Mr Wow and I officially retired in February 2020. Can’t believe it’s been four years! It’s true that time flies when you’re having fun!

Anyway, I was reminiscing about our wealth building journey the other day and thought it appropriate to write something about the topic this month. As usual, I’ll be sharing our experience where relevant, in the hope that it might help you in some way.

In the pursuit of a fulfilling and abundant life, the importance of wealth accumulation cannot be overstated. Beyond mere material possessions, wealth provides security, gives us more freedom and choices in life (e.g. a work-optional lifestyle), and empowers us to make a positive impact on the world around us.

While the road to wealth may seem daunting and uncertain, it is not an elusive dream reserved for the lucky few. I strongly believe that wealth building is something that can be mastered through diligent planning, prudent decisions and unwavering determination.

Whether you’re just starting out on your path to riches or seeking to enhance your finances, you will need to apply these seven strategies to accumulate wealth for a successful financial future.

- Gain Financial Knowledge

- Set Goals

- Keep an Emergency Fund

- Decrease Expenses

- Increase Income

- Reduce Liabilities

- Buy Assets

1. Gain Financial Knowledge

This is not an opinion but a fact. The most common financial stumbling block is the lack of education. People who say they aren’t good with money are often the least educated on money. Nevertheless, building a strong foundation for wealth accumulation begins with arming yourself with financial knowledge — there’s no two ways about it.

Educate yourself about personal finance, investment strategies and money management principles. Read books, watch YouTube videos and attend seminars to broaden your understanding. Financial knowledge enables you to make informed decisions, identify opportunities and navigate potential pitfalls. In contrast, ignorance costs dearly.

When I first made up my mind to pursue Financial Independence Retire Early (FIRE) years ago, I had very little knowledge, money and time. My business with Mr Wow was barely two years old and we were busy trying to grow it.

However, I was undeterred. No matter how late I ended work or how tired I felt, I spent at least two hours a day reading and learning. I highly doubt I would be able to achieve FI in 2019 and RE in 2020 if I had spent all that time watching TV instead.

To accumulate wealth, you need to acquire financial knowledge. You will always be busy, so find the time now and make it a regular habit.

Check out: Why Being Knowledgeable is Important

2. Set Goals

Setting financial goals is key to maintaining motivation and focus throughout your wealth accumulation journey. When you establish clear and specific goals, you create a roadmap for your financial success and provide yourself with a sense of purpose and direction. Here’s how goal-setting has helped Mr Wow and me:

- Clarity of Purpose: In 2012, we set a 10-year goal to accumulate 35 times our annual expenses and invest the money in income-generating assets. This gave us a clear vision of what we wanted to achieve. You can read more about our net worth and the size of our investment portfolio in The Big Reveal: Our Net Worth Exposed.

- Measurable Progress: We then broke our 10-year goal into smaller short- and mid-term milestones. This allowed us to track our achievements and celebrate each milestone reached, reinforcing our commitment to the long-term target. For instance, we treated ourselves to a two-week vacation in Bali when we hit one million in investable assets.

- Disciplined Financial Behaviour: Setting a series of well-defined goals encourages discipline and accountability. If you’re a disciplined person to begin with, you will be even more disciplined. Our goals reminded us to stay on track and prioritise savings over spending, e.g. resist impulse buying. This ultimately led to greater financial stability and an investment portfolio that grew faster than expected.

- Enhanced Decision-making: Our decision-making became more straightforward in the sense that we could evaluate business opportunities, investments and expenses based on how they aligned with our overall plan. This made it easier to say “yes” to what supported our objectives and “no” to what didn’t. For example, although we wished to build wealth quickly, we also wanted to do it safely. Thus, we decided against investing in penny stocks due to their speculative nature.

- Motivation during Challenging Times: As you work your way to financial success, you’re likely face obstacles, setbacks or burnout. In my case, I had a pretty bad burnout, which took its toll on my physical health. But never once did the thought of giving up cross my mind. My goals were a constant source of motivation, reminding me of the reasons I embarked on my FIRE journey. After a month-long break from my business to restore my health, I changed my approach and never looked back.

- Continuous Progression: After reaching a goal, we found ourselves setting new ones to pursue. This continuous progression fuelled our aspiration to keep growing and improving our financial position, turning wealth building into a lifelong journey.

Setting a series of well-defined goals encourages discipline and accountability.

Goal-setting is not just about identifying a bunch of targets. It gives you a sense of empowerment and control over your finances. You know you have the ability to shape your financial future by making deliberate choices and committing to a plan.

Of course, financial goals are not set in stone; they can be adjusted as circumstances change. You have the freedom to recalibrate them if you encounter unexpected life events or new opportunities, so stay flexible.

Check out: How to Set Goals and Make Them Happen

3. Keep an Emergency Fund

An 𝕏 account that I follow, Tom | The Savings Captain wrote this several months ago: Using a credit card as an emergency fund is like using a fire extinguisher as home insurance.

The post remains etched in my mind as I absolutely love the analogy. Given the high interest rates credit card companies charge on unpaid bills, this obviously spells disaster. Yet, many people still do not maintain an emergency fund and have to max out their credit cards in times of financial hardship.

If you’re serious about accumulating wealth, setting aside an emergency fund that’s equivalent to three to six months’ worth of living expenses is of paramount importance. Here’s why:

- Reduce Stress: Life is unpredictable and unforeseen events such as major home repairs and sudden job loss can strike any time, causing tremendous stress. An emergency fund acts as a safety net, providing you with immediate access to cash when faced with unexpected challenges. This can significantly reduce stress, allowing you to focus on your wealth accumulation goals with confidence and peace of mind.

- Avoid Debt: During emergencies, people often resort to borrowing or accumulating debt to cover urgent expenses (like the tweet I mentioned above). An emergency fund prevents you from taking such unfavourable measures. By staying debt-free or minimising debt, you can allocate more resources to wealth building activities.

- Protect Investments: When you have cash readily available for emergencies, you’re less likely to prematurely liquidate investments, which may result in penalties, losses or missed growth opportunities. Preserving your investments ensures that they can continue to grow and contribute to your overall wealth accumulation strategy.

So don’t let emergencies derail your plan. Build and maintain a safety net so that you have the financial resilience to navigate life’s uncertainties while continuing to amass wealth over time.

Check out: The Importance of Liquidity in Personal Finance & Investing

4. Decrease Expenses

Controlling your expenses is an integral part of wealth accumulation. No, I’m not asking you to wait till your sunset years to enjoy life. You do not have to eliminate everything that brings you pleasure. If Starbucks coffee is one of your few pleasures in life, please go ahead and drink it.

Our expenses reflect what we value and the process of reducing them is highly personal. You will have to analyse your spending habits and identify areas where you can cut back without compromising your quality of life.

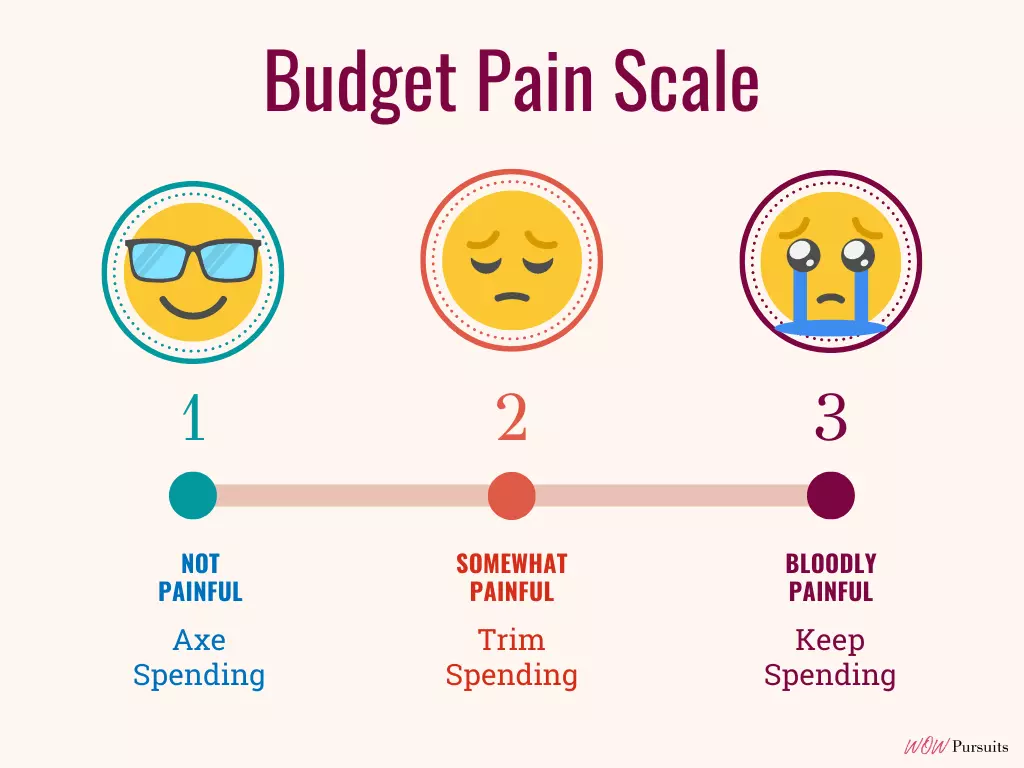

Start by tracking your expenses for a couple of months so that you know where your money is going. Next, work out a realistic budget by deciding on the items to axe, trim or keep (see Budget Pain Scale below). Simple changes, e.g. cooking at home more often or opting for public transportation, can have a significant impact over time, freeing up more funds for savings and investments. Remember to prioritise your needs over wants and keep it sustainable. I repeat: keep it sustainable.

I know what some of you might be thinking. Expense tracking and budgeting are so tedious!

Well, guess what? They work, especially if you’re trying to crush debt (see point 6). And like every other habit, they too can become second nature to you. Although Mr Wow and I have a budget, we don’t really need to follow it anymore as our spending is predictable and everything comes naturally. Honestly, it’s almost impossible for us to overspend.

So say no to mindless spending and lifestyle inflation. If there’s something you need to inflate, it’s your investment portfolio.

Check out: Why You Should Track Your Expenses Down to the Penny

5. Increase Income

To optimise wealth accumulation, a comprehensive approach that includes both expense management and income growth is most effective. You cannot neglect the latter. Put it this way. While it’s crucial to be mindful of expenses and eliminate unnecessary spending, there are practical limits to how much you can cut. On the other hand, income has scalability potential.

There’s no limit to how much you can increase your earnings, especially if you diversify your income streams. Advancing in your career and taking on side gigs are just two ways to grow your income. The goal is to save and invest your earned income so that you can make money without requiring constant active effort (see point 7).

As an investor, a major plus point of having high income is that you can take advantage of various financial instruments that may have minimum investment requirements or qualifying criteria. For instance, being an accredited investor will give you access to certain private equity funds that are not available to other investors.

In Singapore, you must fulfil at least one of three conditions to be an accredited investor, one of which is a minimum income of S$300,000 (or its equivalent in a foreign currency) in the last 12 months. As they say “it takes money to make money” and in this case, it couldn’t be more true.

A major plus point of having high income is that you can take advantage of various financial instruments that may have minimum investment requirements or qualifying criteria.

Check out: Multiple Income Streams: Weighing the Pros and Cons and Why Having Multiple Streams of Income May Be Overrated?

6. Reduce Liabilities

When you lower your expenses and increase your income, you will be able to manage and bring down your debt more effectively. With more funds available, you can make larger debt repayments and eliminate high interest loans sooner. This saves you money on interest payments, freeing up more cash flow that can be redirected towards wealth building activities. You will be in a stronger position to take advantage of investment opportunities and make your money work for you.

I know many people consider certain types of debt to be good debt. A common example is one’s mortgage. If your money could give you higher returns elsewhere, e.g. invested in stocks, you should certainly weigh the opportunity cost before paying off yours. Mr Wow and I chose to crush our mortgage by downsizing two years before our early retirement. By doing so, we became debt-free without having to tap into our savings.

Everyone’s situation is different, so you will have to come up with a strategy that’s best for you and your family. Just keep in mind that debt can increase financial risk, especially if you’re heavily leveraged. Minimising your debt exposure will therefore provide a more stable foundation for wealth accumulation.

There are several intangible benefits too. For one thing, you will have peace of mind as debt can be a significant source of stress and anxiety. By actively reducing liabilities, you lift that burden off your shoulders and feel a sense of relief, freedom and accomplishment. This reinforces the idea that you’re in control of your financial life.

Check out: Why We Do Not Consider Our Home an Asset

7. Buy Assets

Finally, investing in assets is the cornerstone of wealth accumulation. Assets provide opportunities for income generation and appreciation, laying the groundwork for financial prosperity in the long run.

For instance, rental properties and dividend stocks generate passive income that can appreciate in value over time. It is thus crucial that you take a long-term approach to investing and allow compounding to work its magic. When your assets produce enough passive income to support your lifestyle, you’re financially independent. That means you no longer need to work for survival. Woohoo! Supercalifragilisticexpialidocious!

Needless to say, investing always involves risks, but having a diversified portfolio that includes a mix of asset classes can minimise the impact of potential losses in any single asset and maximise returns. You should always do your due diligence and educate yourself about each asset class before committing your hard-earned money. If you’re thinking of using financial leverage, make sure that you have a thorough understanding of the associated risks.

Note: Some assets offer tax advantages such as tax deductions and tax-deferred growth. Utilising tax-efficient investment strategies can optimise your wealth accumulation efforts.

Check out: The Retirement Bucket Strategy Demystified

To recap, here are the seven strategies to accumulate wealth:

By following these strategies, you seize control of your financial narrative and lay a solid foundation for a prosperous future.

Remember: your plan will evolve over time. Stay committed to your goals but don’t be rigid. Celebrate every milestone reached and learn from every challenge faced.

Looking back, my wealth accumulation journey with Mr Wow was a transformative one. Yours will be too. Besides monetary gains, you will also experience personal growth and empowerment.

As you work towards your financial aspirations, your mindset will evolve, your habits will reshape and your perspective on wealth will mature. Put simply, you will only get better.

You may also like: There’s Nothing Wrong with Pursuing Wealth | How 3 Investors from Different Continents Grow their Wealth

There’s a ton of gems above and thanks for sharing, Lynn!

Living in NYC with extremely high income taxes, focusing on lowering taxes, building tax-efficient income and maximizing the return on my main job as much as possible was a constant focus for me.

Everyone’s journey is different but those that proactively seek out financial literacy tend to win the game in the long run.

You said it, Rob! 🙌

Everyone’s journey is different. It’s all about proactively educating ourselves and finding ways to take control of our personal finances.

If there’s a will, there’s a way! 💪

This is some detailed stuff. Massive information there, Lynn.

I absolutely agree that wealth building is simply — doing diligent planning, being wise in decision making and having unquenchable determination.

You know it, Simon! 🙌

It’s all about controlling your own financial destiny.

We all have to start somewhere and I hope this post gives those willing the impetus to do so! 🔥