the purpose of the strategy, which is to balance the need for income stability and capital growth.

Many people have the wrong impression that they are supposed to ‘empty’ the buckets in chronological sequence, i.e. spend everything in Bucket 1, then Bucket 2, followed by Bucket 3.

If a retiree exhausts his buckets sequentially, he would find himself with an increasingly aggressive portfolio that focuses on capital appreciation rather than cash flow and capital preservation. With little or no allocation to cash or bonds, such a portfolio requires a high tolerance for risk — something that many do not have, let alone elderly retirees. Personally, I choose a good night’s sleep over a potentially bigger nest egg, but that’s just me.

3. Why Are There So Many Variations of the Retirement Bucket Stragegy

The many variations of the bucket strategy also create some confusion. If you have been researching into this topic, you have probably come across different versions from the one presented above.

For instance, the original strategy (pioneered by US financial planning guru Harold Evensky in 1985) only has two buckets: one for cash, another for long-term investments. I have seen versions with four and even five buckets. The time horizons and asset allocations can vary considerably too. Naturally, a question arises — Which variation is the best?

Well, the best variation is one that caters to your needs. Put it this way. Everyone’s retirement is different. If you look at age, it goes without saying that an early retiree in his 30s can afford to take a more aggressive investment approach than someone in his 60s due to a longer time horizon. However, if you take portfolio size into account, you may draw a different conclusion. Throw risk profile into the mix and you may arrive at yet another conclusion. No wonder there are so many variations floating around!

The best variation is one that caters to your needs.

The bottom line is that you need to customise the strategy to suit your unique circumstances. While the general principles are the same, the implementation is not rigid.

4. How Does the Retirement Bucket Strategy Work — A Case Study

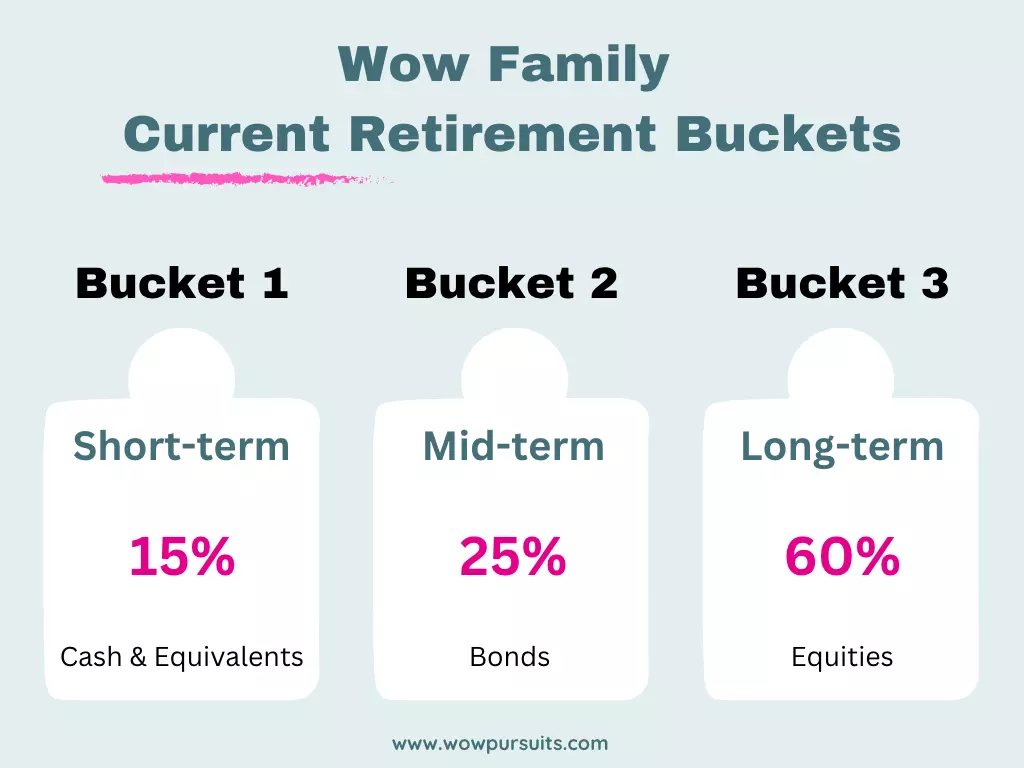

In case you need some ideas, I shall use my portfolio with Mr Wow as an example. In my article How We Achieved Financial Independence Retire Early in 7 Years, I mentioned that Mr Wow and I withdraw 3% of the total value of our portfolio each year (principal untouched as our dividends and coupons yield more than 3%). Adapting the Retirement Bucket Strategy, we split our portfolio three ways as shown in the diagram below:

This current allocation has served us well. For one, the high liquidity gives us peace of mind to stay invested when the market is down. It is also very easy to rebalance our portfolio. We are very fortunate that our investments have been generating higher returns than our withdrawal rate, so the surplus is used for rebalancing and of course, to create more passive income.

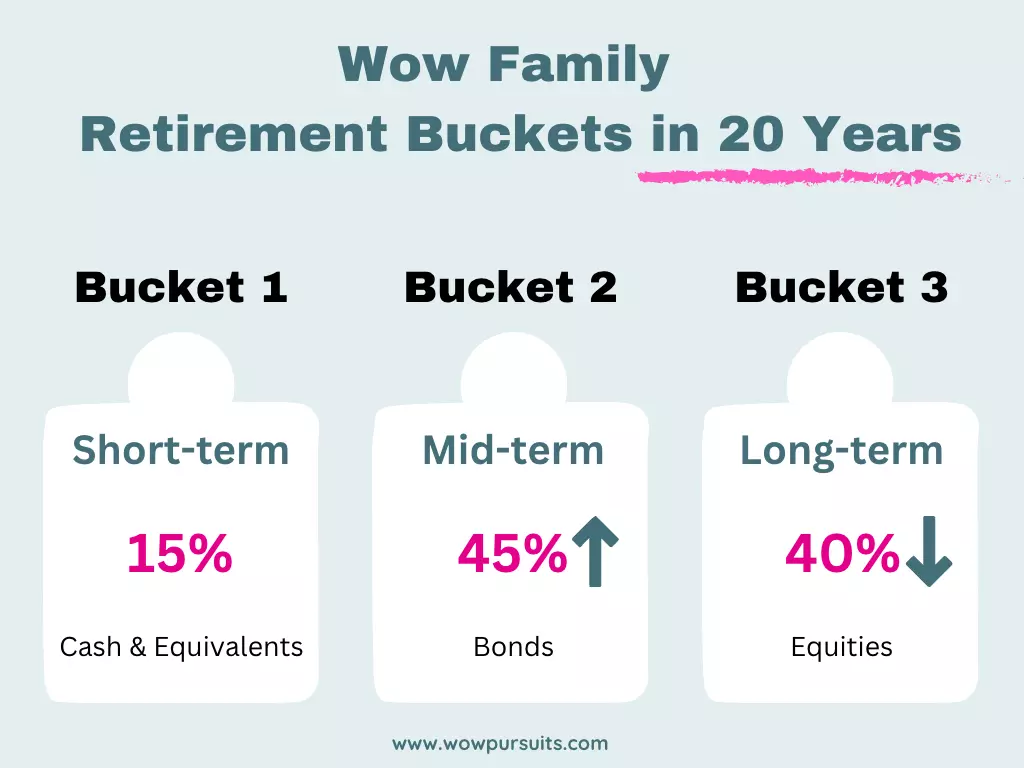

That said, retirement planning is dynamic. Right now, Mr Wow and I are comfortable with an equity-dominated portfolio because we are still in our 40s (long time horizon). All things being equal, as we get older, we plan to gradually reduce our risk exposure by giving bonds (Bucket 2) a heavier weighting. Our allocation may look like the following 20 years down the road:

Depending on your circumstances, you may want to have an even more defensive portfolio by increasing your Bucket 2 to 60% as recommended by some financial advisors, or you may prefer a greater weighting on equities, provided that you can accept the accompanying risks.

Check out: The Big Reveal: Our Net Worth Exposed

5. Benefits of the Retirement Bucket Strategy

It Prompts You to Give Time Horizon Careful Consideration

When structuring your investment plan for retirement, it’s imperative that you consider your time horizon, which is a main determinant of your investment choices. Generally speaking, the longer the time horizon, the more risks you can afford to take in exchange for higher returns. When you apply the bucket strategy, you will automatically segment your portfolio into different time horizons and choose investments that are suitable for each time frame.

It Helps You to Stay On Course

Even though history proves that those who stay invested are likely to reap positive returns in the long run, many people find it hard to stick to their investment plans during a bear market. It can be deeply disconcerting to see your investments dip in value and you may feel an overwhelming urge sell them out of fear. Having a cash reserve (Bucket 1) will give you a certain confidence to stay on course and avoid making emotionally-driven decisions that may possibly sabotage your long-term success.

Check out: The Compound Effect: Supercharge Your Wealth to Abundance and Tame Your Emotions: Let Your Wealth Compound Uninterrupted

6. Drawbacks of the Retirement Bucket Strategy

It’s Rather Complex

Some people find the bucket strategy rather complex to execute. Decisions must be made about how many buckets to create, as well as what and how much to invest in each bucket. You may find the whole process challenging without professional advice. Then, there’s the ongoing maintenance after you have segmented your portfolio. The key to the strategy is rebalancing as you live through retirement. If left unattended, your buckets may not yield the desired results.

It Requires You to Take Some Risks

Putting 70% in Bucket 1, 20% in Bucket 2 and 10% in Bucket 3 will not work. For the bucket strategy to be effective in ensuring that your money does not run out during your lifetime, you will need to stay invested with significant exposure to growth assets. If you are risk averse, you will find this highly uncomfortable.

Putting 70% in Bucket 1, 20% in Bucket 2 and 10% in Bucket 3 will not work.

To sum up, the Retirement Bucket Strategy helps to balance the need for regular income and capital growth in retirement. Each time-segmented bucket consists of different asset allocations, and is built with an individual’s financial situation and risk preference in mind. I hope this article has deepened your understanding of the strategy and given you some ideas on retirement planning.

Tell us what you think of the strategy in the comment section below.

Sources:

- Retirement Bucket Portfolios Made Simple: https://www.morningstar.com/articles/664406/retirement-bucket-portfolios-made-simple

- The Bucket Approach to Building a Retirement Portfolio: https://www.morningstar.com/articles/840177/the-bucket-approach-to-building-a-retirement-portfolio

- What is the Retirement Bucket Strategy?: https://smartasset.com/retirement/retirement-bucket-strategy

- The bucket approach to retirement income: https://www.capitalgroup.com/advisor/practicelab/articles/bucket-strategy-retirement-income.html

Learn how to insulate your portfolio and maximise returns in economic downturns. Read Investing During a Recession: What You Need to Know.

You may also like: Unlock Your Future: 5 Reasons to Plan for Early Retirement | Why We Wanted to Achieve Financial Independence Retire Early (FIRE) | Embracing Early Retirement: Why I Don’t Miss Work