This is the second instalment of a two-part series on the cost of living in Singapore, the most expensive city in the world. Previously, I touched on how we tackle the high cost of housing. Now, let’s look at the cost of transport and food.

Whichever country in the world you live in, housing and its related expenses (e.g. utilities and maintenance) are likely to account for the largest share of your monthly household spending. This is usually followed by food and transport.

Here in Singapore, the overall prices of food are moderate to high depending on where and what you eat while public transportation is one of the most affordable in the world. In contrast, owning a private vehicle is a luxury.

- Cost of Car Ownership in Singapore

- Our Approach to Transport and Car Ownership

- Cost of Food in Singapore

- Our Approach to Food Expenditure

1. Cost of Car Ownership in Singapore

If you think homes prices in Singapore are outrageous, you might fall off your chair when you see the sky-high car prices. The island country is the most expensive place in the world to buy a car, largely because of taxes aimed at discouraging car ownership so as to limit traffic and pollution.

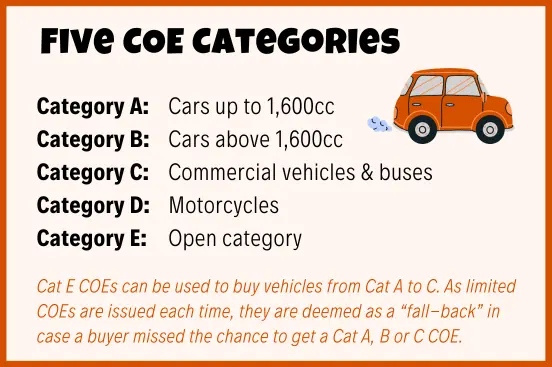

To own a car here, a buyer needs to bid for a permit known as the Certificate of Entitlement (COE). Each COE only lasts for 10 years. Once it expires, the owner can either renew it or deregister his vehicle (i.e. scrap or export it to other countries).

The COE system has been in force since 1990. There are two bids every month for five different categories:

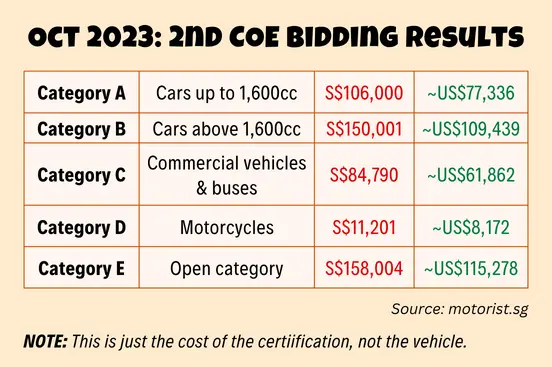

The following are the results of the second bid in October 2023, an all-time high.

Note: At the time of writing, all figures are based on an exchange rate of US$1 to S$1.37.

Yes, I double-checked the figures. It costs an eye-watering S$150,001 (~US$109,439) just for the right to own a car that’s above 1,600cc — on top of the car itself!

To give you a better idea of the cost, below are the prices of eight car models including COE as of 30th October 2023:

1️⃣ Nissan Note e-POWER Hybrid (1.2 Premium): S$158,800 (~US$115,809)

2️⃣ Kia Niro Hybrid (1.6 EX): S$172,999 (~US$126,164)

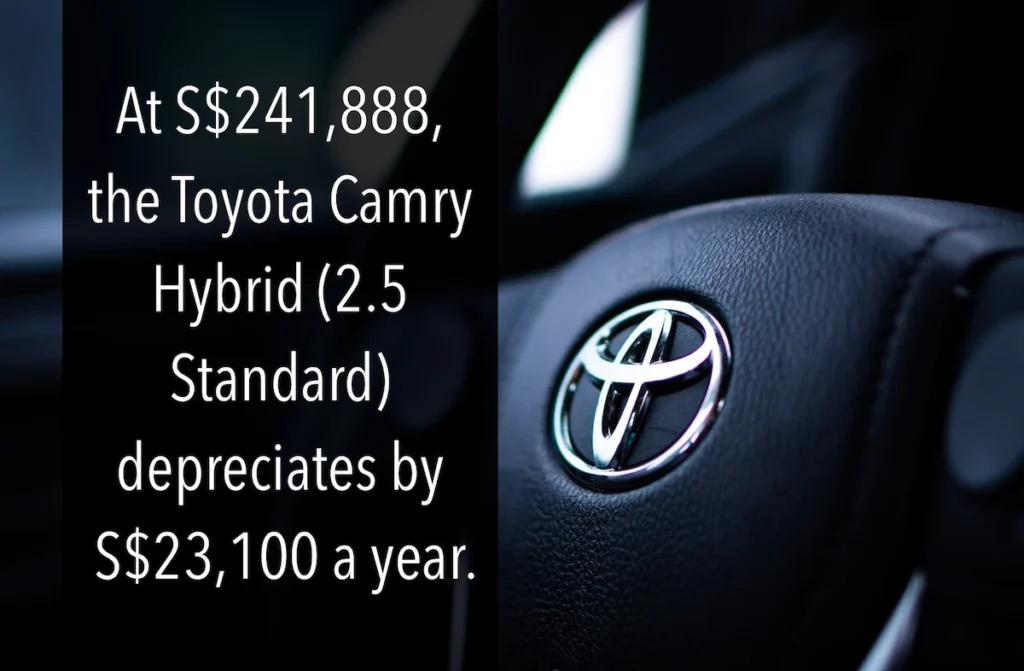

3️⃣ Toyota Camry Hybrid (2.5 Standard): S$245,888 (~US$179,320)

4️⃣ Honda CR-V (1.5 Turbo 5-Seater): S$255,999 (~US$186,694)

5️⃣ Audi A6 Sedan Mild Hybrid (2.0 TFSI S Tronic): S$326,212 (~US$237,898)

6️⃣ Volvo XC60 Mild Hybrid (B5 Plus): S$344,000 (~US$250,871)

7️⃣ BMW 7 Series Mild Hybrid (735i Pinnacle): S$651,888 (~US$475,406)

8️⃣ Mercedes-Benz S-Class Mild Hybrid (S450L 4MATIC): S$724,888 (~US$528,643)

Source: Sgcarmart

I KNOW, RIGHT?!

It’s hard to believe that people are paying these insane prices for just 10 years of usage, NOT indefinitely. Other costs like road tax, insurance, gas, parking, road toll, maintenance and interest on the car loan have not even been factored in yet.

Even more shocking is that the best-selling car brand in Singapore in 2022 was Mercedes-Benz. Toyota came in second, followed by BMW.1

If you recall, I mentioned in Part 1 that the current value of my home is S$405,000. Cars here are basically HDB flats on wheels! This is one of the main reasons why Singapore keeps topping the EIU’s list of most expensive cities in the world — eight times in 10 years to be precise.

So are Singaporeans crazy rich or mentally ill? Well, there’s definitely no shortage of rich people here, so I’m sure some can well afford the hefty price tags of their cars. But for others, I’m afraid the decision to own cars will set them back financially for years.

2. Our Approach to Transport and Car Ownership

Mr Wow and I get the appeal of owning a car. Like many, obtaining our driving licences in our youth was a rite of passage into adulthood. Cars provide a sense of personal liberty, an independence of movement to go wherever we want, whenever we want. More than just a status symbol, they are also a convenient mode of transportation for many, especially those with young children and elderly parents under their care. Convenience notwithstanding, we gave up our car in 2014.

To give some background, I didn’t earn my first two cars. They were gifts from my dad — one when I was studying abroad, another when I came back to Singapore upon graduation (yes, I know I’m very fortunate to win the birth lottery). Thanks to my dad’s generosity, Mr Wow and I didn’t have to buy a car when we got married. We shared my car until its COE ran out, then bought another car, which would be our last.

When I first suggested leading a car-free life, Mr Wow was somewhat doubtful. I think his exact words were “Are you sure? You’ve not lived without a car since you were a teenager. Do you even remember how to take public transport?”

Valid concern. Human beings are creatures of habit. That’s why most of us dislike change. Once we’re used to certain things (material comforts especially), it can be hard to part with them. Nevertheless, new habits can be formed, if we allow ourselves to.

“I’ll adapt,” I remember saying. “What’s the worst thing that can happen? If it turns out that life without a car sucks, we can always buy another one. Gotta give it a shot to know, right?”

We sold our car the following month. Was it painful to let it go? Not really as I had mentally prepared myself even before talking to Mr Wow. I think the only time I ever cursed and swore at my decision was when I was stuck at a bus stop for more than an hour due to a sudden downpour. Ever since that day, I always carry an umbrella.

As for Mr Wow, it was quite effortless as he used to take the bus home from work (I only sent him there in the morning). Furthermore, he’s a highly adaptable person — one of his many strong points.

Although we adjusted well to our new lifestyle, it doesn’t mean it wasn’t a sacrifice. The thing is, we both love driving and fast cars. We just love the idea of achieving financial independence more. From a purely practical standpoint, car ownership will easily set us back about S$2,000 to S$3,000 a month. It’s a costly convenience we’re not willing to pay. We do not see ourselves slaving for a house, let alone a car that can only be used for 10 years.

If the public transport system in Singapore were crappy, we would have thought twice about our decision. But it’s world-class (ranked fourth in the world in a study early this year by UC Berkeley and Oliver Wyman2) and significantly cheaper than driving.

Now that we’re retired and hardly go out, we spend as little as S$70 a month on transport, which includes a combination of bus, MRT (our rail system), taxi and private-hire cars. Not once have we burst our monthly budget of S$150.

The MRT is our preferred mode of transportation as we live a stone’s throw away from a station. It’s super convenient and stress-free (no more traffic jams). Best of all, it costs just S$1.60 per person to get to the city centre. In less than 20 minutes at that!

However, I always book a private-hire car when I’m all dressed up and wearing my 4-inch heels. We don’t have a mortgage, don’t drive and don’t lead a lavish lifestyle. Our passive income gives us a healthy surplus every year. I think I can afford a S$25 car ride from time to time. Agree?

Human beings are creatures of habit. That’s why most of us dislike change. But new habits can be formed, if we allow ourselves to.

Mr Wow and I are not too attached to material things. That’s why we could give up our car so easily. I know it’s hard to imagine, but once you’re used to a car-free life, car ownership in Singapore is not as alluring as it once was, especially when it comes at such an exorbitant cost.

I’m not suggesting that everyone should be like us. But do yourself a favour and don’t be too quick to say that you can’t live without something. A car may provide a certain sense of freedom, but I think the ability to detach ourselves from material possessions is the true ticket to freedom.

3. Cost of Food in Singapore

The cost of food in Singapore is manageable in that a lot of it is within one’s control.

Let’s start with eating at home. Grocery expenses can be moderate to high, depending on factors such as the type of food and the quality of ingredients. As mentioned in Part 1, Singapore imports more than 90% of its food supply. Needless to say, produce and food items from neighbouring countries are substantially cheaper than those from other regions. For instance, a dozen free-range eggs from Malaysia costs about S$8 while Australian ones can cost up to S$14.

Staples like rice from Thailand and vegetables from Malaysia are not too costly. Tropical fruits (e.g. bananas, papayas and pineapples) are a lot cheaper than temperate fruits (e.g. strawberries, cherries and peaches). Non-Asian products such as bratwurst and gourmet cheese are expensive.

Interesting information: The global food price surge in 2022 was a major concern for Singapore. To reduce its reliance on food imports and mitigate the impact of supply disruptions, the city-state aims to develop its agri-food industry’s capability and produce 30% of its nutritional needs by 2030.

The cost of dining out also varies significantly depending on the location, from affordable hawker centres to high-end fine dining establishments. As long as you don’t eat in restaurants all the time, you’ll be fine.

Hawker food: There are presently 118 government-run, open-air food courts known as hawker centres. A meal at a suburban hawker centre typically costs S$4 to S$10 and there’s a splendid array of dishes to choose from.

Casual dining: Mid-range cafes and restaurants can also be found throughout the country. A meal at a moderately-priced establishment ranges from S$25 to S$50 per person (more if you drink alcohol, which is costly here).

Fine dining: The average cost for fine dining is about S$100 to S$200 per person. High-end establishments that offer set or tasting menus are much pricier. In 2021, Singapore was ranked the second most expensive country to dine at top Michelin-starred restaurants, where the average full tasting menu was US$364 (~S$498).3 I’m sure it costs a lot more now (no data available) given the higher-than-usual food inflation in the past two years.

4. Our Approach to Food Expenditure

Pre-retirement, Mr Wow and I ate a lot of hawker food as it was the most convenient and affordable. We also tended to rush our meals so as to get back to business ASAP. Post-retirement, we try to eat healthily and mindfully.

While food is a basic necessity for survival, it also has the power to evoke feelings of joy, comfort and satisfaction, particularly when it’s prepared with care and affection. Eating shouldn’t be a mere routine task, but an enjoyable experience. That doesn’t mean we have to be extravagant. Good food is very often simple food.

These days, we eat at home most of the time. Frankly, cooking our own meals doesn’t really save us money as it can be more expensive than buying hawker food. We cook because we enjoy it.

The trick to cutting cost is to become really good at cooking. First, we can control the portions better. Second, we can get creative and make full use of leftover ingredients easily. Third, we like our own food so much that we’ve no desire to eat out, ha!

Mr Wow and I have a pretty wide repertoire. Brunch (yes, we combine breakfast and lunch) is usually an all-day breakfast menu. If not, it’s a sandwich with soup or salad. Really simple stuff. Dinner is more elaborate. We eat a lot of Chinese. At least once a week, we will make something fancy like pho, sushi, steak, quesadilla and lasagna.

We follow three grocery shopping guidelines:

1️⃣ Buy Cheaper Versions: Eating well doesn’t mean eating the “best” of everything. We buy regular local eggs for less than S$4 instead of imported free-range eggs, which are at least double the price. We also stretch our dollar by opting for affordable house brands for certain items (if the taste is acceptable). There are some things we simply won’t compromise though, e.g. Haagen-Dazs ice cream. If we’re going to pack calories, we expect it to taste divine.

2️⃣ Buy Discounted Items: We eat whatever we like, but for expensive items such as Japanese sauces and condiments, temperate fruits and diary products (e.g. butter, cheese and sour cream), we usually buy when they’re on special offer.

3️⃣ Buy in Bulk: We buy our drinks in bulk, so we always have coffee, tea, Coke, beer and whisky in our house at any point in time. Believe it or not, there are currently three dozen bottles of whisky in our study as our online wholesaler had a promotion. No… we’re not alcoholics although Mr Wow claims that he can only write when he drinks, ahaha…

Twice a month, we take a break from cooking and order food delivery. It’s more peaceful than eating out as most mid-range restaurants are really crowded at mealtimes. In the past, casual dining was a weekly thing. Now, we prefer to just go for fine dining on special occasions like our birthdays and wedding anniversary.

We also like to pig out when we travel. Vacations are a great time to try out new flavours. Thanks to the strong Singapore dollar, we’ve high purchasing power overseas (especially in the region), so we don’t see a need to skimp on food.

Good food is very often simple food.

In closing, Singapore has one of the highest costs of living globally. Housing, in particular, constitutes a significant portion of one’s expenses, with property prices being among the highest in the world. Private vehicles cost a king’s ransom while public transportation is relatively cheap. Food prices range widely depending on where and what you eat.

Although salaries in Singapore are quite competitive, I fear that many middle-class families are now “cashless” in the sense that most of their money has gone into mortgage and car loan repayments. A big house and a nice car are swell until we think about their long-term impact on our finances. How many Singaporeans will be working away their golden years, I wonder.

Life is about trade-offs. We can’t have it all, so it’s important to prioritise and make choices that lead to happiness and satisfaction. Mr Wow and I chose to downsize our home and lead a car-free life because we prioritise time freedom and early retirement. Another couple will have a different set of priorities and retirement lifestyle in mind. I can only hope that they exercise financial prudence in their decisions.

Check out: Unlock Your Future: 5 Reasons to Plan for Early Retirement

I can still recall verbatim the comment a foreign friend once made. “A car is a basic need, not a luxury item! This is so sad!” I know where she’s coming from, but Mr Wow and I prefer to focus on the positive side of things.

No country is perfect. Singapore is expensive, fast-paced and somewhat stressful, but everything is relative. There are many things to like about the country including its robust economy, excellent healthcare facilities, high standard of education and low crime rate. Personal income tax is also pretty low, capped at 22% for residents (to be adjusted to 24% next year), and capital gains are not taxed. Overall, it’s a highly liveable city.

So what are your thoughts about the cost of living in Singapore? As we approach the end of 2023, the EIU will once again be releasing its list of most expensive cities in the world. Do you think Singapore will be dethroned this time? I hope so.

NEWS FLASH: Singapore has yet again been ranked as the most expensive city to live in, sharing the top spot with Zurich in 2023, according to the Economist Intelligence Unit.4 This is the ninth time in 11 years that Singapore topped the list, while Zurich jumped from sixth place last year. New York, which shared the top spot with Singapore in 2022, dropped to third place, sharing the spot with Geneva.

Sources:

- Mercedes-Benz is best-selling car in Singapore, Tesla makes it to top 10 list in 2022: https://www.straitstimes.com/singapore/transport/mercedes-benz-is-best-selling-car-in-s-pore-tesla-makes-it-to-top-10-list-in-2022

- Singapore Ranked 4th In The World For Public Transport, Hong Kong Takes Top Spot: https://mustsharenews.com/singapore-4th-public-transport/

- How Much to Dine Out at a Top Michelin-Starred Restaurant: https://www.chefspencil.com/top-michelin-starred-restaurants-prices/

- Worldwide Cost of Living: Singapore and Zurich top the ranking as the world’s most expensive cities: https://www.eiu.com/n/singapore-and-zurich-top-the-list-as-the-worlds-most-expensive-cities/

You may also like: How to Cut Expenses to Retire Early: Getting Started | How to Cut Expenses to Retire Early: Realistic Budgeting | Relocating from Lisbon to London: A Firsthand Experience

Great post and I love learning about other cities to understand how the cost of living compares to NYC! I didn’t know that it cost that much for a COE! We don’t have that in the US/NYC but we are recently implementing a congestion tax which can range to an extra $9-$23 per day, which is nothing compared to the COE. I can’t blame you for giving up your car.

By the way, we cook our own food as well because we’ve recently become huge fans of the blue zones, longevity and it brings us happiness/creativity to our day!

Thanks, Rob. I’m glad you found the article interesting. 😊

Car Ownership — The cost of a COE is indeed eye-watering. It does deter people from driving, but it also makes cars even more coveted. Your congestion tax is pretty steep. Here in Singapore, our electronic road toll charges up to S$6 per trip during peak hours. We’re starting to switch to a satellite-based system and prices will be determined based on traffic conditions (i.e. the speed) in the future. I believe it will be more expensive than now.

Cooking and BlueZones — Yes, cooking is so much fun and a great way to unleash your creativity! 🙌 Not sure if you’ve been to any of the Blues Zones. We happen to love Okinawa. It has a really chill vibe and the food is so good! You’ll love it there!