There is always risks in investing. Nevertheless, a diversified portfolio containing a blend of asset classes will help to balance out the risks and maximise returns. Every asset class has different characteristics and unique capabilities, and you should read up on them before investing your hard-earned money.

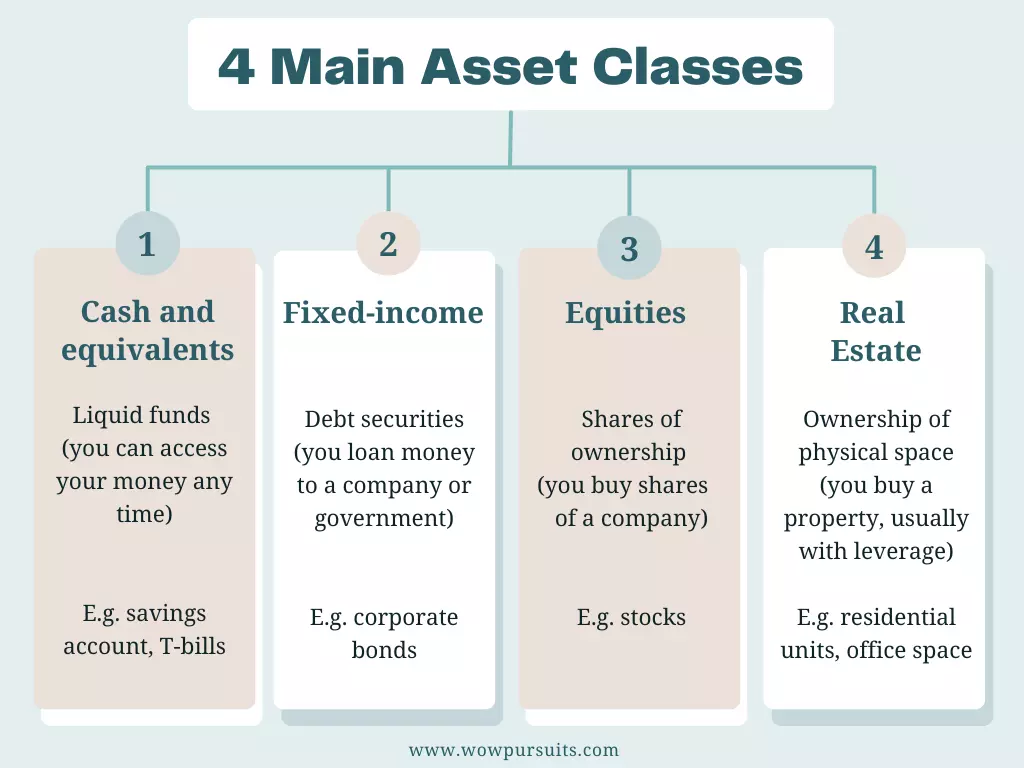

A portfolio should ideally contain a mix of investments from different asset classes. The four main asset classes are cash and equivalents, fixed-income (bonds), equities (stocks), and real estate.

This article gives you an overview of the various asset classes before zooming in on the four main ones:

1. Types of Asset Classes

To put it simply, an asset class comprises investments that share similar traits and are subject to the same laws and regulations.

Equities (stocks), fixed-income (bonds), as well as cash and equivalents are considered traditional assets. They are also the most liquid.

Real estate and commodities (e.g. crude oil, gold and silver) are two popular alternative assets.

Other alternative assets include, but not limited to, hedge funds, cryptocurrencies, art, and tradable collectibles. In general, the more ‘alternative’ the asset, the riskier or more illiquid it is.

Some assets are hard to categorise. You will know what I mean if you have been reading up on this subject.

Take gold and silver for example. They are tangible assets and there are people who own bullion coins and bars outright. However, the precious metals are also traded in the form of futures, i.e. derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. There is also an array of gold Exchange-traded Funds (ETFs) that investors can buy and sell like stocks. Given the case, how would you classify gold and silver?

It’s the same for Real Estate Investment Trusts (REITs). Would you categorise them as real estate or equities since they are traded like stocks on the stock market? According to Investopedia, REITs should be defined as an equity sub-asset class, meaning they possess certain traits that make them unique within the umbrella of the equity asset class.

According to Investopedia, REITs should be defined as an equity sub-asset class.

Frankly, as a small-time retail investor, I don’t fret over such technicalities. I think you shouldn’t either, as long as you have a clear understanding of the risk and return characteristics of your investments.

Right now, Mr Wow’s and my portfolio includes a bunch of REITs and ETFs. We consider them equities.

Check out: What Types of REITs are Available: A Beginner’s Guide and Are REITs Safe? 4 Key Risk Factors You Must Know

2. The Four Main Asset Classes

If you’re new to investing, you should definitely know these four main asset classes:

Cash and Cash Equivalents

► Overview: The main advantage of holding cash is liquidity. You have peace of mind knowing that you have access to a sum of money in times of trouble.

Mr Wow and I usually hold 15% or thereabouts of our portfolio in cash (mostly in high-yield savings accounts and Singapore Savings Bonds). Some people also put their cash in time/fixed deposits and Treasury bills (T-bills) with short maturities of three months to a year. (Mr Wow did a detailed analysis on high-yield savings accounts in Singapore. You should definitely check it out if you want to know how these accounts work and how to maximise them to get the most interest.)

Note: I know some people classify time/fixed deposits and T-bills as fixed-income (since their returns are pretty much fixed). I think there’s no right or wrong answer as long as you know how they work and use them to your advantage.

► Risk: There’s little risk to hold cash. For instance, if you buy Singapore T-bills, it’s practically risk-free as they are backed by the Singapore Government, which has a AAA credit rating. But do note that the prices of T-bills may fall if you wish to sell them in the secondary market before maturity. As for time/fixed deposits, although you can access your money immediately, you will lose your interest if you withdraw your money early. Thus, it’s best to spread your cash instead of putting everything in one account or product.

► Reward: Generally speaking, the safer the investment, the lower the return. Hence, cash and cash equivalents are considered low-yield compared to other investments.

Fixed-income (Bonds)

► Overview: Fixed-income assets are mainly corporate and government bonds, which are basically debt securities. They make regular interest payments to investors, with the principal returned upon maturity. Currently, intermediate bonds account for about 25% of my portfolio with Mr Wow.

► Risk: The risks associated with bonds include credit risk and interest rate risk. However, they are not a big concern if you plan to hold your investment till maturity. Of course, there’s always a possibility of the bond issuer defaulting or failing to repay the principal to investors. If your risk tolerance is low, opt for government bonds with AAA credit rating instead of corporate bonds.

► Reward: As the name suggests, the yield is fixed and you can calculate the expected return before investing your money.

Equities (Stocks)

► Overview: Equities or stocks are shares of ownership issued by companies. They are traded on stock exchanges.

► Risk: Equities are subject to stock market fluctuations. Depending on what you buy, it’s possible for you to lose money including your principal. If you are not good at stock picking or do not want to go through the hassle, consider index funds as they are diversified and therefore less risky than individual stocks.

► Reward: You can profit from equities in two ways: capital gains and dividend income.

Real Estate

► Overview: A tangible asset, real estate is extremely popular AND expensive in cities like San Francisco, Hong Kong and Singapore. The asset class includes residential, commercial and industrial properties, as well as plots of land.

► Risk: Real estate is illiquid and cannot be converted to cash easily. Risks to watch out for include poor location, high vacancies, interest rate hikes and negative cash flows. Investors should also be prepared for price fluctuations caused by changes in economic conditions.

► Reward: A major advantage of real estate investing is the ability to use financing (i.e. leverage) to increase the return on investment (ROI) of your property. Over time, real estate tends to appreciate in value. Rental income is also a good way to fight inflation as rents usually increase with the cost of living.

In conclusion, each asset class has its own unique strengths and weaknesses. To reduce the volatility of your portfolio, diversification is key. This way, if an asset does not perform well, its impact will be limited by those that perform better.

Which asset class are you the most interested in? Do leave us a comment.

You may also like: Investing Jargon in Layman’s Terms | Trading vs. Investing: What You Need to Know | The Importance of Liquidity in Personal Finance & Investing | Portfolio Rebalancing for Beginners | Investing During a Recession: What You Need to Know