This article uses REITs listed on the Singapore Stock Exchange (SGX) as examples. Even if you happen to be residing somewhere else in the world you will still benefit from it as the same principles apply.

As a kid, I remember getting excited every time I entered a candy store. As soon as I walked through the door, my senses were overwhelmed by the sweet smell of sugar and the bright colours of the candies. I could almost taste the sugary goodness in the air.

I would run from isle to isle, picking my favourites. My first stop was usually the gummy jars — gummy bears, gummy worms and gummy cola bottles. Next up, fruit candies — fruit slices, fruit tarts and of course jelly beans. I would usually give hard candies a skip (bad dental experience) and end off at the chocolate isle. Oh what heavenly bliss!

Like candy, Real Estate Investment Trusts (REITs) come in a variety of types and ‘flavours’. If you are new to REITs, it can be a little intimidating at first (I know I was). But don’t let that put you off. Let the sweet smell of passive income pull you in. You will get to know REITs a whole lot better after exploring its different categories, relatives and sectors. Here’s what I have in store for you:

1. Categories of REITs

Generally speaking, REITs are broadly classified into three categories, namely

- equity REITs,

- mortgage REITs, and

- hybrid REITs.

Equity REITs

The most common are equity REITs which own and manage income-producing properties that generate dividends for its unit holders from rental income. S-REITs are all equity REITs.

Mortgage REITs

Mortgage REITs (aka M-REITs) as its name implies, invest in mortgages either directly by lending money to real estate owners or indirectly through the acquisition of mortgage-backed securities.

Mortgage REITs earn income from the spread between the interest they make on the mortgage loans and the cost of financing these loans (very much like banks that profit from net interest margins). This makes them highly sensitive to interest rate fluctuations. In any case, mortgage REITs are not available in Singapore.

Hybrid REITs

Lastly, we have hybrid REITs that are a combination of equity REITs and mortgage REITs. This would probably appeal to investors looking for a balance between both equity and mortgage REITs. Hybrid REITs are also not available in Singapore.

S-REITs are all equity REITs.

2. Relatives of REITs

At times, mentioned in the same breadth as REITs are its close relatives: business trusts and stapled trusts.

Business Trust

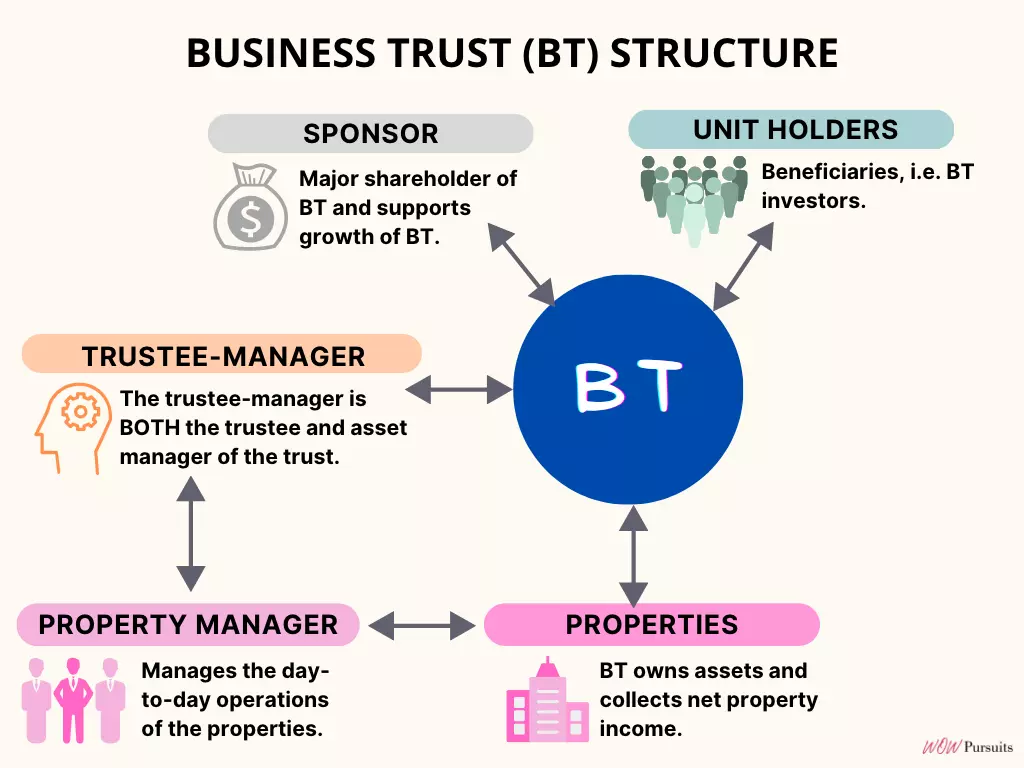

Business trusts have a slightly different trust structure compared to REITs. Here is a typical structure of a business trust.

In a business trust, the trustee and asset manager are combined together as the trustee-manager. This means the trustee-manager not only manages the real estate assets, but also holds the assets on behalf of the unit holders. For a REIT, the trustee and asset manager are separate entities. (See trust structure of a REIT.)

There are a few key legal differences between a business trust and REIT. Firstly, REITs are required by law to maintain a gearing ratio limit of 50% (it was raised from 45% during the COVID-19 pandemic). Business trusts have no such restrictions on borrowing. However, a property-related business trust may impose such limits on itself to provide the same level of assurance as REITs to its unit holders.

Secondly, REITs have to distribute 90% of their taxable income to unit holders in accordance to taxation laws. Business trusts on the other hand are not obligated to distribute their income. Having said that, property-related business trusts do typically pledge (in the trust deed) to distribute 90% of their taxable income to unit holders akin to REITs. Please do not take this for granted, and do read the fine print if you intend to invest in a property-related business trust.

Thirdly, restrictions are imposed on REITs to limit their exposure to risks and uncertainties associated with property development activities. A business trust has no such limitations and opting for a business trust structure may offer a property-related business trust the needed flexibility in development activities that a REIT structure cannot afford. Examples of property-related business trusts listed on the SGX are Dasin Retail Trust and CapitaLand India Trust.

In a business trust, the trustee and asset manager are combined together as the trustee-manager.

Stapled Trust

Stapled trusts can be thought of as a mix between a business trust and a REIT and are commonly adopted for hospitality assets (e.g. hotels and serviced apartments). Here is the typical stapled trust structure.

All the stapled trusts listed on the SGX are in the hospitality sector. In a nutshell, the stapled trust structure generates tax-exempt rental income from the ‘REIT side’, while the ‘BT side’ offers flexibility for the stapled trust to carry out hospitality-related development activities not suited for a REIT.

All the stapled trusts listed on the SGX are in the hospitality sector.

Note: SGX collectively refers to both property-related business trusts and stapled trusts as ‘property trusts’. To avoid confusion, we will do the same in the following section.

3. Sectors of S-REITs and Property Trusts

Let’s now explore the various sectors of S-REITs and property trusts. By the way, all the S-REIT data presented in the tables below (market cap, dividend yield, etc.) are based on the SGX Chartbook: S-REITs and Property Trust, December 2022 research paper. For your convenience, I’ve placed the PDF download link at the end of this article if you’re interested in reading the full paper.

According to SGX, S-REITs and property trusts are categorised into seven property sectors:

- Industrial

- Retail

- Office

- Hospitality

- Healthcare

- Specialised

- Diversified

1️⃣ Industrial

Industrial REITs mostly own and manage income-producing real estate such as business parks, flatted factories, hi-tech buildings, warehouses, distribution centres and data centres. These properties house local and international companies from a wide range of industries, including engineering, biomedical sciences, logistics, manufacturing, information technology and even financial services (mainly backend support).

There are a total of eight industrial S-REITs and here is the entire list:

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | Capitaland Ascendas REIT (f.k.a Ascendas REIT) | A17U | 11,712 | 5.6 |

| 2 | Mapletree Logistics Trust | M44U | 7,743 | 5.6 |

| 3 | Mapletree Industrial Trust | ME8U | 6,030 | 5.6 |

| 4 | ESR-Logos REIT | J91U | 2,318 | 8.3 |

| 5 | Aims Apac REIT | O5RU | 862 | 7.8 |

| 6 | Sabana Industrial REIT | M1GU | 455 | 7.5 |

| 7 | Daiwa House Logistics Trust | DHLU | 439 | 6.3 |

| 8 | EC World REIT | BWCU | 364 | 12.6 |

2️⃣ Retail

Retail REITs and property trusts essentially own and manage shopping malls and retail outlets. I’m sure all of us are familiar with shopping centres and outlets — no need for further elaboration.

Do note that I’ve excluded CapitaLand Integrated Commercial Trust, Mapletree Pan Asia Commercial Trust, Suntec REIT and Landlease Global Commercial REIT from the list below. Although all four S-REITs have significant exposure to retail assets both within and outside of Singapore, these REITs also own assets in other sectors and have now been reclassified as diversified REITs (more on this later).

Here are the eight retail S-REITs and property trusts listed on the SGX:

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | Frasers Centrepoint Trust | J69U | 3,459 | 6.0 |

| 2 | Paragon REIT (f.k.a. SPH REIT) | SK6U | 2,532 | 6.1 |

| 3 | Starhill Global REIT | P40U | 1,191 | 7.2 |

| 4 | Sasseur REIT | CRPU | 958 | 9.2 |

| 5 | United Hampshire US REIT | ODBU | 379 | 12.2 |

| 6 | BHG Retail REIT | BMGU | 259 | 3.6 |

| 7 | Lippo Malls Indonesia Retail Trust | D51U | 231 | 12.0 |

| 8 | Dasin Retail Trust* | CEDU | 193 | 9.3 |

Check out: Understanding Retail REITs in Singapore: A Beginner’s Guide and Evaluating Retail REITs: The Numbers You Need to Know

3️⃣ Office

Office REITs as its name suggest own and manage (usually Grade A) office spaces often located within prime business districts.

Here is the complete list of the six office S-REITs (diversified S-REITs that own office real estate has been excluded):

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | Keppel REIT | K71U | 3,368 | 6.5 |

| 2 | Manulife US REIT | BTOU | 949 | 13.4 |

| 3 | Keppel Pacific Oak US REIT | CMOU | 801 | 11.1 |

| 4 | Prime US REIT | OXMU | 784 | 14.4 |

| 5 | IREIT Global | UD1U | 601 | 8.5 |

| 6 | ELITE Commercial REIT | MXNU | 382 | 10.5 |

4️⃣ Hospitality

The stapled trust structure is preferred for the hospitality sector as previously mentioned. Hospitality real estate include hotels, motels, resorts, serviced apartments, student accommodations, senior housing, co-living spaces, etc.

Here is the full list of the five stapled trusts (you’ll notice that the stock codes are all three characters in length, without the suffix ‘U’) listed on the SGX:

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | CapitaLand Ascott Trust (f.k.a Ascott Residence Trust) | HMN | 3,256 | 4.8 |

| 2 | CDL Hospitality Trusts | J85 | 1,460 | 4.3 |

| 3 | Far East Hospitality Trust | Q5T | 1,253 | 4.9 |

| 4 | Frasers Hospitality Trust | ACV | 857 | 3.6 |

| 5 | ARA US Hospitality Trust | XZL | 296 | 3.4 |

Note: Eagle Hospitality Trust (EHT) has been excluded from the list. If you didn’t already know, EHT was listed on the SGX in May 2019. After its debut, the stapled trust took a nose-dive and trading was suspended in March 2020. EHT eventually filed for Chapter 11 Bankruptcy protection in January 2021.

The misfortune of EHT should remind us of the risks involved with equity investing. I’ll elaborate more on the risks associated with S-REITs and how we can mitigate these risks in a follow-up article, so stay tuned.

5️⃣ Healthcare

There are two healthcare S-REITs listed and both hold healthcare related real estate such as hospitals, medical centres, outpatient facilities, nursing homes, etc. Here’s the list:

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | ParkwayLife REIT | C2PU | 2,353 | 3.7 |

| 2 | First REIT | AW9U | 494 | 11.0 |

Note: RHT Health Trust has been excluded from the list and after disposing its entire portfolio of healthcare assets on 15 January 2019, now functions purely as a cash trust. Unfortunately, plans to wind up the business trust has been put hold due to contempt proceedings (by the Supreme Court of India) against its sponsor, Fortis Healthcare Ltd. It’s turning out to be quite a fiasco. A story for another day.

6️⃣ Specialised

Specialised REITs typically own a unique or specific property type that may not fit well within the other property sectors. For example in the US, specialised REITs come in a wide variety and include movie theatres, casinos, farmland, etc. In Europe, you even have a choice of vineyard REITs.

In Singapore, the two specialised S-REITs own and manage data centres around the globe. Both pure-play data centre S-REITs focus on providing real estate and infrastructure assets that support the digital economy. The specialised S-REITs are:

| No. | Name | Stock Code | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|

| 1 | Keppel DC REIT | AJBU | 3,180 | 5.5 |

| 2 | Digital Core REIT | DCRU | 945 | 4.8 |

By the way, if you are looking for exposure to data centres without taking on too much concentration risk within the sector, you can consider two other alternatives: CapitaLand Ascendas REIT and Mapletree Industrial Trust. These two industrial S-REITs also hold data centres in their portfolio and have been actively positioning themselves for the new economy.

7️⃣ Diversified

The last sector comprises of Diversified S-REITs that own real estate assets in more than one of four sectors — industrial, retail, office and hospitality.

Diversified S-REITs essentially offer investors a broader exposure of real estate assets which lowers concentration risk and improves income stability from a diverse pool of tenants across different sectors. Here is the full list of all nine diversified S-REITs and property trusts listed on the SGX:

| No. | Name | Stock Code | Property Sectors | Market Cap (S$M) | Div Yield (%) |

|---|---|---|---|---|---|

| 1 | CapitaLand Integrated Commercial Trust | C38U | Industrial, Retail & Office | 13,735 | 5.0 |

| 2 | Mapletree Pan Asia Commercial Trust^ | N21U | Industrial, Retail & Office | 8.954 | 5.9 |

| 3 | Frasers Logistics & Commercial Trust | BUOU | Industrial & Office | 4,214 | 6.7 |

| 4 | Suntec REIT | T82U | Retail & Office | 3,998 | 6.6 |

| 5 | OUE Commercial REIT | TS0U | Retail, Office & Hospitality | 1,995 | 6.6 |

| 6 | CapitaLand China Trust | AU8U | Industrial & Retail | 1,891 | 7.6 |

| 7 | Landlease Global Commercial Trust | JYEU | Retail & Office | 1,658 | 6.6 |

| 8 | CapitaLand India Trust* (f.k.a. Ascendas India Trust) | CY6U | Industrial & Office | 1,358 | 6.7 |

| 9 | Cromwell European REIT | CWBU | Industrial, Retail, Office & Hospitality | 1,223 | 11.1 |

^Mapletree Commercial Trust merged with Mapletree North Asia Commercial Trust and was renamed Mapletree Pan Asia Commercial Trust on 3rd August 2022

Phew! What a variety of REITs to choose from. Now that you have the big picture, you may be wondering which REIT will give you the most bang for your buck.

However, before taking the plunge, I believe it’s prudent for any investor to fully understand the risks involved. So make sure you check out: Are REITs Safe? 4 Key Risk Factors You Must Know.

If you are fuzzy about how a REIT actually works, do read my previous article How REITs Work: Get Started on Real Estate Investing to learn more about the trust structure of REITs, fees incurred by REITs and the expected return from S-REITs.

Source: SGX’s Chartbook: S-REITs and Property Trusts, SGX Research, December 2022