What’s the difference between ice cream and gelato? Ice cream contains more cream and typically includes egg yolks while gelato consists of more milk and rarely has egg yolks in it. If you’re not into creamy, frozen desserts, you probably don’t know the difference. Similarly, if you’re not into stocks, you may not know the difference between trading and investing.

When it comes to engaging in the stock market, there are two main approaches: trading and investing. Traders and investors share a common goal: to profit from the markets. However, the way they go about it varies significantly. For the uninitiated, this article explains the key differences between the two.

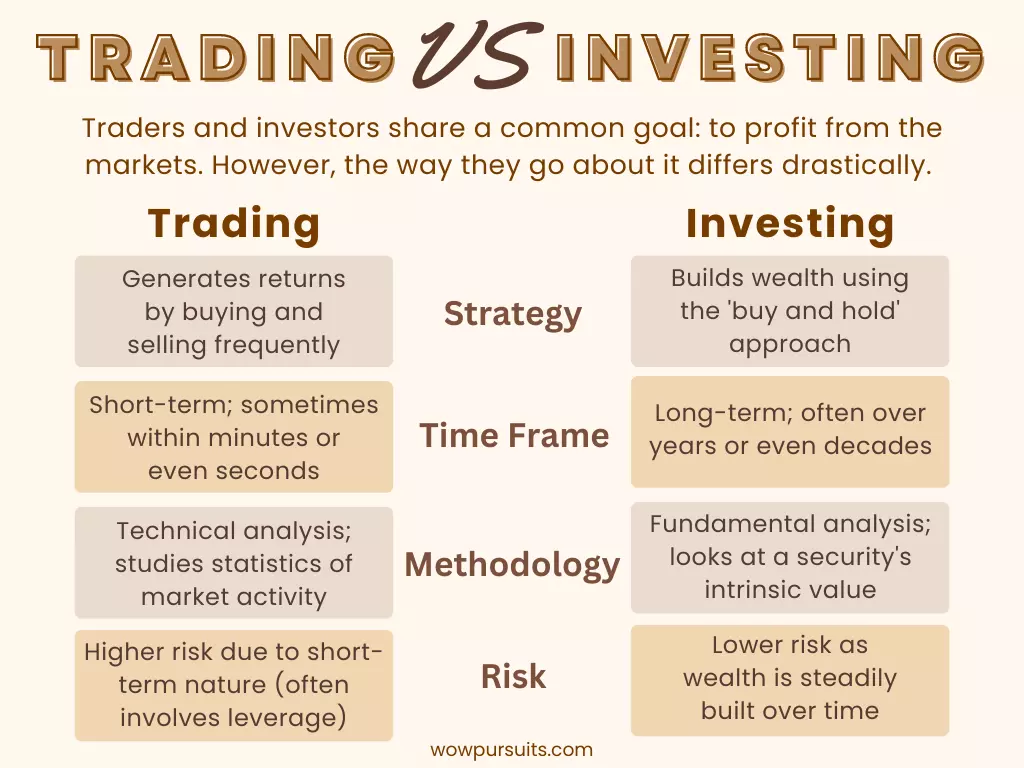

At the most fundamental level, trading and investing are the same. To buy and sell securities, both traders and investors need to have a brokerage account. Both can choose from an array of investments to help them attain their financial goals. What sets them apart is the strategy they apply, which involves using distinct methodologies to make decisions. The time frame and amount of risk involved also differ. The diagram below sums up the differences:

1. Strategy

Trading is a short-term strategy that involves buying and selling financial instruments such as stocks, exchange-traded funds (ETFs), bonds, commodities, and so on with the goal of turning a quick profit. Traders buy and sell securities frequently (often within the same day), capitalising on small price movements and the volatility of the stock market. Their primary concern is to hit their target prices, which are set through technical chart analysis. Once target prices have been reached, they take profit and move on to the next trade.

Investing, on the other hand, is a long-term strategy. The goal of investors is to generate high returns on investments that have the potential for long-term growth. To achieve that, they assess a company’s long-term prospects and buy stocks at fair prices. For some investments, dividend income makes up a sizeable portion of the total return.

2. Time Frame

Perhaps the most obvious difference between trading and investing is the length of time involved.

Broadly speaking, there are four trading methods: scalping, day trading, swing trading, and position trading.

| Trading Method | Time Frame |

|---|---|

| Scalping | Short-term: seconds or minutes |

| Day trading | Short-term: no longer than one day |

| Swing trading | Short-/medium-term: several days to weeks |

| Position trading | Long-term: weeks, months or years |

The most short-term form of trading is known as scalping. Scalp traders focus on making multiple small profits off minor intraday price movements. Positions are only open for seconds or minutes and the goal is to make numerous trades that add up to a larger cumulative profit. Scalping can be mentally and physically taxing due to the high-pressure environment and the amount of research and transactions required.

As the name says, day trading occurs within the same day. This removes the risk of any large overnight price fluctuations. Day traders typically hold their positions for minutes or hours. Like scalp traders, they profit by making frequent trades. Although day trading is less intense than scalping, it still requires one to put in a significant amount of time to analyse the markets and monitor his or her positions throughout the day.

Swing traders usually hold their positions for several days or weeks. This allows them to take advantage of short-term market moves without having to constantly keep an eye on their trades. For this reason, swing trading is a good option for people who have other commitments and would like to trade in their free time. However, some time must still be allocated to analysing the markets.

Scalping, day trading and swing trading are short-term. Position trading is quite different from them in that it focuses on long-term price movements. To achieve maximum profits from major price swings, position traders may maintain a holding period of weeks, months or even years. As such, position trading is often considered a form of investing.

Unlike short-term traders, long-term investors do not make frequent trades to try to beat the markets. They buy and hold their investments for an extended period of time — often years, if not decades.

3. Methodology

Traders and investors use different methods to make decisions.

Traders rely heavily on technical analysis to predict future price movements. This involves the study of past prices and trade volume to identify patterns and trends in the market. Common chart patterns include head and shoulders, double tops and bottoms, and trend lines.

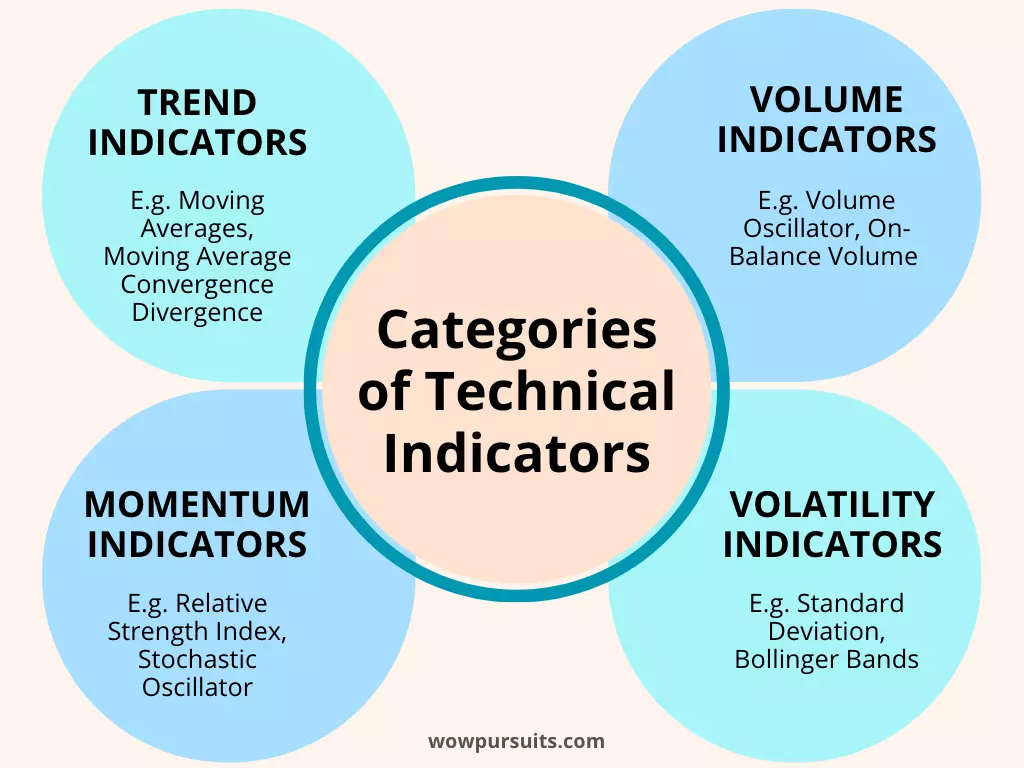

Besides chart patterns, traders also use a variety of indicators (i.e. mathematical calculations and statistics) to help them identify trading opportunities, as well as entry and exit points. In general, these indicators fall under four categories: trend, volume, momentum and volatility. In addition, traders also analyse news and other external factors that may affect the markets.

In contrast, ‘buy and hold’ investors primarily use fundamental analysis. The aim of fundamental analysis is to ascertain the intrinsic value of a security. It involves examining the financial and economic conditions of a company or sector to identify potential investments. Investors typically look for companies that have a strong balance sheet, sound management, and good prospects for future growth. Macroeconomic factors such as the state of the economy and industry conditions are also taken into consideration.

4. Risk

Both trading or investing involve risk, and the amount of risk depends on the individual’s goals, risk tolerance, and investment strategies. Generally speaking, trading carries a higher level of risk than long-term investing as it involves more frequent buying and selling of stocks, commodities or other financial instruments. Also, traders often leverage their investments in order to increase their potential returns, which increases their risks as well.

5. Am I a Trader or an Investor?

Whenever I tell people that I invest in the stock market, most immediately assume that I’m a trader. Actually I’m mostly an investor. That means I maintain a long-term passive portfolio that I rarely touch. This portfolio consists of a mix of stocks, index funds and S-REITs.

However, I do keep a separate active portfolio for trading (just a small one) because I enjoy it. This way, I don’t have to worry about putting my long-term financial plan in jeopardy. Most of the time, I hold my positions for a few weeks or months, so you can consider me a swing/position trader.

Scalping and day trading are definitely not for me due to the sheer amount of time and effort needed to be successful. I simply do not see myself monitoring the markets for hours each day as I enjoy my early retirement too much.

In my view, trading should not represent an individual’s entire portfolio because of the amount of risk involved, but that’s just me. Ultimately, the decision of whether to trade or invest comes down to the individual’s goals and risk tolerance.

You may also like: Why We Love Dividend Investing but It’s Not For Everyone | The Importance of Liquidity in Personal Finance and Investing | Portfolio Rebalancing for Beginners | Investing During a Recession: What You Need to Know

Great educational article and nice visuals illustrating the differences! I am also mostly a long-term investor, but have a smaller portion of my portfolio dedicated to trading, especially within my Roth IRA for tax efficiency.

Thanks, Rob! Hopefully, more people will know that investing is very much a long-term game. Great move to tap on your Roth IRA for tax-free growth and withdrawals in retirement!

Great article!

I don’t think many people understand that there is a difference between Investing and Trading. This is a great education. Time and Risk are super important differences, when you give your investments more time, the risk goes down.

And I’m just like you! I consider myself an “Investor” but I have a small portfolio for swing trading. More educational than anything.

Hi Brett, you are absolutely right about risk and time. Huge difference there and more people should be aware.

Haha… great minds! I really like having a small portfolio for trading. It helps to sharpen my technical analysis, which frankly still has much room for improvement! 🤣