What? The tortoise wins? How is that even possible? Why would the hare take a nap during a race? How could it lose the race to the tortoise who is beyond slow?

Aesop’s tale of the tortoise and the hare stuck with me ever since I heard it as a toddler. I was convinced the race was rigged. The hare must have eaten a poisoned apple that made him sleep.

However, as I grew older, I began to see the wisdom behind the tale. I began to realise that in real life, hares do lose and tortoises do win, especially when it comes to the investing race.

Let’s take another look at this classic fable to understand why investing in index funds is like being the tortoise who starts slow but finishes strong. Here’s what I have in store for you:

- Why the Hare Loses the Investing Race

- Why the Tortoise Wins the Investing Race

- The Reality: It’s Tough Being a Tortoise at Times

1. Why the Hare Loses the Investing Race

The hare is smart, confident and a real go-getter. Most would even agree that he’s cute and quite the charmer. I mean, who doesn’t like the easter bunny, right? He clearly has the speed and drive to win the race. So why did he end up losing?

What I had failed to understand when I first heard the fable was that the race was a marathon, NOT a sprint! If it had been a sprint, even the fastest tortoise on the planet would not have had a chance against the average hare. But in a marathon, everything changes!

In a marathon, the name of the game is not speed, but pace and stamina. So the question is not whether the hare is faster than the tortoise, but rather, can the hare sustain its blazing speed throughout a marathon?

The answer is obvious, and that’s exactly why the hare needed to take a nap — he was simply flat out of energy.

The hare thought: even if that slow coach of a tortoise were to overtake me while I was napping, I could easily catch up and still win the race. The hare let his guard down, underestimated his opponent and totally misjudged the race.

In the end, while the hare was taking his extended nap, the tortoise just kept at it and eventually won the race.

Likewise in the game of investing, it’s a marathon we are running, not a sprint. So who is the hare when it comes to investing? Well… it’s any individual or organisation who thinks they are able to consistently beat the average market returns over the long term (we’re talking about a period of at least 5 to 10 years).

In my previous article Why Index Funds are Perfect for the Do-Nothing Investor, I wrote about Warren Buffett placing a bet that the S&P 500 index would beat hedge funds (or any actively managed fund) over a period of 10 years. In this case, the tortoise is the S&P 500 index and the hare is the actively managed fund.

Even if you have yet to read about Warren Buffett’s bet, you can probably guess that the tortoise did indeed win the race.

But let’s focus on the hare at this point. Is there really no chance the hare can win the race? Or maybe Buffett’s win was a fluke?

The passive vs active fund debate has been going on for quite a while and will likely persist as active fund managers continue to defend their profession. However, instead of diving into this perennial debate, let’s look at what history shows us.

If you didn’t already know, S&P has been keeping close tabs on the performance of actively managed funds for more than 20 years. In fact, the renowned SPIVA (S&P Indices versus Active) research just celebrated their 20th anniversary this year.

I’ve place the link to SPIVA’s US Year-End 20221 research report at the end of this article for your reference. For me, the key takeaway of the 10 paged report is this:

- Net of fees and taking into account funds that went belly up, about 86.5% of large-cap equity funds underperformed the S&P 500 index over a 5-year period.

- In 10 years, the underperformance increased (worsened) to 91.4% (it was no fluke — Buffett won his bet as the odds were clearly in his favour).

- In 20 years, the underperformance didn’t cease and degraded to 94.5%. Yikes!

Think about it this way. It takes a hell lot of research, technical analysis and market know-how to hand-pick that perfect stock or blend of stocks that will consistently beat the average return of the S&P 500, year after year after year.

Even if you have what it takes to figure out that winning portfolio, it’ll require active monitoring and management to always stay ahead. Being a hare, to say the least is exhausting. It’s no wonder the hare needed to take a nap and lost the investing race at the end.

Even if you have what it takes to figure out that winning portfolio, it’ll require active monitoring and management to always stay ahead.

2. Why the Tortoise Wins the Investing Race

Did you know that the Galapagos giant tortoise can live well over a century? For example, a captive Galapagos tortoise named Harriet, lived for at least 175 years!

Compared to the hare with an expected lifespan of about 3 to 4 years in the wild, the tortoise by nature knows that the race he’s running will be a gruelling marathon. Time is his friend and all he needs to do is keep moving forward to win the race.

Likewise in the investing race, time is your greatest ally. The longer your time horizon, the larger the reward. I previously wrote about the total annual returns of the S&P 500 since its inception and won’t reiterate here (tap on the link for more details), except that the tortoise sure knows how to make use of the most powerful force in the universe — the compound effect.

Besides longevity and endurance, the tortoise also has something the hare doesn’t — a protective shell that keeps it safe from its predators. I reckon that nature does indeed give all creatures a fair chance for survival.

Although the tortoise doesn’t have the speed to outrun its predators, it has an armour of defence like a knight. All the tortoise needs to do when threatened is to retreat into its shell until the storm blows over. It knows that clear skies are ahead. It just needs to hunker down in the meantime.

The protective shell of the tortoise is akin to the instant diversification offered by investing in an index fund. Take the S&P 500 index for instance. It tracks the top 500 largest companies in the US spread across 11 sectors.

As such, you don’t need fancy mathematics to figure out that the risk of catastrophic and complete failure of all 500 companies within a specific time frame is extremely low.

The inherent diversification of index funds is what provides you the investor that protective shell of security you will NOT get by picking your own basket of stocks, say in the tech sector only. (I’ve placed the link to the full list of the S&P 500 components that gets updated daily by Slickcharts2 at the end of the article for your reference.)

Note: The number of components/constituents of the S&P 500 exceed slightly over 500, as some of the companies have multiple share classes. If the multiple share classes fit the criteria of the S&P 500, they will be included inside the index too. For example, Alphabet Inc. has two classes of shares in the S&P 500, Class A and Class C. Currently, the total number of components stand at 503.

Check out: Portfolio Diversification: Understanding its Pros and Cons

But you might ask: is the shell of the tortoise durable? Does it degrade over time? Well, at a ripe old age of 175 years, Harriet’s shell was still as strong as ever. Likewise, the S&P 500 has withstood the test of time (65 years running) and continues to be rejuvenated, maintaining its integrity to date.

The constituents of the S&P 500 index is not set in stone. Only the strongest survive, leaving those who do not meet the mark to be relegated. In other words, companies that are distressed or doing poorly will be replaced by up-and-coming companies.

The constituents of the S&P 500 index is not set in stone. Only the strongest survive, leaving those who do not meet the mark to be relegated.

The S&P 500 index rebalances every 3 months. Besides tweaks and changes to the weighting of the existing index components, replacements also occur when required.

Check out: Beyond Borders: Why Invest in a Global Index Fund

3. The Reality: It’s Tough Being a Tortoise at Times

The downside of being a tortoise in the investing race is that there will be times you will feel like, erm… for lack of a better word… a loser. Just like in the fable, the tortoise is way behind the hare at the onset of the race as well as at other times.

Not too long ago during the 2020 to 2021 period, right after the markets pulled-off a V-shaped recovery from the ominous news of the COVID-19 pandemic, many tech-related stocks and funds skyrocketed and hit all-time highs, including cryptocurrencies.

It was “hare-days” for investors who were able to successfully pick the winners. I remember reading countless comments and testimonies on social media about so and so reaping 10X, 20X and even more than a 100X on their investments. Newly minted millionaires and billionaires seem to be popping up all over the place.

The bull market was raging yet again. Stock pickers were buying the dip and racking up exceptional returns.

If you were invested in a S&P 500 index fund then, you wouldn’t be fairing too badly yourself. However, if Bitcoin or Tesla or Ark Innovation ETF (ARKK) had been on your radar, you might have felt more than just a tinge of FOMO (fear of missing out) and may have been tempted to get in on the action. Heck the tortoise, I want to be a hare!

It is at times like this that being a boring tortoise might come into question. I remember reading the comments section of my favourite financial YouTubers (who are usually proponents of “dull” value stocks and index funds) and coming across negative comments along the lines of:

- My cryptocurrency portfolio is up by more than 20X. Index funds are for losers! Stop sprouting bad investing advice.

- Warren Buffett is a dinosaur, a has-been. He doesn’t know what he is talking about anymore. Move on with the times.

- Tesla to the moon! S&P 500 sucks!

I have no idea who these commentators are and it doesn’t matter. Everyone is entitled to their opinions, good or bad. I just hope they realised their profits when the going was good. If they had held on to their positions till today, the picture would no longer be so pretty. In fact, most of these commentators have gone silent in recent times. I wonder why.

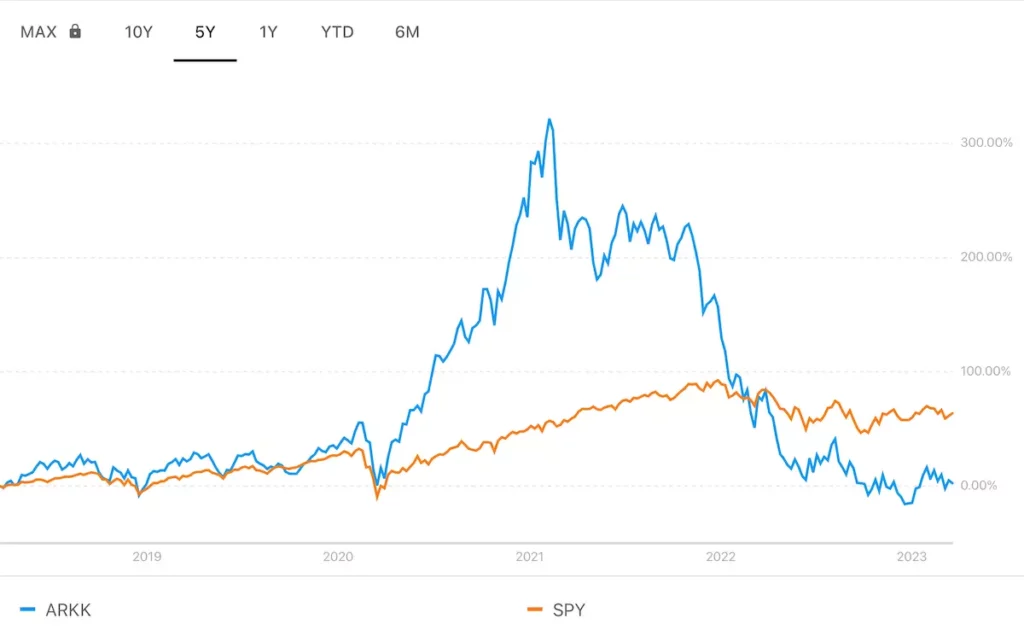

To round off my point, let’s objectively compare two exchange-traded funds (ETFs), the ARKK and the SPDR S&P 500 ETF (SPY). For this comparison, I’ve picked ARKK simply because it was a very popular, high-flying thematic ETF (based on the theme of disruptive technology) in 2020, hitting a total annual return of 152.82% that year. Cathie Wood, the CEO of ARK Invest was constantly featured on many media outlets then. She was (and still is) the poster girl of disruptive technology investing, the future of innovation.

The above chart shows the total annual returns (adjusted for splits and dividends) of ARKK and SPY for the last 5 years, i.e. since 2018. As seen, ARKK was pretty much ahead of SPY since 2018 and took a huge lead in 2020-2021. The hare was clearly way ahead of the tortoise during this period.

Then in 2022, ARKK “took a nap” and lost its lead to SPY. So far, in the first quarter of 2023, ARKK is still behind SPY. The tortoise is now in the lead.

Will ARKK take the lead again? Your guess is as good as mine. What I do know is that investing in an index fund tends to be less volatile. It’s not going to make the investor rich overnight. Instead, it will gradually grow his or her wealth over time. When others are making big bucks elsewhere, it can be challenging to stick to the plan and not be distracted by the noise. Remind yourself that everyone has a different strategy and risk profile. Do not succumb to FOMO buying no matter what.

Check out: Tame Your Emotions: Let Your Wealth Compound Uninterrupted

As the story goes, the tortoise is nonchalant and continues moving forward, unperturbed by how much of a lead the hare has over him. That is exactly the attitude we should strive for as index fund investors. Ignore short-term market fluctuations and understand that you’re in a marathon, not a sprint.

Here’s to the success of the unwavering tortoise investor!

Sources:

- SPIVA U.S. Year-End 2022: https://www.spglobal.com/spdji/en/spiva/article/spiva-us

- S&P 500 Companies by Weight: https://www.slickcharts.com/sp500

More investing basics: Why We Love Dividend Investing but It’s Not For Everyone | How REITs Work: Get Started on Real Estate Investing