This article uses REITs listed on the Singapore Stock Exchange (SGX) as examples. Even if you happen to be residing somewhere else in the world you will still benefit from it as the same principles apply.

In my previous article, Why We Love Dividend Investing but It’s Not For Everyone, I discussed why Mrs Wow and I invest in dividend-yielding assets such as value stocks, Exchange Traded Funds (ETFs) and Real Estate Investment Trusts (REITs) amongst other assets. It’s now time for REITs to take centre stage.

At the onset of our investment journey, Mrs Wow and I always knew that REITs would play an important role in our investment portfolio. However, like with any form of investment, we had to do our due diligence and make sure we were comfortable with REITs.

For a start, we had to understand how REITs work and this is exactly what I will be sharing with you in this article:

- What are REITs?

- How Do REITs Work?

- What are the Fees Incurred by REITs?

- How Much Return Can Be Expected from S-REITs?

1. What are REITs?

Have you ever dreamed of being a property magnate? Imagine owning a row of Grade A office buildings or a string of crowded shopping malls. Imagine if you could just sit back and collect rent from an army of tenants without lifting a finger. Ahhh… wouldn’t that be nice?

The truth is, becoming a property tycoon is a pipe dream for the vast majority of us. For one, it takes money to make money and you will need a truck load of it to own prime commercial properties. Moreover, being a landlord isn’t always as glamorous as it appears. If you choose to manage the property yourself, you will likely face your fair share of having to chase for rental payments, dealing with tenant attrition, sorting out property maintenance issues, etc. The reality is, rental income isn’t exactly passive.

But what if I told you that there is a way to own part of a prime commercial property without having to fork out an arm and leg for it. Furthermore, you will be able to collect your share of the rent without the hassle of managing the property yourself. Sounds too good to be true? Well, it’s not. Welcome to the world of REITs.

So what is a REIT? Much like a mutual fund, REITs pool your money together with other investors to finance, own and operate income-producing properties such as offices, shopping malls, hotels, data centres, healthcare centres, warehouses and manufacturing facilities.

When you invest in a REIT, you become part-owner of the properties that the REIT manages and get a share of the rental income after management fees and other expenses are paid. Nice, right?

So how do you invest in REITs? It’s actually pretty straightforward. REITs are public listed companies on the stock exchange and all you need is a brokerage account to purchase REIT shares. (If you have yet to open your first brokerage account, do check out my article What to Know Before Opening Your First Brokerage Account.)

REITs listed on SGX are known as S-REITs. Excluding Japan, Singapore has the largest REIT and property trusts market in Asia at a market capitalisation of S$99 billion (as of December 2022) with a lot more room to grow in the long run.

Even if you have never heard of S-REITs, if you reside in Singapore, you will have likely stepped into a downtown office building or shopping mall owned and managed by CapitaLand Integrated Commercial Trust. Or perhaps, you frequent a suburban shopping mall nearer to home like Causeway Point, Tampines 1 or Hougang Mall — all of which are owned and managed by Frasers Centrepoint Trust.

S-REITs own and operate many prime properties not just in Singapore, but also in other countries, such as China, Japan, Germany, Australia and the United States. So it doesn’t mean that S-REITs only hold Singapore properties (if so, S-REITs would have limited acquisition or growth prospects within land-scarce Singapore). In fact, over 90% of S-REITs and property trusts hold overseas assets outside of Singapore.

2. How Do REITs Work?

Trust Structure

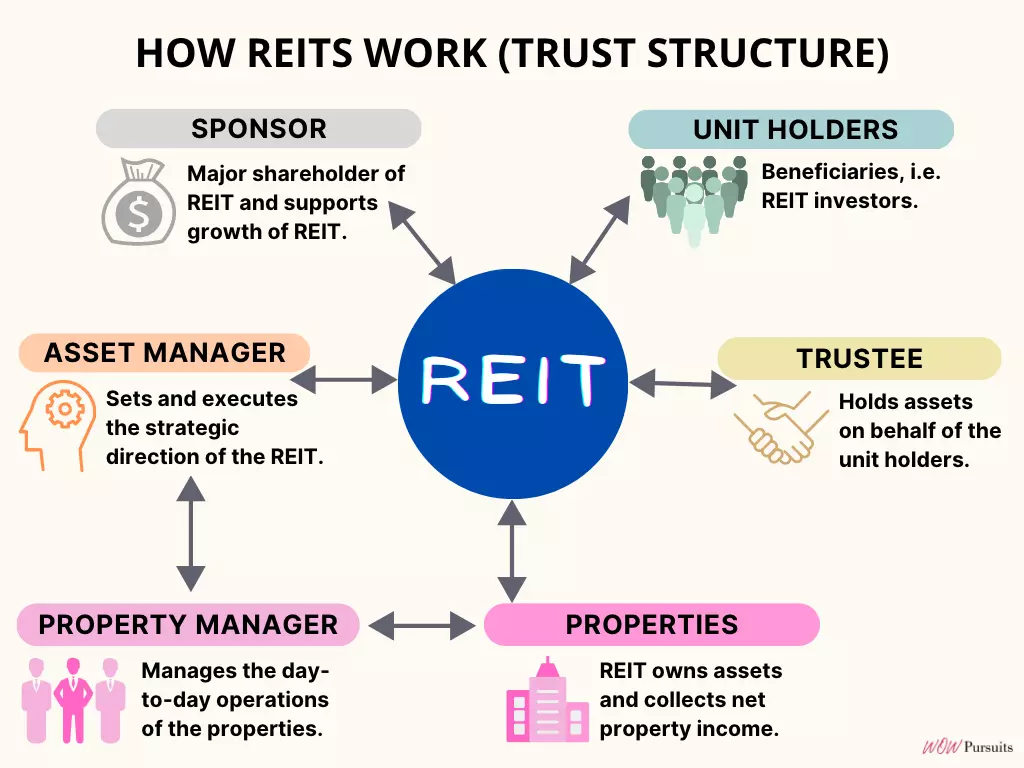

Although the structure of REITs does vary, the typical trust structure remains the same and will usually consist of the following stakeholders:

- Trustee

- Sponsor

- Asset Manager

- Property Manager

Trustee

The trustee is responsible for holding the assets of the REIT on behalf of its unit holders, i.e. ‘us the investors’. A REIT is constituted pursuant to a trust deed entered between the REIT manager and trustee.

The trustee is responsible for holding the assets of the REIT on behalf of its unit holders.

In essence, the trustee aims to safeguard the interest of the unit holders by carrying out administrative services which involve regulatory compliance and reporting, legal due diligence on the assets held by the trust, and even redress unit holders’ grievances or complaints if any.

Sponsor

The majority of S-REITs are supported by a sponsor who is usually a property company and has a major stake in the REIT and/or REIT manager. The main role of the sponsor is to continually source and inject valuable properties into the portfolio of the REIT. Strong sponsors often provide a steady pipeline of quality assets for the REIT to acquire down the road.

The main role of the sponsor is to continually source and inject valuable properties into the portfolio of the REIT.

The sponsor also provides financial support when the REIT makes acquisitions. Without doubt, backing from a strong sponsor can be extremely beneficial, not just for growth, but also for riding out economic downturns.

Asset Manager

The asset manager (aka REIT manager) is tasked with steering the REIT in the right strategic direction, which aligns with the investment goals of the trust and its unit holders. This implies that the asset manager is responsible for the acquisition, divestment and enhancement of the REIT’s properties.

The asset manager is tasked with steering the REIT in the right strategic direction.

On top of that, the asset manager is charged with ensuring high occupancy rates and maximising net property income (NPI) to achieve higher distributions for unit holders.

Do note that a REIT can be managed internally or externally. Internal asset managers are employed by the REIT and compensated with a salary, while external asset managers are a separate entity from the REIT and charge management fees for their services. The vast majority of US REITs are internally managed, while S-REITs are externally managed.

There is an on-going debate on internally vs. externally managed REITs and this is beyond the scope of this article — it shall be a topic for another day.

The bottom line is, regardless of whether a REIT is managed internally or externally, a well managed REIT is a well managed REIT. So long as the asset manager runs a tight ship and generates both income and growth for its unit holders, it’s a win-win for everyone.

Property Manager

The property manager is usually appointed by the asset manager and both work closely together. The property manager essentially handles the day-to-day operations of the REIT properties.

The property manager essentially handles the day-to-day operations of the REIT properties.

Responsibilities of the property manager encompass renting out the property to an ideal mix of tenants, running marketing events and maintaining the building and facilities.

3. What are the Fees Incurred by REITs?

Like with any other business, REITs have bills to pay. From the trust structure, you can probably guess that all services rendered by the trustee, property manager and asset manager come at a cost.

The trustee is paid a trustee’s fee for its trustee services. The property manager is paid a management fee for its property management services. Last but not least, we have the asset manager (the brains of the REIT) who has to be properly incentivised to managed the trust in alignment with the interest of its unit holders.

The asset manager charges a base fee (usually 0.25% to 0.5% of the property value), a performance fee (usually based on income or profits) and fees for acquisitions and divestments of the REIT properties. And sometimes, a portion of the asset manager’s fee is paid in units of the REIT (in lieu of cash).

Whatever the case, one thing is for certain, the cost of running a REIT doesn’t come cheap. In the end, what matters most is that the REIT is well managed and generates a healthy rate of return for its unit holders.

4. How Much Return Can Be Expected from S-REITs?

Now that you have a clearer picture of how REITs are structured and the various types of fees involved in running a REIT, it’s time to talk about income distribution and the expected rate of return for unit holders.

S-REITs have to distribute at least 90% of their taxable income (primarily rental income generated from real estate assets) to unit holders at regular intervals (quarterly or biannually) in order to enjoy tax transparency treatment at the corporate level.

S-REITs have to distribute at least 90% of their taxable income to unit holders at regular intervals.

In other words, income generated by S-REITs are tax exempted at both the REIT level and unit holder level (dividends are tax-free at the individual level in Singapore). This means unit holders are able to reap higher dividends or distributions per unit (DPU) from S-REITs. Woohoo!

The returns from S-REITs can come from either price gains or dividends. For S-REITs, don’t expect to get rich by making exceptional gains on its price. Yes, the price of S-REITs can possibly appreciate over the long term if well managed, but the primary purpose of S-REITs is to generate consistent (better still, increasing) DPU for its unit holders. So let’s take a closer look at what we can expect in terms of dividend yield from S-REITs.

The primary purpose of S-REITs is to generate consistent DPU for its unit holders.

Based on the latest (December 2022) SGX Research Chartbook, the average 12-month dividend yield of all 42 REITs and property trusts in Singapore was at 7.5% (by the way, all data presented in this article is mainly sourced from this report and I’ve placed the link below). That’s way higher than the STI Index which yielded 4.0% that same period.

Overall, S-REITs have established an impressive track record and no wonder they are so well loved by investors far and wide. I hope this article has given you a good overview of what REITs are about.

So are you keen on REITs? Do leave us a comment.

Source: SGX’s Chartbook: S-REITs and Property Trusts, SGX Research, December 2022

More like this: What Types of REITs are Available: A Beginner’s Guide | Understanding Retail REITs in Singapore: A Beginner’s Guide | Evaluating Retail REITs: The Numbers You Need to Know | Are REITs Safe? 4 Key Risk Factors You Must Know.