This is the first instalment of a three-part series on downsizing as a strategy to clear your mortgage and achieve financial independence. Part 1 and 2 cover the financial and lifestyle benefits of downsizing respectively. Part 3 touches on the key factors that will set you up for a successful downsizing.

It’s a dream shared by many. First, buy the best house you can possibly afford. Next, upgrade to a bigger, grander, pricier one when you have made it in life. Your home is the ultimate status symbol, never mind that you will be saddled with an elephantine mortgage for decades. If it’s any consolation, you’re one of millions in the same boat.

Mr Wow and I do not share this dream. Truthfully, it seems more like a nightmare to us. So… four years ago, we made a strategic move to downsize to a smaller home. It was an important milestone for us — we crushed our biggest expense, became debt-free and were on the fast track to Financial Independence Retire Early (FIRE).

There are three main financial benefits of downsizing: you can pay off your mortgage without tapping into your savings, release the equity in your home, and reduce your monthly expenses.

If you’re tired of being a slave to your house, tired of being house poor and tired of being in debt, maybe you should consider downsizing. It’s a big decision and it may or may not be the right call for you and your family. There are factors that are unique to you and you need to ruminate on them carefully.

To help you figure things out, I will share our experience with you in this three-part series. I hope it will serve as a useful case study and answer some of your questions. Let’s set the ball rolling with Part 1, the financial benefits of downsizing:

1. When is the Right Time to Downsize

There’s really no right time to downsize to a smaller home. Sometimes, a life event might trigger the thought. Perhaps your grown children have moved out and the house is way too big for you and your spouse. Or maybe you’re approaching retirement and want to cut your expenses. I think most people fall under the latter category. They plan to downsize in their early to mid 60s just before their retirement.

Mr Wow and I did it in our early 40s for a number of reasons and you will have to read on to find out. Speaking from experience, we think it makes sense to consider downsizing before you get too old and frail. If you only start thinking about it in your 60s or even 70s, the thought of moving house might be so overwhelming that you end up aborting it.

Put it this way. Downsizing is a major project that takes up a lot of energy. The selling, the buying, the negotiations, the renovation, the big move and so on, no matter how well-executed, can be stressful and exhausting, so you probably want to do it while you still have the stamina. Of course, when you choose to do it has to align with your life circumstances and goals. Let’s look at the monetary benefits of downsizing.

2. Financial Benefits of Downsizing

You Want to Pay Off Your Mortgage Without Tapping into Your Savings

We live in a world where carrying a 30-year mortgage is more common than having a pet, and people say being a pet owner is a huge responsibility. Kinda bizarre, don’t you think? Despite the high cost in interest repayments (fixed home loan rates just hit 4.3% in Singapore on 15th November 2022), many people will not hesitate to take out a 30-year mortgage to get the most house they possibly can. But just because many people are doing it doesn’t make it less dreadful. Thirty years is NOT a short time. You’re basically in debt for most of your adult life!

We live in a world where carrying a 30-year mortgage is more common than having a pet, and people say being a pet owner is a huge responsibility. Kinda bizarre, don’t you think?

If you’re thinking about becoming mortgage-free, downsizing could be a feasible option, especially if you do not want to tap into your savings. That was the biggest motivation behind Mr Wow’s and my decision to downsize in 2018. Financially, we were doing well and were very close to FIRE. Crushing our mortgage and becoming debt-free before our retirement was therefore our number one priority. Our monthly expenses would be substantially lower and we would reach our FIRE goal even sooner.

Could we have stayed put and paid off the mortgage with cash? The answer is yes, but it made no sense considering the opportunity cost. The returns from our equity investment way surpassed the interest we would save on the mortgage, so it would be silly to touch our nest egg. Downsizing was the way forward. We studied the property market and ran the numbers. It was economically viable, so we took action.

We sold our home and used the profit to buy a smaller, less expensive one. After completely paying for and renovating our new home extensively, we still managed to pocket slightly more than S$60,000 (see 3 Key Success Factors of Downsizing to be Mortgage-Free for the breakdown). Sixty grand isn’t a lot of money; you could possibly make more than us. Even if there’s no surplus, you will still eliminate your mortgage, which is a big deal!

You Want to Release Equity Locked in Your Home

A house-poor person is someone who spends too much of his or her income on housing. Related expenses include mortgage repayments, property tax, utilities and maintenance. Most financial experts recommend spending no more than 30% of one’s total income on housing, but in reality, many people spend more than that. If you know who Property Soul is (she’s a real gem), you would have read about her 3-3-5 rule, which helps you ascertain whether a property is affordable to you. Here’s the rule in a nutshell:

► Rule 1: Your initial capital should be at least 30% of the property’s asking price in order to pay for the downpayment, transaction costs and other miscellaneous expenses.

► Rule 2: Your monthly mortgage payment should not exceed 1/3 of your monthly salary.

► Rule 3: The purchase price of the property cannot exceed 5 times of your annual income.

Yes, it’s a tough rule, but a prudent one. Unfortunately, human beings often break rules no matter how well-intended they are. It’s very tempting to overstretch yourself on housing by ‘maximising’ your home loan. I get it. In Singapore and many parts of the world, home ownership is seen as a key pillar of financial security and wealth building.

However, there’s always a trade-off. The expensive roof over your head is going to hold you back in other areas. You might not be able to save for a rainy day or invest for a better future because you’ve poured everything into your house. You might have kids some day and want to be a stay-at-home mum or dad. You can’t because your massive mortgage requires you and your spouse to keep working. Or you might feel burned out at work and wish to take time off. Again, you can’t. Your big house is basically limiting your options in life.

Back in 2018, Mr Wow and I lived in a five-room resale HDB flat*, our crib for 17 years. Although we could well afford the S$1,300-per-month mortgage, we didn’t like the fact that a good chunk of our net worth was tied up in an unproductive asset, which really was too much space for us. We wanted our money to work harder for us, so by downsizing, we unlocked the equity in our home and invested the profit in dividend stocks, ETFs and REITs for passive income. You might have a different reason from us, e.g. to pay for your child’s education. Whatever the reason, downsizing to free up cash will give you more flexibility and freedom to deal with various life events.

*In case you’re not familiar with Singapore — Since independence in 1965, land-scarce Singapore has established an incredibly successful public housing programme. Today, around 80% of the residents here own and live in public housing known as HDB flats. These flats, which come in various sizes, are sold on a 99-year leasehold. An HDB flat is definitely cheaper than a private condominium or landed house. Nevertheless, record-high resale transactions over the past one year (those above one million Singapore dollars) have rekindled conversations about whether HDB flats are still affordable for the average Singaporean.

You Want to Reduce Your Monthly Outgoings

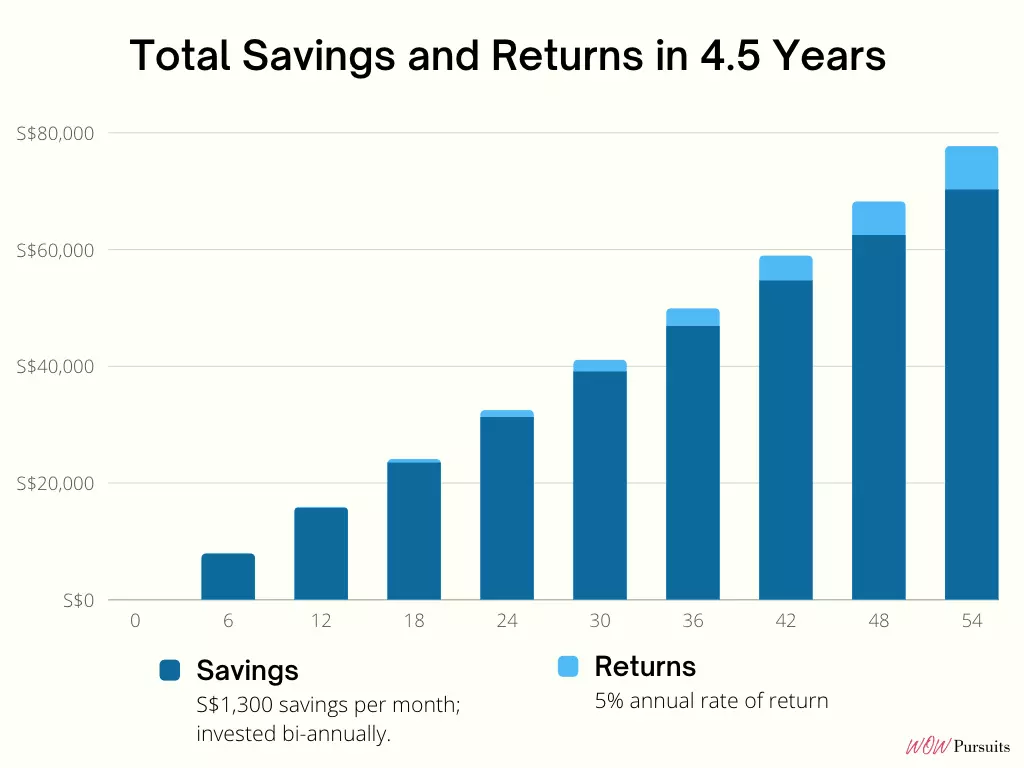

Your monthly cash flow will improve when you downsize and become mortgage-free. In our case, not having a mortgage means an extra S$1,300 per month. Instead of spending the money, we invested every single cent. It has been four and a half years since we downsized to our current home. That’s 54 months of savings on mortgage repayments: S$1,300 x 54 = S$70,200. But that’s not all. We have been able to generate an average return of at least 5% per annum with this amount of money, so we’re actually S$77,645.25 wealthier and this excludes the sales proceeds.

| Month | Total Savings | Total Returns | Balance |

|---|---|---|---|

| 0 | S$0.00 | S$0.00 | S$0.00 |

| 6 | S$7,800.00 | S$0.00 | S$7,800.00 |

| 12 | S$15,600.00 | S$195.00 | S$15,795.00 |

| 18 | S$23,400.00 | S$589.88 | S$23,989.88 |

| 24 | S$31,200.00 | S$1,189.62 | S$32,389.62 |

| 30 | S$39,000.00 | S$1,999.36 | S$40,999.36 |

| 36 | S$46,800.00 | S$3,024.35 | S$49,824.35 |

| 42 | S$54,600.00 | S$4,269.96 | S$58,869.96 |

| 48 | S$62,400.00 | S$5,741.70 | S$68,141.70 |

| 54 | S$70,200.00 | S$7,445.25 | S$77,645.25 |

Wait, there’s more. Before downsizing, we still had 13 more years of mortgage to go. That’s A HELL LOT OF MONEY in mortgage repayments and potential returns! Let’s see how much:

| Year | Total Savings | Total Returns | Balance |

|---|---|---|---|

| 0 | S$0.00 | S$0.00 | S$0.00 |

| 1 | S$15,600.00 | S$195.00 | S$15,795.00 |

| 2 | S$31,200.00 | S$1,189.62 | S$32,389.62 |

| 3 | S$46,800.00 | S$3,024.35 | S$49,824.35 |

| 4 | S$62,400.00 | S$5,741.70 | S$68,141.70 |

| 5 | S$78,000.00 | S$9,386.38 | S$87,386.38 |

| 6 | S$93,600.00 | S$14,005.31 | S$107,605.31 |

| 7 | S$109,200.00 | S$19,647.83 | S$128,847.83 |

| 8 | S$124,800.00 | S$26,365.75 | S$151,165.75 |

| 9 | S$140,400.00 | S$34,213.52 | S$174,613.52 |

| 10 | S$156,000.00 | S$43,248.33 | S$199,248.33 |

| 11 | S$171,600.00 | S$53,530.28 | S$225,130.28 |

| 12 | S$187,200.00 | S$65,122.50 | S$252,322.50 |

| 13 | S$202,800.00 | S$78,091.32 | S$280,891.32 |

That’s a whopping S$280,891.32! Notice how ‘frothy’ the returns get over time? That’s the power of the compound effect.

For the record, I have nothing against property as an investment. As a matter of fact, I think property investment is awesome if you know what you are doing. I am just against buying too much house for own stay and shouldering a hefty mortgage for decades. My view is one’s home is an unproductive asset. The property might appreciate in value but it’s unrealised profit until it’s sold. Meanwhile, it’s a cash flow negative expense and a good chunk of the homeowner’s net worth is locked in an illiquid asset. Leverage is a double-edged sword. More on this in Why We Do Not Consider Our Home an Asset.

The truth is we save more than S$1,300 per month because a smaller home means smaller bills. Currently, our property tax is a fraction of what we used to pay and our utility bills are about 30% less than before. It’s a pretty significant sum in the long run.

A life with no mortgage holding you down is incredibly liberating. If you invest the money saved on mortgage repayments (safely of course), you will enjoy a comfortable retirement like us. Yes, even in a smaller home.

However, money was not the only thing that motivated us to downsize. Some benefits cannot be measured by dollars and cents. In Part 2 of this series, I’ll talk about the lifestyle benefits of downsizing.

You may also like: The Singapore Price Tag: Cost of Housing