Everyone wants to be financially successful but many haven’t got a clue how. Their idea of wealth building is to work hard and save money, and they don’t know the first thing about retirement planning. Some don’t even spend time thinking about money, let alone do something to improve their financial circumstances. If you are one of those people, you need to change because financial success, or any kind of success for that matter, is not by chance but by choice.

Financial success is a series of deliberate steps. You need to invest in yourself and have a plan, among other things. To be financially successful, there are five things you need to know:

- Knowing that You Need to Invest in Yourself

- Knowing that You Need to Have a Plan

- Knowing that You Do Not Need to Take Free Advice

- Knowing that You Become Who You Marry

- Knowing that You Become Who You Hang Out With

1. Knowing that You Need to Invest in Yourself

Everyone wants to be smarter, but how many are willing to make time and effort to expand their minds? Charlie Munger and Warren Buffett are two of the most successful investors of our time. Both continuously invest in themselves by reading. A HELL LOT. Buffett spends most of his work day reading and thinking in his office. ‘Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it,’ he once said.

You are your own knowledge asset. To maximise your potential, you need to invest in yourself and make knowledge acquisition a top priority. Knowledge and expertise take time to develop, that’s why you need to get started ASAP. About 10 years ago, I did not know jack shit about investing, but I kept reading and reading. Now, I am reaping the benefit. Mr Wow and I are happily FIREd (= Financial Independence Retire Early) because we have built a diversified portfolio that generates more than enough passive income to cover our annual expenses.

Many big decisions you make in life are financial ones. To make rational and well-informed decisions, you need to gather information and assess the options. Granted, your knowledge will not insulate you from failure, but it will certainly boost your chances of success. And the more knowledge you have, the more you will be able to face the future with confidence.

Go to bed smarter than when you woke up.

Charlie Munger

Check out: 5 Money Secrets of the Rich

2. Knowing that You Need to Have a Plan

‘I WANT TO BE RICH!’

And you are wondering why you are still poor.

How do you plan on becoming rich once you have gained knowledge? You need to have a plan because you can’t attain financial success just by reading all day long. You gotta take further action. If you do nothing, you reap nothing.

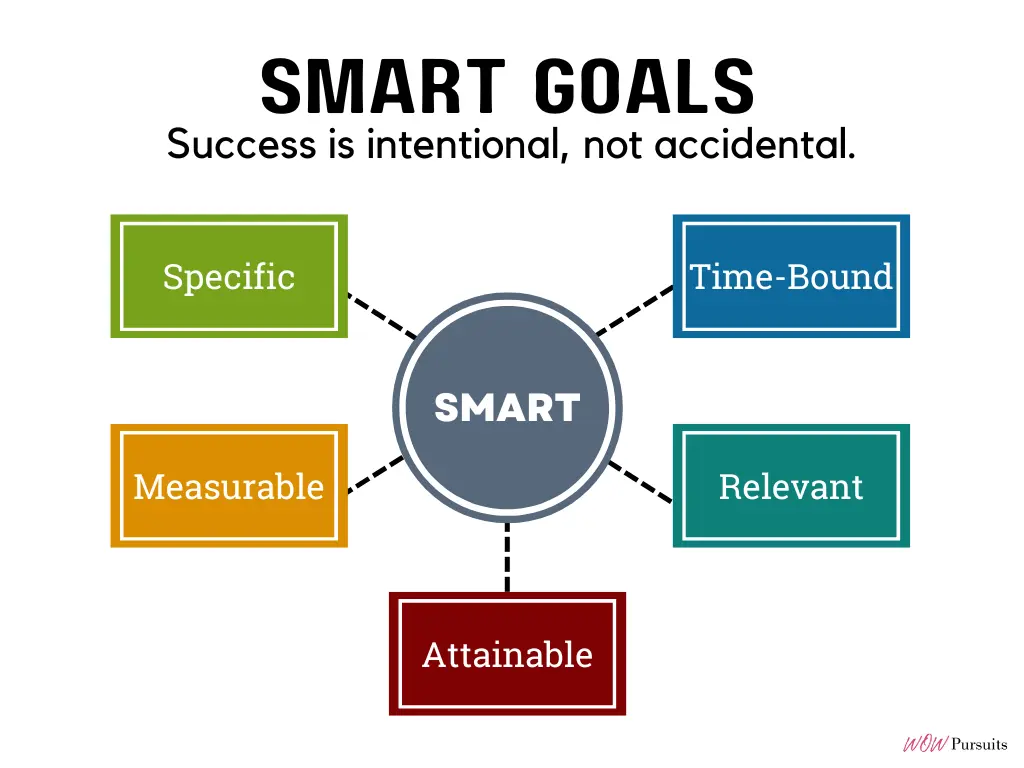

Success is intentional, not accidental. You need to consider what you want to achieve and set yourself some SMART (specific, measurable, attainable, relevant and time-bound) goals. Without concrete goals, you are a boat cast adrift. You have no destination and you are letting the current sweep and push you around. If you need to get your bearings, do read the article 7 Levels of Wealth: A Different Way to Think About Money. It will help you set a clear path towards your financial goals.

Your plan will involve sacrifices, e.g. cutting expenses and saying no to certain activities. You may find the going hard at times, but the reward will be worthwhile. Your plan will involve a lot of strategic thinking, e.g. how you want to allocate your investment portfolio. It will factor in your know-how and risk tolerance.

Mr Wow and I had a plan to achieve FIRE in 10 years. We did it in less than eight. We still have a plan to preserve and grow our wealth and it’s constantly evolving. A good plan is never stagnant. It’s dynamic.

If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.

Jim Rohn

3. Knowing that You Do Not Need to Take Free Advice

Free financial advice is everywhere. These days, they do not just come from family and friends. There are innumerable wealth gurus, pundits and coaches on the internet, in particular YouTube. It’s always good to consider a broad range of perspectives, but you need to be selective and learn how to filter out the noise. A lot of general advice should be taken with a pinch of salt, especially if the person giving it has an agenda, e.g. to sell you something.

It’s always good to consider a broad range of perspectives, but you need to be selective and learn how to filter out the noise.

You also need to remind yourself that everyone has different life circumstances, so what works for others may not work for you. It’s like buying health insurance. Every policyholder is insured different amounts for different things like hospitalisation and surgery, 30 major illnesses and so on. Some people want maximum protection but cannot afford the high premium. Every case is different.

Within your social circle, you must also learn how to filter. Everyone including your broke friend, in his infinite wisdom, has an opinion. I am sure you have the sense not to listen to his ‘wise counsel’. Go to someone who actually knows what he’s talking about instead. For instance, I will approach my dad rather than my mum if I need advice on money matters. The former is a shrewd investor and businessman, while the latter’s financial knowledge is limited to the prices of goods at the supermarket. Getting advice from the right people is soooooo important.

4. Knowing that You Become Who You Marry

Mr Wow and I are incredibly lucky to have found each other. We are similar in numerous ways, yet different enough to complement each other. We are each other’s intellectual equal; I know our conversations will always have depth and we will never run out of interesting things to talk about. We are each other’s rock; I know we can always count on each other through thick and thin. We share the same aspirations and want the same things in life; I know no dream is out of reach when we work as a team. Together, we are a force to be reckoned with.

Mr Wow is the most influential person in my life and vice versa. Although we are still our own person, we have become more like each other after more than 20 years of marriage. Without a doubt, one of the most important decisions of your life is who you choose to marry. Choose the right one, you are complete. Choose the wrong one, you are finished.

Your spouse has a profound influence on your level of success and overall life satisfaction. He or she is your pillar of support, parenting partner (if you have children) and old-age companion. Where money is concerned, you should be each other’s financial helpmate, not hellmate. Yes, it’s imperative that the both of you are on the same financial page and trust each other’s money management skills. That doesn’t mean that you will not have differences.

Mr Wow and I were not financially compatible from day one. Like most couples, we have had our fair share of disagreements about money, but we work on it because that’s what marriage is all about. Whenever our views differ, we always communicate (which includes listening, not just talking) and find common ground. Frankly, I couldn’t have done all the ‘crazy’ things and achieved FIRE if I weren’t married to him.

Read how Mr Wow and I resolve our money differences as a couple.

5. Knowing that You Become Who You Hang Out With

When I was young, my mum would constantly remind me not to mix with delinquents. Peer pressure is powerful among adolescents and parents often worry that their teenage children will be led astray by bad company. In the adult world, negative peer influence exists as well and it could have a detrimental impact on your financial health.

If all your friends like to lead the high life and spend money like water, you might be pressured to conform and squander money too. If all your friends are slothful and unaccomplished, you might be less motivated to achieve personal and professional success. What about toxic friends who perpetually put you down, ridicule you in front of others and undermine your success? Instead of feeling happy and uplifted, you feel like crap every time you go out with them. Eventually, your self-confidence diminishes and you begin to question your abilities.

You become the folks you spend the most time with, so choose your pals wisely. If you want to be financially prudent, hang out with people who have a healthy relationship with money. If you want to be successful, hang out with people who are more accomplished than you. Emulate them and be inspired. Finally, if you want to live a positive life, you need to dissociate yourself from negative, toxic people. UNFRIEND THEM NOW! They serve no purpose in your life except drain your energy, dash your spirits and deflate your ambitions. They DO NOT deserve your friendship.

In summary, to be financially successful, you need to invest in yourself and learn how money works. You need to develop a plan and improvise as you go along. You should only hang out with and take advice from the right people. If you are married, your financial values and goals should align with your spouse’s. You can do a lot more to secure a better financial future for yourself and your family. Your success is in your hands. I hope this article has provided inspiration and given you things to ponder.

Are you in good financial shape? Assess your financial health with my checklist.

You may also like: What Are Your Money Values and Why You Need to Know Them | Admit It: Money CAN Buy Happiness | What We Learn Growing Up Rich | Don’t Be A Rich Jerk: 5 Ways Money Makes Us Arrogant | Exploring Money Mindsets: A Rich Man & His Four Sons