This is the second instalment of a two-part series on portfolio diversification. In Part 1, I covered the pros and cons of diversification in investing. Now let’s look at ways you can diversify your portfolio.

Investing is a game that requires strategy. One key strategy that has proven its resilience over time is portfolio diversification.

Previously, we learnt that diversification presents avenues for growth while reducing risk and volatility of your portfolio. Nevertheless, excessive diversification, commonly referred to as diworsification, can introduce complexity and dilute potential returns. Increased buying-and-selling activity associated with diversification also incurs more transaction costs.

Hence, the key to leveraging the potential advantages of diversification is to strike the right balance. But what exactly is the right balance? There are, of course, a myriad of factors to consider.

From diversifying across asset classes to within equities, this article unravels the key components of building a diversified portfolio to help you achieve long-term success in the dynamic world of investing.

- List of Asset Classes

- Diversification across Asset Classes

- Diversification within Equities

- Diversification through Exchange-traded Funds (ETFs)

- How Diversified Should Your Portfolio Be

1. List of Asset Classes

First, you need to know what an asset class is. Put simply, an asset class is a group of similar investment vehicles. Within each asset class, there are often sub-asset classes that represent more specific groupings of assets. Here are the common asset classes:

➡️ Cash and Equivalents: Money you can access easily, e.g. high-yield savings accounts, time deposits, Singapore Savings Bonds, Treasury bills and money market funds.

➡️ Fixed Income (Bonds): Debt securities like government and corporate bonds.

➡️ Equities (Stocks): Shares of ownership issued by publicly traded companies.

➡️ Real Estate: Physical properties, e.g. residential homes, commercial buildings and industrial warehouses.

➡️ Commodities: Raw materials or primary goods like precious metals (e.g. gold and silver), oil and agricultural products. Commodities are traded on stock exchanges, and their prices are influenced by factors such as supply and demand, geopolitical events and economic conditions.

➡️ Exchange-traded funds (ETFs): A basket of securities that follow an index, commodity or sector. Traded on stock exchanges, ETFs can represent a variety of asset classes, not just equities. While many ETFs track equity indices, there also those that cover other assets like bonds and commodities.

➡️ Real Estate Investment Trusts (REITs): Investment vehicles that own, manage or finance income-generating real estate across various sectors such as commercial and industrial properties. Generally considered an equity sub-asset class, REITs offer a way for investors to gain exposure to the real estate sector without directly owning the properties.

➡️ Alternative Investments: Hedge funds, private equity, peer-to-peer (P2P) lending, cryptocurrency, etc.

➡️ Collectibles: Art, antiques, classic cars, watches, wines, toys, sports memorabilia, etc.

Each asset class has a different set of risks and opportunities. You don’t have to be an expert in all of them (I most certainly am not) but understanding their key characteristics will help you create a more balanced and resilient portfolio.

2. Diversification across Asset Classes

Astute investors often spread their investments across a range of asset classes, with each taking up a specific percentage within the portfolio. Many see stocks, bonds and real estate as foundational asset classes that, when strategically integrated, can help them build wealth while mitigating risk.

For example, I’m sure you’ve heard of the 60/40 rule, which recommends allocating 60% to stocks and 40% to bonds in a portfolio. This allocation is a possible consideration for investors seeking to balance growth potential with income and stability.

Treasury bonds in particular are seen as a traditional safe-haven asset and investors often turn to them during periods of market turmoil or economic uncertainty. Thus, a portfolio that includes both stocks and Treasury bonds will probably yield a reasonable return for a lower level of risk compared to an all-stock portfolio.

Real estate investments offer diversification benefits as they are influenced by different market dynamics and factors such as location, property type, supple and demand, as well as financing terms. They are favoured by many investors as their values have the potential to appreciate over time. Furthermore, investors can earn rental income by leasing out their properties, generating a steady stream of cash flow.

I should also mention gold since it has been getting a lot of attention in recent years. The precious metal, which has a low correlation1 with stocks, is widely viewed as another safe-haven asset and a hedge against inflation.

When inflation is high and volatile, gold prices tend to rise. This is because high inflation can erode the purchasing power of fiat currencies, prompting investors to buy gold as a store of value.

In times of global uncertainty and economic downturns (e.g. Covid-19 recession and Russia-Ukraine war), investors may also flock to gold, driving up its price. Conversely, during periods of economic expansion or bullish stock markets, investors tend to favour stocks for their growth potential.

Silver shares similarities with gold in terms of its role as a precious metal, but it has significant industrial uses, which can affect its prices.

There are, of course, many other types of investments and it’s up to you to decide which ones to include to appropriately diversify your portfolio.

1 Asset correlation measures how investments move in relation to one another on a -1 to +1 scale. -1 indicates a strong negative correlation, meaning that the assets tend to move in opposite directions. If one asset goes up, the other goes down, and vice versa. 0 indicates no correlation, meaning that the assets operate independently of each other. They sometimes move in the same direction, while other times, they don’t. +1 indicates a strong positive correlation, meaning that the assets tend to move in the same direction. If one asset goes up, the other also goes up, and vice versa.

3. Diversification within Equities

It’s not difficult to understand why equities are one of the most, if not the most popular asset class. They have historically outperformed other asset classes, delivering attractive returns over the long term and effectively addressing inflation concerns.

However, higher returns also come with greater risk, so if you’re heavily invested in stocks, learning how to diversify within equities will help to minimise your overall risk exposure. Here are the different ways:

➡️ Sector and Industry: To appropriately diversify an equity portfolio, investors will to need to include stocks from different sectors and industries. This helps to reduce the impact of sector-specific risks. If one sector faces challenges, investments in other sectors may perform better, offsetting potential losses.

For instance, one could hold stocks in technology, healthcare, consumer goods and financial services. During economic downturns, healthcare stocks may demonstrate resilience while technology stocks face headwinds.

➡️ Market Capitalisation: Market capitalisation refers to the total market value of a public listed company. Large-cap companies have a market capitalisation exceeding $10 billion. They are considered safe investments and many pay dividends. Mid-cap companies have a market capitalisation of about $2 to $10 billion. They appeal to investors as they provide a balance of stability and growth potential. Small-cap companies have a market capitalisation of below $2 billion. They are more volatile but hold the promise of bigger returns.

Although many portfolios tend to tilt towards large-caps, diversifying across different market capitalisations provides exposure to companies at different stages of growth. Just look at a stock like Nvidia. Its closing price was $0.09 on 31st December 1999 (still a small-cap then). The last I checked, its 52-week high was a jaw-dropping $140.76! But do note that not all small-cap stocks will experience significant growth.

➡️ Investing Style: Value and growth investing are two distinct investing styles. Value investors seek undervalued stocks trading below their intrinsic value, focusing on fundamentals like low P/E ratios and dividend sustainability. Growth investors, on the other hand, target companies with strong growth potential, often prioritising revenue and earnings growth over current valuation metrics.

A blend of both styles can lead to increased diversification, enabling investors to benefit from different market environments. For example, a portfolio may include value stocks like established consumer staples and growth stocks like innovative technology companies.

Check out: Why We Love Dividend Investing but It’s Not For Everyone and Dividend Investing Ideas: The Dogs of the Dow Strategy

➡️ Geographical Region: Many investors are reluctant to invest in foreign markets due to home bias. This may well be a costly mistake as diversifying across geographical regions not only reduces exposure to country-specific risks but also allows investors to take advantage of global opportunities.

For instance, a US investor could hold domestic stocks like Tesla and Costco, as well as foreign stocks like Alibaba and Coal India. During periods of economic strength in the US, domestic stocks may perform well, while during times of economic expansion in Asia, foreign stocks may outperform.

4. Diversification through Exchange-traded Funds (ETFs)

Investing in individual stocks may seem too risky to some investors. Finding the right ones can also be a time-consuming undertaking. So if you don’t have the time to research, analyse and monitor companies, you may be better off investing in ETFs.

Passive ETF investing is a popular strategy for building a well-rounded portfolio. Known for their cost-effectiveness, ETFs typically have lower expense ratios compared to actively managed mutual funds. Here are a few ways you can diversify through ETFs:

➡️ Market-cap-weighted Index ETFs: Market-cap-weighted index ETFs, such as those that track the S&P 500, weigh companies based on their market capitalisation. They typically hold a large number of stocks, giving investors broad diversification across various companies and industries within the index they track.

Although these ETFs naturally mirror market conditions, they can be disproportionately represented by a handful of large companies. Case in point: investing in the S&P 500 today may mean overexposure to the Magnificent Seven2, which account for roughly 31% of the index’s total market capitalisation. To understand the risk, here are two further reading suggestions for you: Is the U.S. stock market too ‘concentrated’? Here’s what to know and Why Mega-Cap Tech Stocks’ Dominance Is a Risk

2 The Magnificent Seven are a group of US tech stocks that have significantly outperformed the broader S&P 500 index since the market low in October 2022. The group includes Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia and Tesla.

Check out: Why Index Funds are Perfect for Do-Nothing Investors

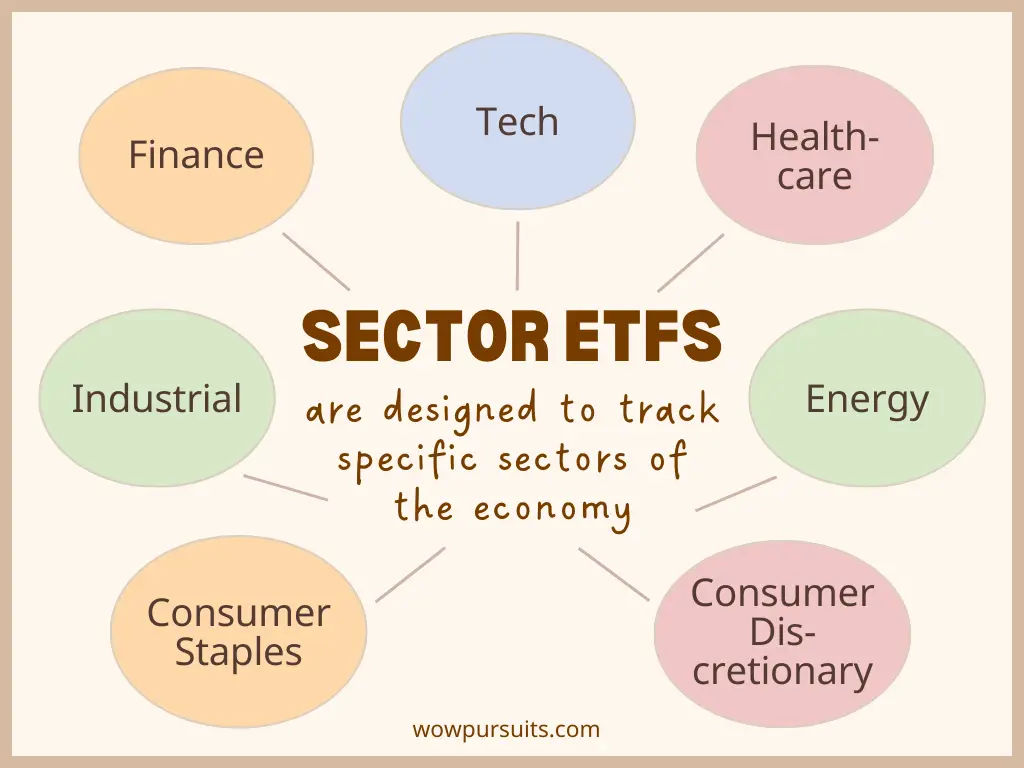

➡️ Sector ETFs: Some investors may prefer Sector ETFs, which focus on specific segments of the economy. An example is the Consumer Staples Select Sector SPDR Fund (XLP). The ETF invests in companies that are primarily involved in the development and production of essential goods like food, beverages and household products.

➡️ International ETFs: International ETFs specialise in foreign-based securities. They allow investors to diversify geographically, thereby reducing reliance on a single country’s economic performance.There are different types of international ETFs to suit most portfolio. Global funds provide exposure to markets from all over the world while regional funds focus on a specific part of the world, e.g. Asia Pacific. There are also funds that target developed or emerging markets.

➡️ Dividend ETFs: Dividend ETFs invest in companies that have a history of consistent dividend payments. These companies tend to be well-established blue chips that are generally viewed as low-risk. For income-oriented or risk-averse investors who are not into stock picking, investing in dividend ETFs is a good way to generate a regular stream of income.

➡️ Non-equity ETFs: There are also ETFs that hold non-equity securities including bonds, commodities, currencies and real estate. Investors can therefore diversify their portfolios by incorporating ETFs that represent different asset classes. For instance, one could hold bond ETFs for fixed income or REIT ETFs for exposure to the real estate market, without the hassle of buying and managing property.

5. How Diversified Should Your Portfolio Be

Here comes the million-dollar question: how diversified should your investment portfolio be?

I’m afraid I don’t have the answer as there’s no one-size-fits-all approach. Ultimately, portfolio diversification should be tailored to your individual circumstances, taking into account the following:

➡️ Investment Goals: What motivates you to invest? Is it save for a house, fund your child’s education or generate passive income for retirement? Your investment goals dictate the desired level of risk and return, which in turn influences your diversification strategy.

➡️ Risk Tolerance: How much risk are you willing to take? Some investors may have a higher risk tolerance and can stomach greater volatility in pursuit of higher returns. Others may be more risk-averse and prefer a more conservative approach. You should match your portfolio diversification with your risk tolerance to ensure that you stay invested during market downturns without succumbing to panic.

➡️ Time Horizon: Your time horizon, i.e. the length of time you plan to hold your investments, is a critical factor in portfolio diversification. Investors with longer time horizons, e.g. young working adults, have more flexibility to withstand short-term market fluctuations and may be able to take on more risk. In contrast, investors with shorter time horizons, e.g. those approaching retirement, may need to prioritise capital preservation and liquidity over higher returns.

➡️ Financial Situation: Your financial situation, including your income, expenses and debts, will impact both your ability to invest and take risk. Investors with stable income and minimum debt are in a better position to allocate funds towards various investment opportunities, while those with limited resources may need to be more conservative in their approach to portfolio diversification.

➡️ Tax Implications: Considering taxes when diversifying your portfolio can help you optimise your investment strategy, minimise tax liabilities and enhance overall after-tax returns. Things to note include your income tax bracket, investments held in tax-advantaged accounts, as well as capital gains tax.

In summary, there are numerous ways to diversify your investment portfolio. To construct a portfolio that meet your specific needs and goals while managing risk effectively, you need to align your diversification strategies with your personal circumstances. If you find the process complex, it might be worth consulting with a financial advisor to develop a plan that’s catered for you.