This is the second instalment of a two-part series on reducing your expenses to achieve Financial Independence Retire Early (FIRE). In the previous post, I covered the importance of tracking your spending and showed you our household expense categories. In this post, let’s work on eliminating your unnecessary outgoings.

Tracking your expenses is actually the easy part. The real challenge comes when you have to decide which expenditure to axe, trim or keep. Your budget should be realistic and something that you have no problem sticking to.

Congratulations! If you have read Part 1 of this two-part series and followed my recommendation, you would have started tracking your expenses. Once you have a good idea of where your money is going every month, you can start making some radical changes to lower your expenses.

The Internet has tons of tips on this topic. One common tip is to separate your needs from your wants. Examples of needs are food, housing and healthcare. Examples of wants are restaurant meals, facials and vacations. Basically, a need is essential, while a want is optional.

Some people can easily eliminate their wants and survive on very little. But for most folks, retaining a few wants is important as these things bring them immense happiness. To quote Marie Kondo, they ‘spark joy’. Mr Wow and I fall under the latter group. While working out our budget, we were pragmatic about what we could part with and what we couldn’t. Every expenditure, be it a need or want, was given careful thought.

Here’s what I will be covering in this article:

- Our Budget Pain Scale Explained

- Pain Scale 1: Axe Spending

- Pain Scale 2: Trim Spending

- Pain Scale 3: Keep Spending

A word of advice: Don’t be too ambitious. To succeed in the long run, you should be realistic about what things you can and cannot live without. You really don’t want to create a budget that is too painful to follow. The last thing you want is to backslide, e.g. go on a sudden spending spree because you feel deprived.

Our Budget Pain Scale Explained

I’m not going to be typical or condescending by telling you what expenses to cut (e.g. stop drinking Starbucks, switch to a cheaper mobile plan, etc.). Instead, I will provide you with plenty of ideas by sharing what Mr Wow and I cut. Everyone values different things, so the process of reducing expenses is a highly subjective decision. What’s necessary to me might be totally unnecessary to you, so you will have to make your own call.

I’m not going to be typical or condescending by telling you what expenses to cut (e.g. stop drinking Starbucks, switch to a cheaper mobile plan, etc.). Instead…

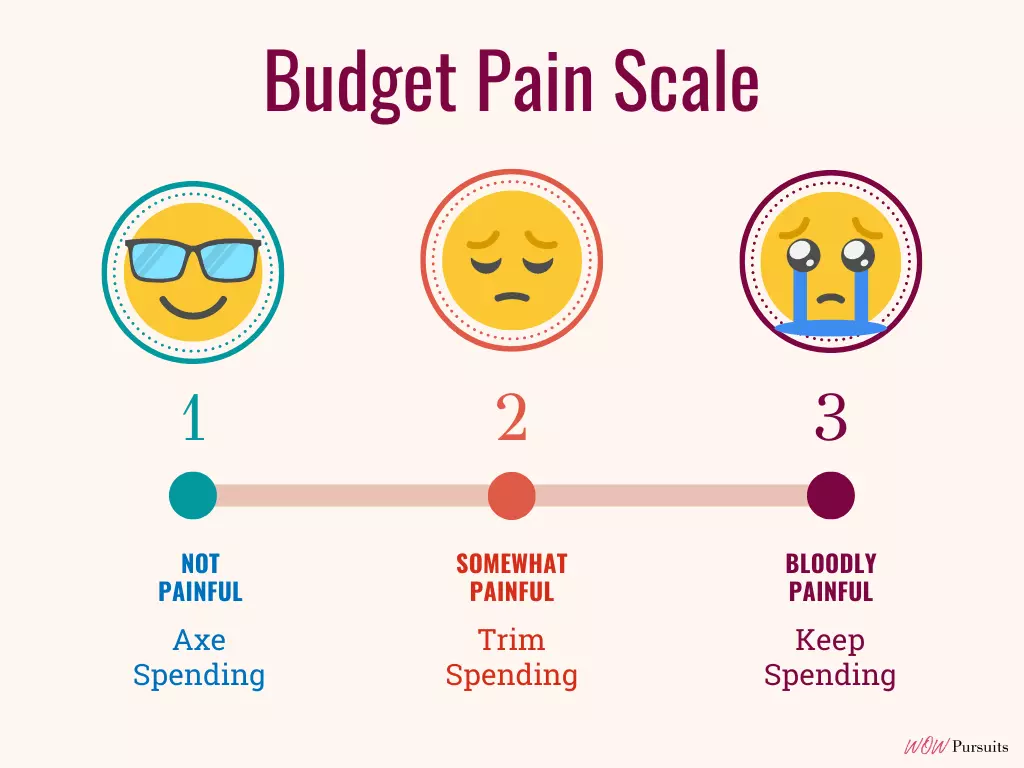

It’s like pain. Everyone has a different pain threshold. If you have ever been to the accident and emergency department of any hospital due to an illness or injury, you might recall the nurses or doctors asking you to score your pain on a scale of 1 to 10. The pain scale is a tool that healthcare providers use to help assess a patient’s pain such as the severity and type. 1 to 3 = mild, 4 to 6 = moderate, 7 to 9 = severe, 10 = very severe. Borrowing the concept, Mr Wow and I came up with a simple Budget Pain Scale to help us in our decision-making. Expenses were axed, trimmed or kept based on our pain scores:

Pain Scale 1: Axe Spending

Interestingly, our biggest expenses turned out to be the most painless to cut:

► Country Club Memberships: I often hear people say that once they have gotten used to certain material comforts, it’s difficult or impossible to let go of them voluntarily. I beg to differ. At the end of the day, it’s what drives you. Mr Wow and I enjoyed a number of privileges growing up. We’re incredibly blessed to have pretty well-off parents who gifted us with country club memberships when we were young. For years, we paid for the monthly subscription fees of both clubs even though we hardly used the facilities (sometimes not even once a year). The food, albeit good, was rather expensive. What about swimming? Too many boisterous kids on the weekend. Bowling? Not keen. Golf? Mr Wow can play a decent game, but I play like a farmer, so forget it. We know country club memberships are seen as a coveted status symbol, but so what? Does it make financial sense to keep paying for the upkeep of the clubs and not use them? Our answer was a resounding NO, so we sold both our memberships without regrets.

► Car: The next major expense to axe was our car. I got my first car (another gift from my generous father) shortly after obtaining my driving licence at 19. For the next 18 years of my life, I always had my own vehicle. Hence, when I first told Mr Wow that I wanted to sell our car, he couldn’t believe his ears. Not that he thinks I’m a spoilt brat. It’s just that human beings are creatures of habit, so he was doubtful that I could live without a car after so long. Nevertheless, I felt absolutely sure about getting rid of it. In fact, I would have gotten rid of it sooner if not because we had a super busy year and I needed our daily commute to be as effortless as possible. Cars are just way too expensive in Singapore* and I simply don’t see myself slogging away for that convenience. Furthermore, our country has a world-class public transport system, so we should at least give it a try. We sold our car the following month and never looked back.

*In case you’re not familiar with Singapore — There’s no such thing as a cheap car in this city-state. Here, a car is more than just a means of transport to get you from point to point; it’s a prized possession. To keep the number of cars on the road in check, the government issues limited permits known as Certificates of Entitlement (COE). Each COE lasts for 10 years. At the end of the 10-year period, you can either renew your COE or deregister your vehicle. Most vehicle owners choose the latter and buy themselves a new car. As of 9th July 2022, a Toyota Corolla Altis 1.6 Standard costs S$137,888 (US$98,568), while a BMW 7 Series 740Li M Sport is an eye-watering S$544,888 (US$389,511). To recap — you’re paying these insane prices for just 10 years of usage (NOT forever) and the other costs of owning a vehicle such as road tax and insurance have not even been factored in yet!

Check out: The Joy of Simple Living: My Story

► Mortgage: We purchased our matrimonial home, a five-room resale HDB flat*, in 2001. It was too big for two people, but perfect should our family expand (thinking long term). Fast-forward to 2018. We decided not to have kids after all, so it was just us two. Financially, we were doing well (it wasn’t always the case) and were very close to FIRE. Paying off our mortgage before our retirement was therefore a top priority. Even though many people around us were upgrading to private condominiums and landed properties, we took the path less travelled and downsized to a three-room HDB flat (also a resale). We made a bit of money, but more importantly, we finally cleared our mortgage (our one and only debt) and were on the ‘FIRE Autobahn’. Some folks might think that it’s a stupid move to pay off mortgages as they are generally viewed as a good debt. Mr Wow and I get where they are coming from, but there’s no such thing as a good debt in our book. To us, all debts are bad; the only difference is some debts are better than others. Being debt-free gives us a sense of freedom and that’s priceless.

There’s no such thing as a good debt in our book. To us, all debts are bad; the only difference is some debts are better than others.

*In case you’re not familiar with Singapore — HDB flats are public housing built by the Housing & Development Board. If you live elsewhere in the world, the term ‘public housing’ might conjure up images of low-income, crime-ridden communities. Here in land-scarce Singapore, they are well-appointed apartments situated in well-developed neighbourhoods. Today, around 80% of Singapore’s residents own and live in HDB flats of various sizes, sold on a 99-year leasehold. An HDB flat is definitely cheaper than a private condominium or landed house. However, record-high resale transactions over the past one year (those above one million Singapore dollars) have rekindled conversations about whether HDB flats are still affordable for the average Singaporean.

Check out: Cut Your Expenses: Quit Buying These 8 Useless Things

Pain Scale 2: Trim Spending

Lowering expenses doesn’t necessarily involve drastic lifestyle changes. Making modest adjustments to your spending goes a long way too. Mr Wow and I kept a number of discretionary items in our budget, but we scaled them down considerably:

► Dining Out: For several years, we had the habit of dining out every Sunday night. Unless there was a special occasion to celebrate, we usually ate at a budget-friendly family restaurant near our place. Sometimes, we opted for McDonald’s or KFC to satisfy our fast food cravings. Honestly, the meals were far from extravagant, but we were happy to adjust the frequency to once a fortnight. These days, we enjoy cooking so much that we often do not dine out the entire month (= more savings).

► Shopping: We strive to lead a simple, uncluttered lifestyle, so we’ve always maintained a policy of buying only what we need. Ever since we downsized to our current home, we buy even fewer things and have slashed our shopping budget to a negligible sum.

► Hair: Since retiring, we’ve picked up a few new skills and one of them is to trim our own hair! It’s not only cost-effective, but also loads of fun! Although we have not been to a salon for a long time, we still keep a small budget for our hair in case we mess things up and badly need professional intervention. LOL…

Check out: 6 Types of Spending Triggers and How to Overcome Them

Pain Scale 3: Keep Spending

There are a few simple pleasures in life that we simply couldn’t do without, so we kept them:

► Netflix: It really didn’t make sense to cut Netflix, our only streaming provider. Movie streaming is one of the most affordable forms of entertainment. Apart from paying for the monthly subscription, all we need is a broadband Internet connection. If the day comes that we have to forgo this, we must be in some major financial shit hole!

► Beer and Whisky: What can I say? Mr Wow loves his beer and whisky so much that he would rather work five more years than to reduce them! In all fairness, he drinks in moderation and buys only mid-range whisky, but that’s partly because I watch him like a hawk!

Pain is personal. That’s why the Budget Pain Scale works. It stops you from overanalysing things and encourages you to be true to yourself, ultimately creating a suitable budget that caters to your situation.

Once you’ve fixed your budget, you face the real challenge of keeping to it. In a world of rampant consumption, any effort to spend less often requires a great deal of discipline. To stay on track, remind yourself of your financial goals and the effects of your decisions. Every time you say no to overspending, you’re putting more money in your pocket and moving a step closer to FIRE. Good luck with your efforts!

What are some expenses you have axed, trimmed and kept? Share with us in the comment section below.

Related posts: Why You Should Track Your Expenses Down to the Penny | Cash Stuffing Budgeting System: No Thanks! | The Compulsive Consumer vs the Austere Saver