This is the second instalment of a two-part series on income diversification. Previously, I touched on the benefits and drawbacks of having different sources of income. In this article, I shall discuss why income diversification may be overrated at times.

To recap, I chanced upon this question on 𝕏 (fka Twitter) a few weeks ago:

Is having multiple streams of income overrated?

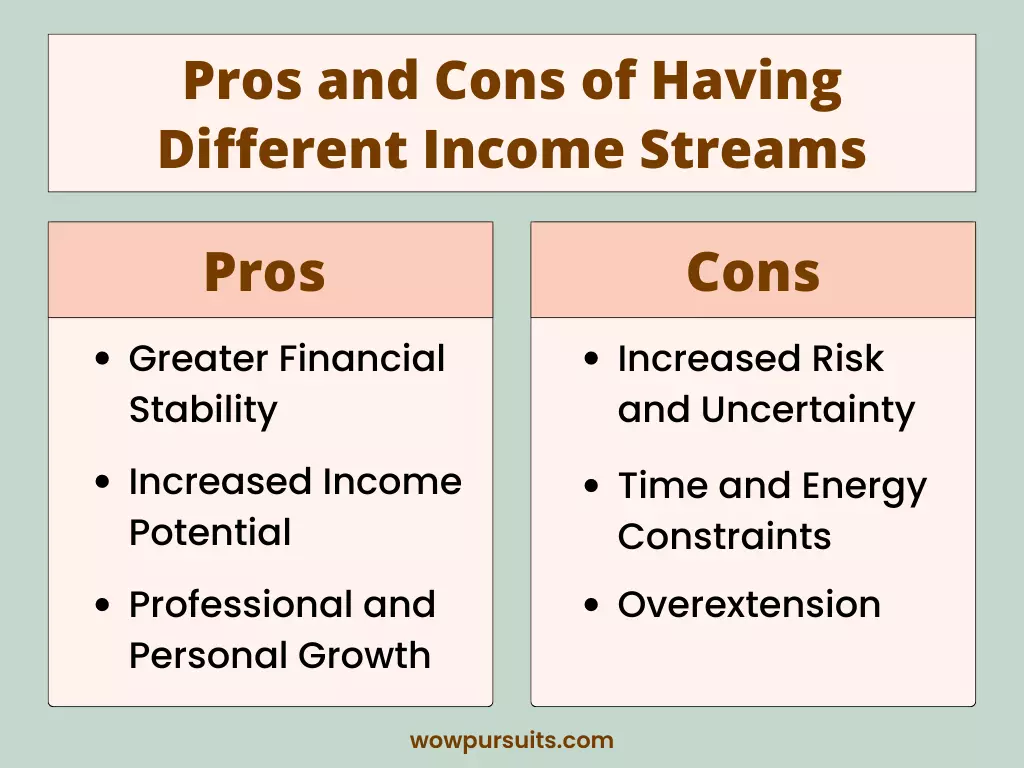

Most people who commented on the post asserted that having different streams of income is extremely important while some felt that it was overrated. Here’s a diagram summarising the pros and cons that were discussed:

On the surface, income diversification does seem like the logical thing to do. It’s like investing. A diversified portfolio helps to mitigate risk and maximise returns. Nevertheless, too much diversification complicates the management of investments and may dilute returns. It’s a balancing act.

As with many situations in life, there are trade-offs to consider. More often than not, our answers are also largely dependent on our outcomes.

Despite the challenges, Mr Wow and I know from personal experience the tremendous value of having different income streams in our wealth building journey, so we’re with the majority. Having said that, there are three situations where I think it’s overrated.

Contrary to popular opinion, having multiple streams of income does not always yield positive results, especially if they require your active involvement or do not align with your strengths. Some income streams also lack long-term sustainability.

- Having Multiple Active Income Streams is Not the Way to Go

- Some Income Streams Lack Long-term Sustainability

- You Will Struggle if You Have Poor Assessment of Your Capabilities

1. Having Multiple Active Income Streams is Not the Way to Go

Let’s start with your motivation. Why do you want to pursue different sources of income? For most people, it’s about increasing earnings and reducing reliance on a single job. Ultimately, you want to have greater financial stability, as well as more freedom and flexibility in managing your finances and personal life.

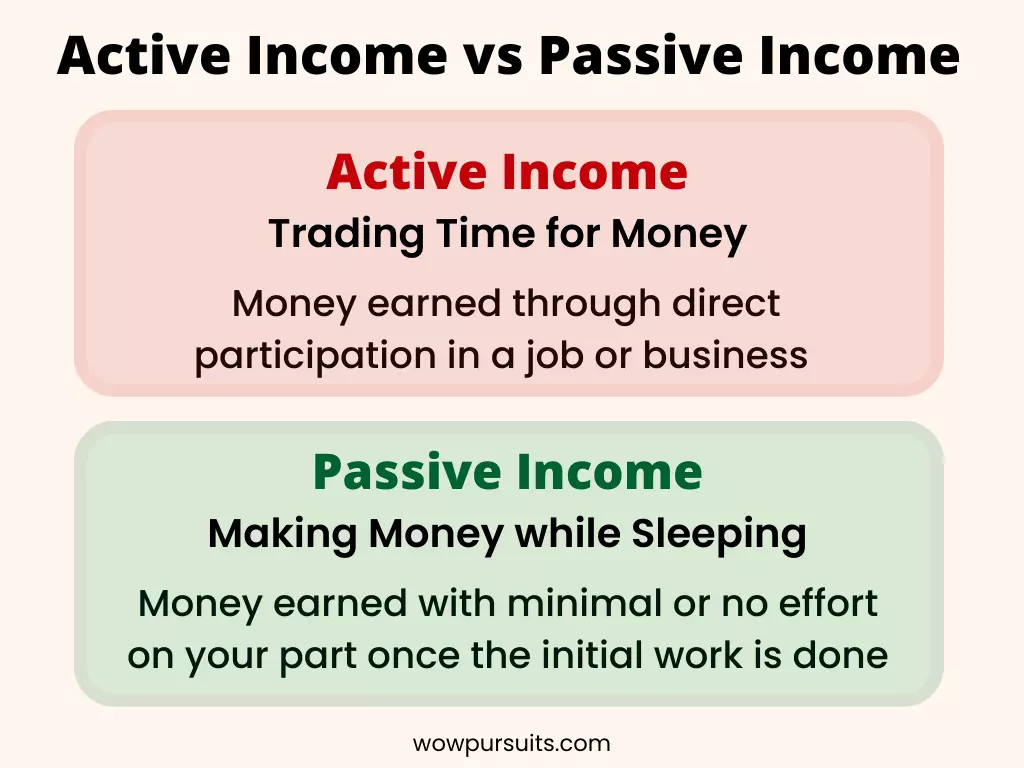

However, that’s difficult to pull off if all your income streams are active ones, i.e. require your ongoing effort and time to generate revenue. Don’t get me wrong. I’m not against the hustle culture, but I do question its long-term viability, especially if you try to bite off more than you can chew.

No matter how competent and efficient you are, there are only 24 hours in a day. Do you see yourself juggling multiple responsibilities day in day out for weeks, months and years? Will it eventually lead to burnout and frustration?

Ultimately, you want to have greater financial stability, as well as more freedom and flexibility in managing your finances and personal life.

If your end goal is to achieve Financial Independence Retire Early (FIRE), you will need to up your game at some point in time and find ways to make money even when you are not actively working. For instance, you can invest in dividend stocks or rental properties with the earned income derived from your regular 9-5 and side hustles.

By using your active income to finance your investments, you are essentially building a life that frees you from working to survive. When your passive income fully covers, or better yet, surpasses your expenses, you will have the option to cut down or stop work as and when you like. You will work because you want to, not because you have to. How awesome is that!

My point is — not all income streams are created equal and generating passive income should be your ultimate goal. No doubt there are many highly lucrative active income streams out there besides your day job. But even if you are making an additional $60,000 a year on TaskRabbit as a worker-for-hire, you are still trading your time for money.

So don’t wear yourself out physically and mentally by taking on multiple active streams of income. Invest that earned income of yours so that you can make money while you sleep. It pays to be lazy!

2. Some Income Streams Lack Long-term Sustainability

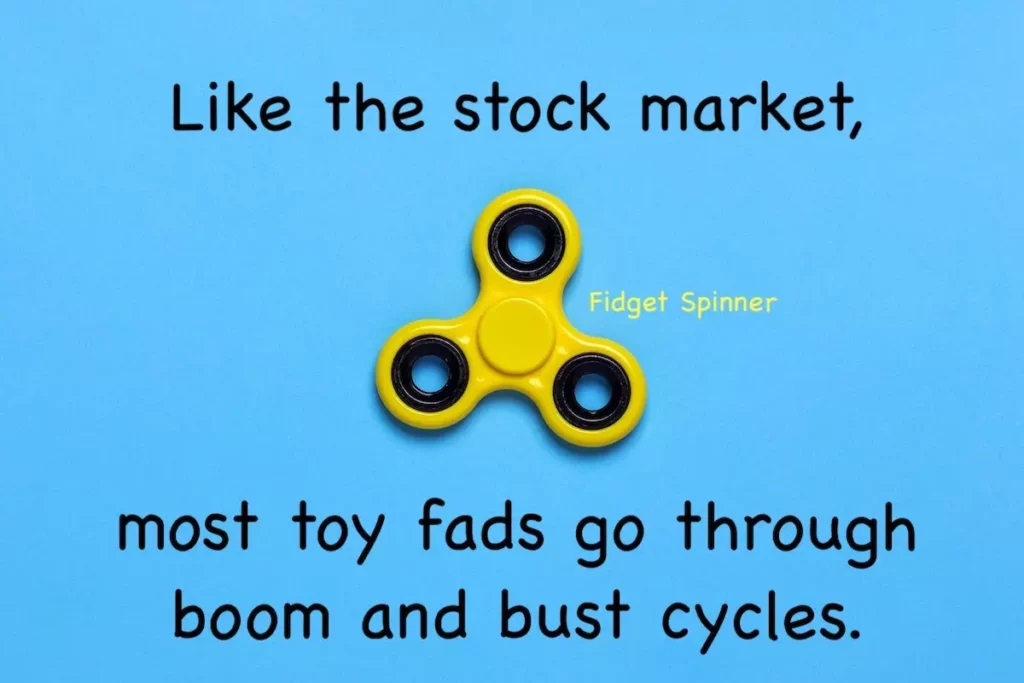

Next, the long-term sustainability of each income stream should be given due consideration. Ventures that provide immediate returns may not be sustainable in the long run. You should assess factors such as market demand, profitability and growth potential before diving into one.

Here’s an example. Let’s say you wish to establish an e-commerce store selling eco-friendly products. This venture aligns with the growing market demand for environmentally conscious products, making it feasible in the long-term. You can also adapt to changing consumer preferences and trends by consistently sourcing and offering new eco-friendly products. With proper marketing, good customer service and continuous improvement, there is potential for steady growth and profitability.

In contrast, an unsustainable venture might involve jumping on short-lived trends e.g. capitalising on a fad such as a particular toy that has gained temporary popularity. Such a venture invests heavily in inventory, marketing and distribution to meet the sudden surge in demand. However, once the trend fades, the market for that specific product will diminish rapidly, resulting in a sharp decline in sales and potential losses. Without the ability to pivot to other products, this venture is unsustainable.

For a real life example, look no further than Mr Wow and me. Our first business back in 2004 lasted less than two years. We had acquired the master licence of a US-based accelerated learning programme. Business was pretty good at the beginning, but it quickly declined after the first year. In hindsight, we could have done a more thorough assessment, in particular the revenue model and market demand. If I’m being honest with myself, we were not only inexperienced, but also naive. It was a good lesson.

So remember: choose ventures that have long-term potential so that you can increase your chances of building a stable and diversified income portfolio.

Check out: 7 Things to Know Before Starting a Business

3. You Will Struggle if You Have Poor Assessment of Your Capabilities

This point has to do with your level of self-awareness. If you go into income streams that do not align with your strengths and interests, you will most likely struggle. A lot.

It’s similar to our career choice. Ideally, we should enter a field where we can make full use of our talents and develop our interests. So if you hate cooking and have no talent for it, you probably won’t think of becoming a chef. But if you are good at writing and enjoy it, you may wish to start a blog.

Check out: One Year In: Our Blogging Insights

When just one of your income streams does not align with your skills and interests, it can pose several challenges. First, depending on how wide the skills gap is, there may be a steep learning curve involved. If you don’t have a genuine interest in acquiring those skills, it can feel like a cumbersome and unfulfilling process. With neither enthusiasm nor expertise, will you be able to grow the income stream?

Second, performing tasks that you find boring or difficult will obviously drain your energy and hinder your overall productivity. This can ultimately impact the quality of your work and the success of other income streams.

Third, if you are dedicating significant effort to learn the ropes, it will take away time and energy for activities and relationships that bring you joy outside of work. In the long run, the heavy workload and lack of satisfaction can lead to stress, exhaustion and yes, BURNOUT.

If you go into income streams that do not align with your strengths and interests, you will most likely struggle. A lot.

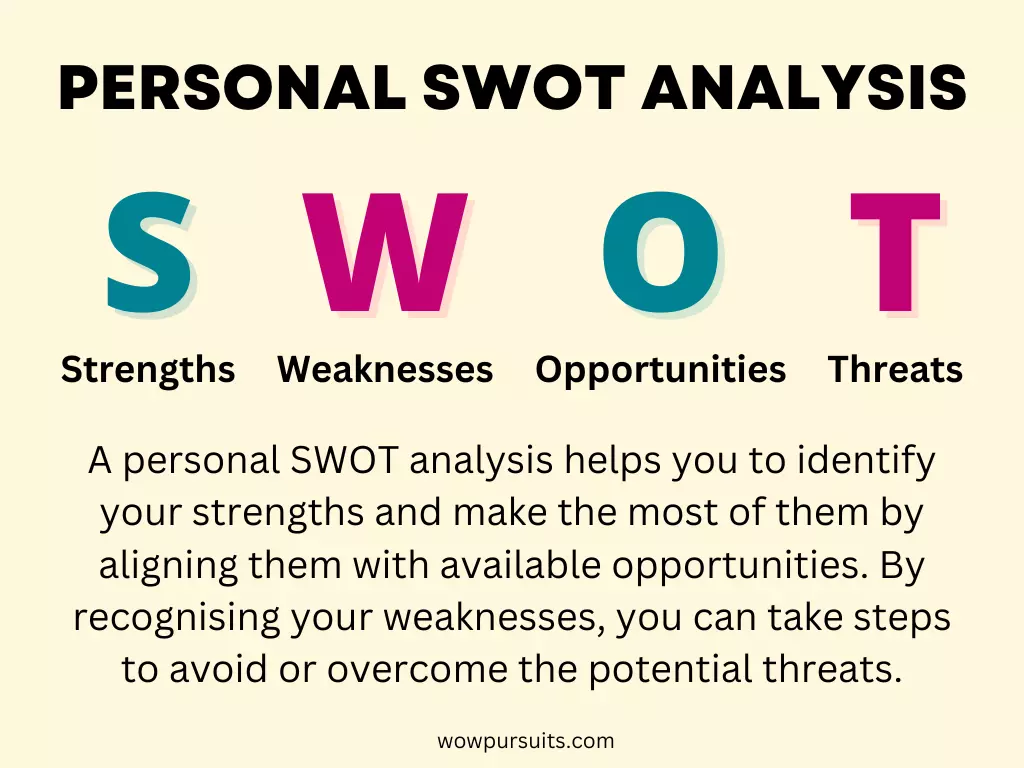

Given these challenges, I would strongly recommend that you explore income streams that match your existing skill set. Take some time to think about what you like, as well as where you can provide value and stand out from the competition. Doing a personal SWOT analysis can be useful. While it may not always be possible to have complete alignment, striving to find a balance is vital to your long-term success and happiness.

To sum up, the decision to pursue different sources of income often boils down to two things: your goals and the opportunities available to you. Some individuals thrive on having diverse professional pursuits, while others may prefer to focus on one area. There’s no wrong answer as long as it aligns with your personal and financial aspirations.

Although I’m in favour of income diversification, there are situations where I think it’s overrated. To have a fulfilling and sustainable income portfolio, you should definitely leverage your strengths and aim to create passive income.

My two cents’ worth: don’t start everything all at once unless you love trouble. Make it manageable! I would also encourage you to focus on building a solid primary source of income first. This will provide stability when you venture into the next.

Good luck!

Great article!

Diversifying income can be a smart move, but your insights about aligning income streams with strengths and focusing on passive income are spot on. It’s all about balance and long-term sustainability.

I’m glad you enjoyed reading the article, JJ. 😊

Exactly! I definitely think income diversification is important in the current world we live in, but we need to give it careful thought and planning if we want to yield positive results.