Money is a powerful tool that enables us to buy things and experiences. Although it is not the only thing that matters, it can be used to create a life of financial stability and freedom. Unfortunately, many people struggle to make their money work for them and often feel overwhelmed by the complexities of managing their finances. The good news is that there are some secrets to successful money management that the wealthy have mastered over the years.

In this article, we will explore five money secrets of the rich and how they can be applied to help you achieve greater financial success.

- Live Within Your Means

- Create Multiple Streams of Income

- Let Compounding Work Its Magic

- Always Maintain Sufficient Liquidity

- Never Invest Without Knowledge

1. Live Within Your Means

One of the most important money secrets of the rich is that they live within their means.

When you live within your means, you can save and invest for a better future. Unfortunately, in a world of consumerism, saving money is sometimes easier said than done as there are so many temptations to buy things that are unnecessary. If you often overspend, you need to remind yourself that building wealth is about delay gratification and living paycheck to paycheck sucks!

Check out: 6 Types of Spending Triggers and How to Overcome Them

Instead of putting aside money as and when you like, you should decide on a fixed monthly amount for savings and investments. To do this, you need to create a budget and stick to it. Work out how much you need to spend each month on essentials such as food, housing and transportation. You may also want to include a few non-essential items that are important to you, e.g. occasional restaurant meals with friends. To succeed in the long run, your budget needs to be realistic. Otherwise, you’ll probably give up after a while.

Following a budget and living within your means require a lot of discipline. When your spending is aligned with your long-term goals, you will be less likely to get into consumer debt and succumb to lifestyle inflation. Your future self will thank you for your financial prudence.

Check out: How to Cut Expenses to Retire Early: Getting Started

2. Create Multiple Streams of Income

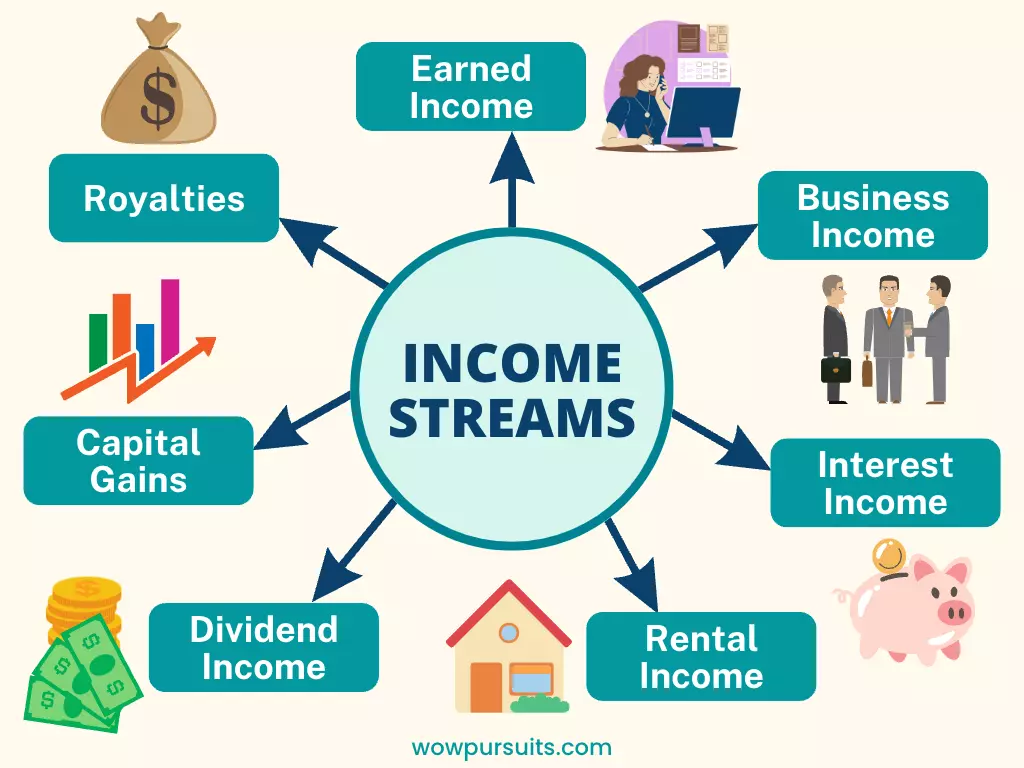

Another money secret of the rich is to create different streams of income.

For most people, climbing the corporate ladder will only get you so far. Eventually, you will hit a ceiling in terms of salary, and that’s provided that you always have a job. As inflation continues to erode your purchasing power and job security becomes a thing of the past, you’d be wise to generate income from different sources.

By diversifying your income, you will not only increase your earning potential, but also be more financially secure. If one source of income dries up, you will still have others to rely on. As the age-old saying goes, “Never put all your eggs in one basket.”

Your income can be both passive and active, but your ultimate goal should be to make money while you sleep. For instance, I was a part-time tutor and freelance copywriter for several years. Both side hustles paid well and I found them easy and enjoyable. However, I had no intention to trade my time for money forever. To maximise my income, most of the money I made from these two sources were invested in dividend stocks and government bonds, so my passive income kept growing over the years.

There are countless potential streams of income, from launching a YouTube channel to investing in a rental property. The possibilities are endless and the sky is the limit!

Check out my two-part series: Multiple Income Streams: Weighing the Pros and Cons and Why Having Multiple Streams of Income May Be Overrated

3. Let Compounding Work Its Magic

The rich understand the magic of compounding and use it to their advantage by investing in stocks and other financial instruments.

Compounding is a powerful way to amass wealth as it allows your savings to grow exponentially over time. Here’s a simple example. Let’s say you invest a lump sum of $12,000 into the stock market every year for 30 consecutive years. Your investment gives you a modest average annual return of 5%, which you reinvest without fail. The following table shows the growth of your investment with compounding:

| Year | Investment ($) | Interest ($) | Total ($) |

|---|---|---|---|

| 1 | 12,000 | 600 | 12,600 |

| 2 | 24,600 | 1,230 | 25,830 |

| 3 | 37,830 | 1,892 | 39,722 |

| 4 | 51,722 | 2,586 | 54,308 |

| 5 | 66,308 | 3,315 | 69,623 |

| 6 | 81,623 | 4,081 | 85,704 |

| 7 | 98,704 | 4,935 | 103,639 |

| 8 | 116,639 | 5,832 | 122,471 |

| 9 | 135,471 | 6,773 | 142,244 |

| 10 | 155,244 | 7,762 | 163,006 |

| 11 | 175,006 | 8,750 | 183,756 |

| 12 | 195,756 | 9,788 | 205,544 |

| 13 | 217,544 | 10,877 | 228,421 |

| 14 | 240,421 | 12,021 | 252,442 |

| 15 | 264,442 | 13,222 | 277,664 |

| 16 | 289,664 | 14,483 | 304,147 |

| 17 | 315,147 | 15,757 | 330,904 |

| 18 | 342,904 | 17,145 | 359,049 |

| 19 | 371,049 | 18,552 | 389,601 |

| 20 | 401,601 | 20,080 | 421,681 |

| 21 | 434,681 | 21,734 | 456,415 |

| 22 | 469,415 | 23,471 | 492,886 |

| 23 | 506,886 | 25,344 | 532,230 |

| 24 | 546,230 | 27,312 | 573,542 |

| 25 | 588,542 | 29,427 | 617,969 |

| 26 | 633,969 | 31,698 | 665,667 |

| 27 | 681,667 | 34,083 | 715,750 |

| 28 | 735,750 | 36,788 | 772,538 |

| 29 | 795,538 | 39,777 | 835,315 |

| 30 | 861,315 | 43,066 | 904,381 |

After 30 years, you will have $904,381, earning an annual interest of $43,066! In reality, you will probably make more than 5% annual return.

Time and compound returns are the building blocks of successful investing and wealth accumulation. That’s why savvy investors buy and hold their investments for an extended period of time (often decades), riding out market fluctuations and avoiding speculation. So start saving and investing early and you too will reap tremendous rewards.

Check out: Tame Your Emotions: Let Your Wealth Compound Uninterrupted

4. Always Maintain Sufficient Liquidity

The rich know that maintaining sufficient liquidity is a crucial factor in personal financial management.

Liquidity is the ability to access your money quickly and easily. It is vital as it allows you to pay for unexpected expenses (e.g. home repairs) and ride out tough economic times (e.g. job loss).

Most experts recommend keeping an emergency fund to cover at least three to six months’ worth of expenses. By having access to ready cash and assets that can be liquidated quickly, you can avoid getting into debt or taking drastic steps that can seriously disrupt your life in times of trouble. This gives you peace of mind and helps you keep your finances in order.

If you have a reserve on top of your emergency fund, you can also take advantage of investment opportunities during economic downturns. Fortunes are often made in crisis, but you need to have the funds first. So if you don’t already have a war chest, you might want to consider building one.

Check out: Investing During a Recession: What You Need to Know

Cash is the most liquid asset as it’s available for immediate use. To maximise your cash in the bank, it’s recommended that you put it in high-yield savings accounts. Fixed deposits, Singapore Saving Bonds and Treasury bills are also considered liquid assets as they can be converted into cash easily. Other highly liquid assets include stocks and ETFs but selling them usually involves more time and cost. To learn more about the different asset classes, read 4 Main Asset Classes: A Beginner’s Guide.

5. Never Invest Without Knowledge

Finally, the rich are careful investors who understand that investing without adequate knowledge is the worst thing one can possibly do.

You should NEVER invest in a business just because your friend claims that it will make money or buy a stock because some random “smart” guy tells you that the price is going to skyrocket. You’d be better off leaving your money in the bank than to invest in something that you have little or no knowledge of.

Every investment entails some degree of risk and it’s very easy to lose money if you don’t know what you’re doing. This is particularly true in a world rife with high-risk, not to mention often illegal, get-rich-quick schemes that target vulnerable individuals who are looking for ways to make money quickly.

It is therefore imperative that you invest in yourself first. Take the time and effort to learn about finance, investing and other topics that can help you build wealth (e.g. read books and attend classes). You should also conduct thorough research before investing your hard-earned money and make sure that you fully understand the risks and rewards associated with the investment.

Don’t forget that well-informed decisions will increase your chances of success by a lot. In contrast, ill-informed decisions are a recipe for financial disaster.

Check out: Why Being Knowledgeable is Important

To sum up, building wealth doesn’t happen overnight. It takes time, hard work and dedication. Thankfully, we can learn from those who have achieved financial success. By emulating them and mastering these five money secrets, you too can accumulate wealth regardless of where you’re starting from.

These 5 crucial moves are the very secrets that’s made most of the wealth on earth today.

– Live Within Your Means (the most crucial step)

– Create Multiple Streams of Income (one step at a time)

– Let Compounding Work Its Magic (hands-free)

– Always Maintain Sufficient Liquidity (temptation to splurge lurks)

– Never Invest Without Knowledge (many investors make this mistake)

Great insights!

Great add-ons! 🎯

You’re absolutely right. The most crucial, basic step is to live within our means.

Don’t spend money mindlessly, only to regret later. By simply saying no to uncontrollable consumerism and practising delayed gratification, we’ll be more in control of our finances.