Never heard of the “Dogs of the Dow”? You are not alone. I only chanced upon it a few years ago, even though this dividend investing strategy was made popular by Michael B. Higgins, in his book, Beating the Dow, published way back in 1991.

I don’t know what you were doing in the 1990s, but I definitely wasn’t thinking about dividend investing or even anything close to it. So, what on earth are the Dogs of the Dow?

In short, the Dogs of the Dow is a stock portfolio containing the top 10 highest dividend-yielding stocks of the Dow Jones Industrial Average (DJIA). Sweet and simple.

What I really like about the The Dogs of the Dow is that it is easily adaptable and appeals to both the newbie and seasoned investor. Let’s take a closer look at how this strategy works and how we can adapt it to our own investment portfolio.

1. How the Dogs of the Dow Work

The main premise of the Dogs of the Dow strategy is to restrict stock picking to blue chips that make up the DJIA. This means that only well established businesses/brands that are able to withstand economic headwinds and maintain their dividend distributions are picked.

With blue chips, a high dividend yield usually indicates a significant stock price drop. Assuming that the fundamentals of the business remains intact, this implies that the Dogs of the Dow investor aims to buy blue chips at a reasonable price, which in turn yields a high dividend payout. There is also the bonus of potential capital gains when the stock price rebounds after market conditions improve.

If things pan out well, the Dogs of the Dow should in theory outperform the DJIA. Sounds enticing? Here’s how it works in 3 simple steps:

- At the start of each year, filter out the top 10 highest dividend-yielding stocks from the DJIA.

- Invest equal amounts into each of the 10 stocks you’ve filtered out.

- Hold the stocks until year-end and rebalance your portfolio at the start of each new year.

The Dogs of the Dow investor aims to buy blue chips at a reasonable price, which in turn yields a high dividend payout

1️⃣ Pick the Top Dogs

Before we start picking the top 10 dogs, let’s gain a better understanding of the DJIA works. If you are already familiar with the DJIA, feel free to skip ahead.

The DJIA, Dow Jones or Dow 30 was created by Charles Dow and Edward Jones in 1896 and consists of 30 large price-weighted blue chip US company stocks across 9 sectors (excluding the transportation and utilities sectors) of the US economy.

The DJIA is one of the oldest and most widely followed indexes in the world. It is often used as a barometer to gauge the average performance of the broader US economy.

Think of the DJIA as the “big boys club” of the major US industries. Only the biggest and the best can enter this exclusive club of 30. Here is the list of the components of the DJIA at the start of 2023 (in alphabetical order):

| No. | Stock Code | Company |

|---|---|---|

| 1 | AXP | American Express Co |

| 2 | AMGN | Amgen Inc |

| 3 | AAPL | Apple Inc |

| 4 | BA | Boeing Co |

| 5 | CAT | Caterpillar Inc |

| 6 | CVX | Chevron Corp |

| 7 | CSCO | Cisco Systems Inc |

| 8 | KO | Coca-Cola Co |

| 9 | DOW | Dow Inc |

| 10 | GS | Goldman Sachs Group Inc |

| 11 | HD | Home Depot Inc |

| 12 | HON | Honeywell International Inc |

| 13 | INTC | Intel Corp |

| 14 | IBM | International Business Machines Corp |

| 15 | JNJ | Johnson & Johnson |

| 16 | JPM | JPMorgan Chase & Co |

| 17 | MCD | McDonald’s Corp |

| 18 | MRK | Merck & Co Inc |

| 19 | MSFT | Microsoft Corp |

| 20 | NKE | Nike Inc |

| 21 | PG | Procter & Gamble Co |

| 22 | CRM | Salesforce Inc |

| 23 | TRV | Travelers Companies Inc |

| 24 | UNH | UnitedHealth Group Inc |

| 25 | VZ | Verizon Communications Inc |

| 26 | V | Visa Inc |

| 27 | WBA | Walgreens Boots Alliance Inc |

| 28 | WMT | Walmart Inc |

| 29 | DIS | Walt Disney Co |

| 30 | MMM | 3M Co |

The beauty of the Dogs of the Dow strategy is that most of the hard work of stock picking has already been done for you. Companies that are in the DJIA are essentially great American businesses that have a solid track record with stable and consistent earnings. All that is left to do is to pick the top 10 highest dividend-yielding stocks from the DJIA.

Here are the Dogs of the Dow for 2023:

| No. | Stock Code | Company | Dividend Yield |

|---|---|---|---|

| 1 | VZ | Verizon Communications Inc | 6.62% |

| 2 | DOW | Dow Inc | 5.56% |

| 3 | INTC | Intel Corp | 5.52% |

| 4 | WBA | Walgreens Boots Alliance Inc | 5.14% |

| 5 | MMM | 3M Co | 4.97% |

| 6 | IBM | International Business Machines Corp | 4.68% |

| 7 | AMGN | Amgen Inc | 3.24% |

| 8 | CSCO | Cisco Systems Inc | 3.19% |

| 9 | CVX | Chevron Corp | 3.16% |

| 10 | JPM | JPMorgan Chase & Co | 2.98% |

2️⃣ Buy Equal Weighted Dogs

Once you have shortlisted your Dogs of the Dow for the new year, it’s now time to buy them. Woohoo!

There’s no need for any complicated weighting calculations. Just buy an equal dollar amount for each stock. So say you have $10,000 at your disposal. All you need to do is buy $1,000 worth of each stock.

That’s it!

After which, just hold on to your Dogs, sit back and collect your dividends for the whole year.

3️⃣ Rebalance Your Dogs

Come New Year’s Eve, you will repeat the above process and shortlist the Dogs of the Dow for the New Year once again.

The easy way to rebalance the Dogs of the Dow is sell your entire portfolio (the old Dogs) and buy the new Dogs of the Dow. However, doing this has a downside — you may incur unnecessary trading cost.

The alternative would be to sell the stocks that that are no longer top Dogs and buy its replacements (if any for that year). For the rest — rebalance till every Dog is equally weighted.

For example, if you were to compare the Dogs of the Dow for 20221 and 2023, Merck & Co Inc (stock code: MRK) and Coca-Cola Co (stock code: KO) dropped out and were replaced by Cisco Systems Inc (stock code: CSCO) and JP Morgan Chase & Co (stock code: JPM).

Here were the Dogs of the Dow for 2022:

| No. | Stock Code | Company | Dividend Yield |

|---|---|---|---|

| 1 | DOW | Dow Inc | 4.94% |

| 2 | VZ | Verizon Communications Inc | 4.93% |

| 3 | IBM | International Business Machines Corp | 4.91% |

| 4 | CVX | Chevron Corp | 4.57% |

| 5 | WBA | Walgreens Boots Alliance Inc | 3.66% |

| 6 | MRK | Merck & Co Inc | 3.60% |

| 7 | AMGN | Amgen Inc | 3.45% |

| 8 | MMM | 3M Co | 3.33% |

| 9 | KO | Coca-Cola Co | 2.84% |

| 10 | INTC | Intel Corp | 2.70% |

That means you sell all of MRK and KO, and buy $1,000 worth of CSCO and $1,000 worth of JPM at the beginning of 2023 and rebalance the rest. So if an existing stock goes up to $1,100, you sell $100 of it. If an existing stock goes down to $900, you buy $100 of it. Once your portfolio is fully rebalanced, all Dogs will equalise back to $1,000 each.

That’s more or less how the Dogs of the Dow works. You repeat the process of filtering out the Dogs of the Dow, collect your dividends and rebalance your portfolio every year.

Check out: Portfolio Diversification: Understanding its Pros and Cons

2. How to Adapt the Dogs of the Dow to Your Own Portfolio

Now that you have a better understanding of what the Dogs of the Dow strategy is, let’s explore how we can improvise or adapt this strategy to meet the various needs and goals of investors from around the world. Here are some ideas.

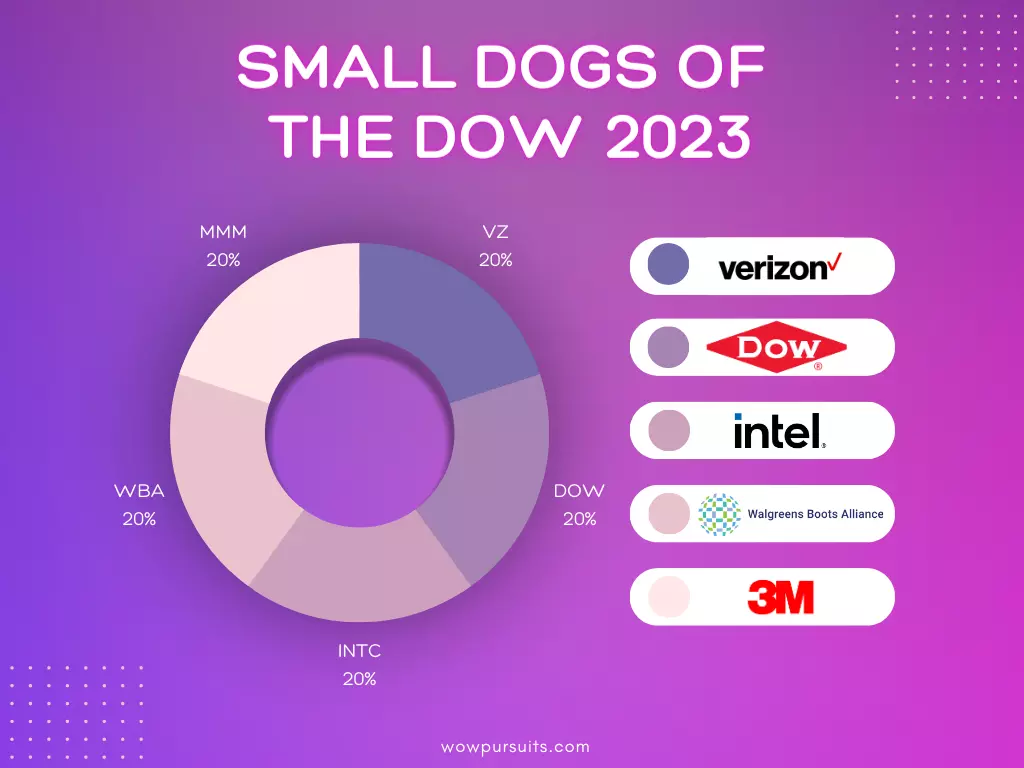

The Small Dogs of the Dow

A popular variation of the Dogs of the Dow is the Small Dogs of the Dow. Instead of filtering out the top 10 highest dividend-yielding blue chips from the DJIA, you now just have to filter out the top 5 — the Small Dogs.

Every investor is different, with a different time horizon, risk appetite, financial capacity, etc. For instance, if you have limited funds, buying 5 stocks rather than 10 may be preferable. Or if you simply want less to manage, then the Small Dogs of the Dow might be more palatable to you.

Interestingly, since 2000, the Dogs of the Dow had an average annual total return of 8.7%, while the Small Dogs of the Dow did better with an annual average of 9.3%2. So in this case, maybe less is more?

Nonetheless, whether you eventually go for the Dogs or Small Dogs of the Dow, as an investor you have to be comfortable with your holdings and be able to sleep soundly at night. Always keep in mind that past performance is no guarantee of future results.

The Dogs of Your Index

If you are a US resident and the Dogs of the Dow strategy resonants with you, go for it! However, if you’re a non-US resident, investing in US stock market for dividends may not be your best option.

The reason: tax! I’m no tax expert but I do know that for Singapore residents, we have to fork out 30% withholding tax for dividends we receive from US stocks. Ouch!

So depending on which part of the world you are residing in, the Dogs of the Dow may not be viable as taxation will eat into your total returns.

So what’s the next best option? Well… you can adapt the principles from the Dogs of the Dow and filter out your own Dogs based on your local stock market index. So if you’re from the UK, you would have the Dogs of the FTSE. If you’re from Australia, the Dogs of the ASX. If you’re from Singapore, the Dogs of the STI. You get the picture.

At the end of the day, blue chips around the world usually display similar characteristics, i.e. they are typically well established businesses/brands with strong economic moats and have a proven track record of consistent earnings and dividend payouts.

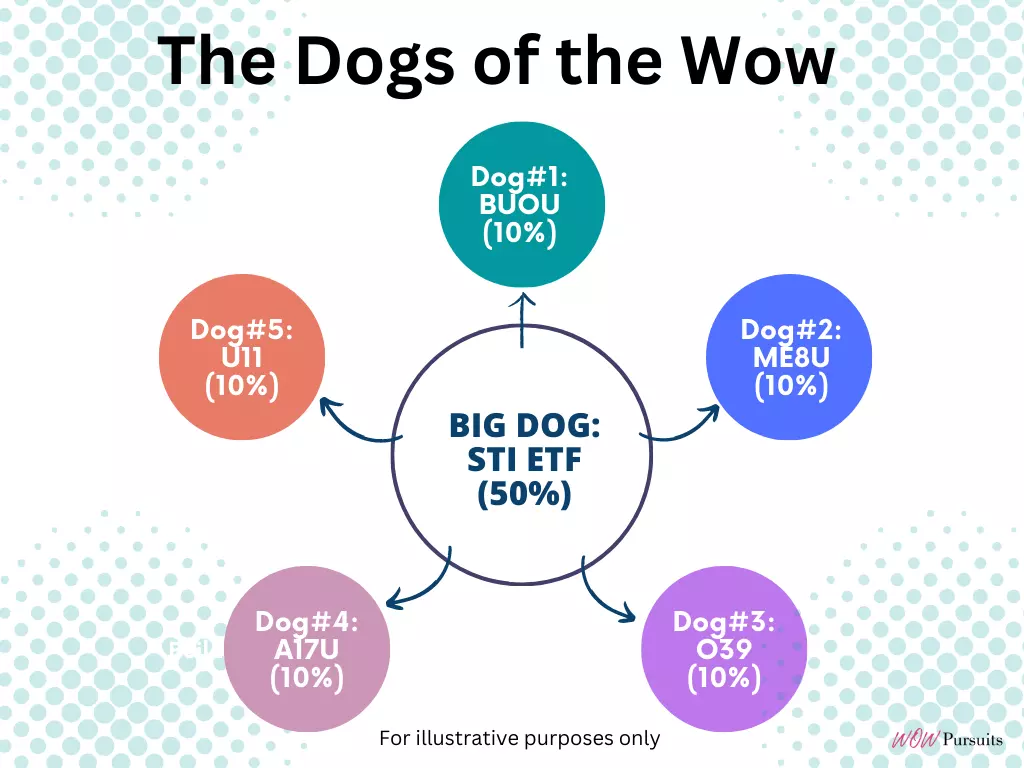

The Dogs of the Wow

This article was written with the aim to share an investing idea, learn the main principles behind it and explore ways to incorporate it into your own investment portfolio, i.e. to make it your own.

For Mrs Wow and I, before discovering the Dogs of the Dow strategy, we already had an existing equity portfolio comprising of domestic and all-world index exchange traded funds (ETFs), Singapore real estate investment trusts (S-REITs) and individual blue chips.

Back then, after quite a bit of research, we decided to adopt the Core-satellite investing strategy (perhaps a topic for another day).

In short, the Core-satellite strategy consists of a core of a low-cost passive index fund or ETF, surrounded by satellites of individual stocks. This method of portfolio construction (if done right), would minimise costs, provide an added layer of safety through instant diversification and improve your chances of outperforming the broader stock market.

As such, we bought the Straits Times Index fund or STI ETF (stock code: ES3) which formed the core of our portfolio and picked a combination of three S-REITs and two bank stocks for our satellites.

Guess how we picked our five satellite stocks? That’s right. We went for the highest dividend-yielding stocks with strong fundamentals in the STI index then, which nicely tied in with our dividend investing goal of generating passive income to cover our expenses.

Whether it was pure coincidence or serendipity, we had inadvertently pick the Small Dogs of the STI for our satellites! So for me, when I first came across the Dogs of the Dow strategy, it immediately struck a chord and acted as confirmation that we were on the right track. Phew!

Of course, our portfolio has evolved ever since. However, to this day, it still very much resembles a hybrid of the Core-satellite and Small Dogs of the Dow strategy, or what I fondly call the Dogs of the Wow.

To illustrate how to structure your investment portfolio based on the Dogs of the Wow, let’s base it on the current Dogs of the STI shown below:

| No. | Stock Code | Company | Dividend Yield |

|---|---|---|---|

| 1 | H78 | Hongkong Land Holdings | 5.74% |

| 2 | BUOU | Frasers Logistics & Commercial Trust | 5.57% |

| 3 | ME8U | Mapletree Industrial Trust | 5.53% |

| 4 | O39 | Overseas-Chinese Banking Corporation | 5.46% |

| 5 | C6L | Singapore Airlines | 5.12% |

| 6 | N21U | Mapletree Pan Asia Commercial Trust | 5.00% |

| 7 | A17U | Capitaland Ascendas REIT | 4.99% |

| 8 | V03 | Venture Corporation | 4.99% |

| 9 | U11 | United Overseas Bank | 4.87% |

| 10 | BN4 | Keppel Corporation | 4.82% |

At the core is Big Dog, surrounded by five satellite Dogs. Here is how the Dogs of the Wow might look like:

In terms of portfolio weighting, Big Dog should take up 50% or more, while the balance is equally divided amongst the satellite Dogs.

So say you have a 50-50 weighting between core and satellites (as depicted in the diagram), that means if you invest $10,000, $5,000 goes to Big Dog while the remaining amount is equally divided amongst the five satellite Dogs, i.e. $1,000 each.

You would also notice that I didn’t exactly go by the book and pick the top 5 highest dividend-yielding STI constituents. Instead, out of the 10, I picked (almost instinctively) the following five satellite Dogs:

- Fraser Logistics & Commercial Trust (stock code: BUOU)

- Mapletree Industrial Trust (stock code: ME8U)

- Overseas-Chinese Banking Corporation (stock code: O39)

- Capitaland Ascendas REIT (stock code: A17U)

- United Overseas Bank (stock code: U11)

Is it because these Dogs are “better” than the rest due to some hidden or intrinsic quality? No siree! The reason I picked the above five Dogs is simply because I’m more than familiar with them, i.e. S-REITs and Singapore banks.

Your choice of the five satellite Dogs or even the Big Dog could be different from mine. As Warren Buffett once said, “Everybody’s got a different circle of competence. The important thing is not how big the circle is. The important thing is staying inside the circle.”

So yeah… the Dogs of the Wow (not Dow) is also about keeping within our circle of competence and not just based squarely on dividend yield. A high dividend yield could be a trap; I’ll remember to write an article about this down the road.

Ultimately, the intent of this article is to provide you with ideas that can help meet your investment objectives. I hope your mind has been expanded.

Keep your eye on the goal. Keep investing. Keep growing your wealth!

Sources:

- Dogs of the Dow: Definition, List of Stocks, Performance: https://www.investopedia.com/terms/d/dogsofthedow.asp

- Dogs of the Dow Total Return: https://www.dogsofthedow.com/dogyrs.htm

You may also like: Are REITs Safe? 4 Key Risk Factors You Must Know | How 3 Investors from Different Continents Grow their Wealth

Thanks for sharing this concept of the “Dogs of the Dow” and the Ralph Seger quote.

In the US, income/value investors typically identify positions from the list of S&P 500 Dividend Aristocrats or Dividend Kings. Common evaluation metrics to screen companies include relative valuation (P/E or PEG) vs. the sector, dividend payout history, dividend growth and payout ratio (dividends/earnings) in addition to the dividend yield.

Qualified dividend income is typically taxed 0%, 15% or 20% at the federal level, depending on your income level and tax filing status. At the state level, you could be subject to additional taxes. So if you are in a high income tax state like NY, the total federal and state tax could be closer to 30% much like for Singapore investors.

Therefore, in the US, most dividend investors keep their positions in a tax favorable investment account (e.g., 401K, Roth IRA). Other income assets that are more tax-friendly (e.g., government bonds) may be kept in their taxable non-retirement account.

Hope this additional info is helpful context for US investors.

I really like your point, Rob. 👍 Without a doubt, the tax implications on dividend income must be carefully considered to optimise returns.

Geez… if the total federal + state tax can be as high as 30% for an investor in NY (like yourself), then keeping his positions in his 401k or Roth IRA retirement account makes good sense in the long run.

Thanks so much for sharing your knowledge with us. I’m sure our US readers will find it very helpful. 🙌😄